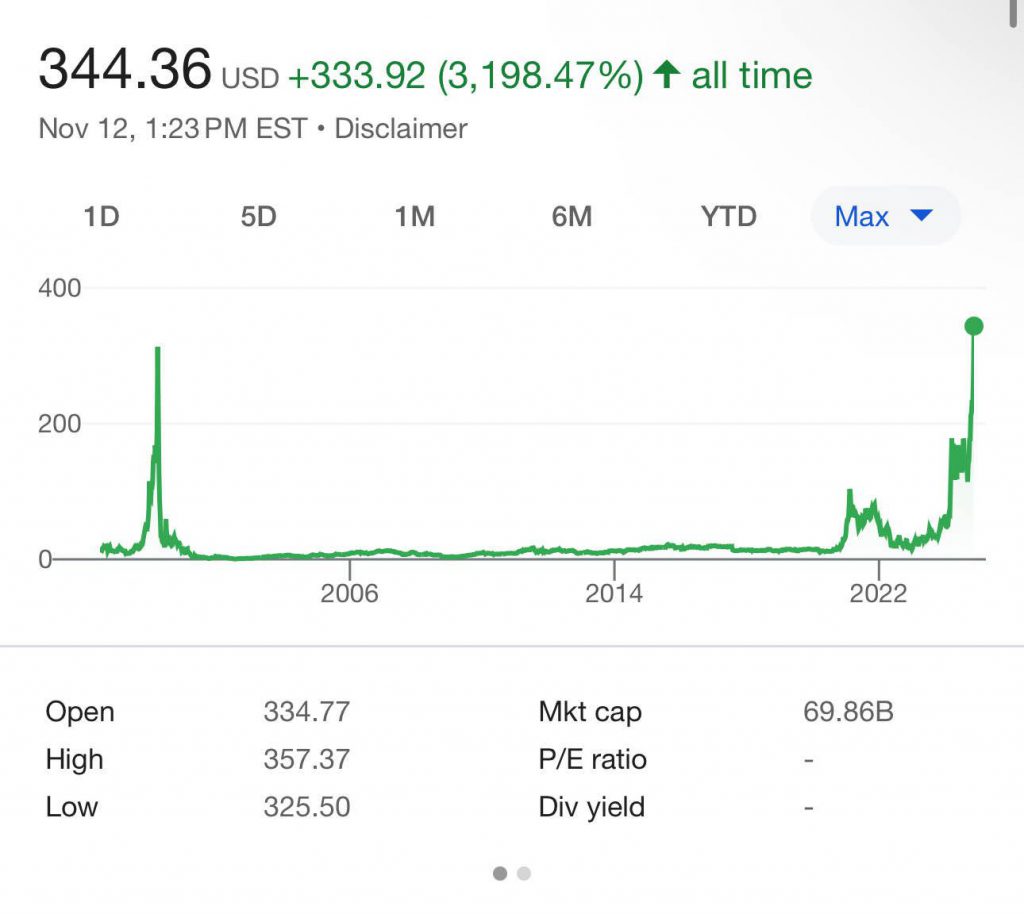

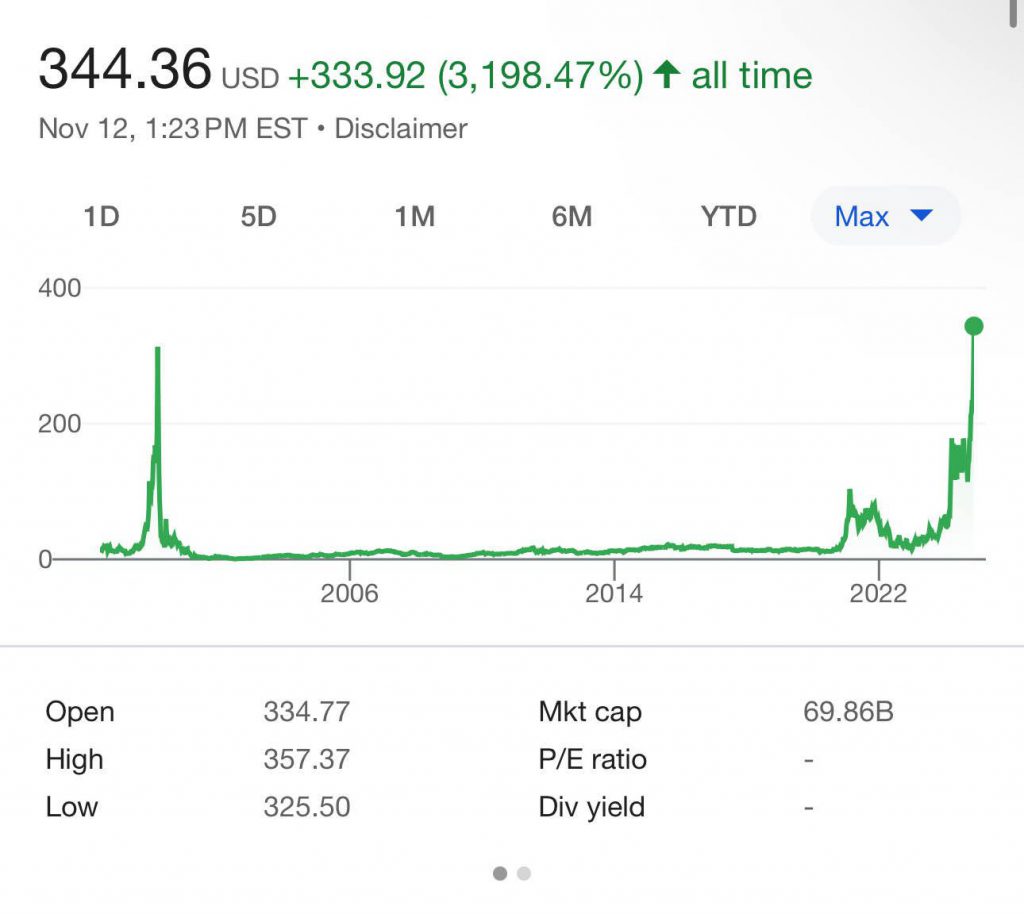

Stock shares in Michael Saylor’s MicroStrategy (MSTR) hit a new all-time high on Tuesday afternoon of $357.37, with an intraday market cap of $70.138B. During off-hours earlier Tuesday morning, the MSTR stock even reached over $365 in share value.

MicroStrategy stock has climbed over 50% in the last five days alone, following a statement Bitcoin decision by Michael Saylor. On Monday, the company continued its commitment to the leading cryptocurrency, purchasing another 27,200 Bitcoin. At press time, this bulk of BT was worth a remarkable $2.03 billion. Bitcoin has surged over 25% in the last seven days, representing heightened excitement for the crypto asset. Additionally, the average daily trading volume for MSTR over the past 30 days is 20.47 million shares.

Bitcoin Continues to Thrive Post-Election, MicroStrategy Stock Rides the Wave

2024 has continued to be the most important year in Bitcoin’s history. The industry leader had become the first crypto-based ETF in the United States and has set a host of price records throughout the last ten months. That was magnified with the 2024 election results, as Donald Trump became the first pro-crypto US President.

Yet Michael Saylor has remained one of Bitcon’s loudest advocates long before its 2024 success. And even as it reaches new record prices, Saylor’s MicroStrategy has not ceased buying, as it has officially purchased another $2 billion in Bitcoin to start the week. The purchase spurred stocks in MSTR to also rise, as more investors support the company’s Bitcoin initiative.

Last week, MicroStrategy also announced a three-year plan to invest $42 billion in Bitcoin through capital raises. More companies are looking to follow in MicroStrategy’s footsteps, Bitcoin as a treasury reserve asset.

Furthermore, MicroStrategy President and CEO Phong Le stated last month, “Our focus remains to increase the value generated to our shareholders by leveraging the digital transformation of capital. As a Bitcoin treasury company, we plan to use the additional capital to buy more Bitcoin as a treasury reserve asset.”

Most market experts predict Bitcoin to continue its ongoing rally through the end of 2024. According to a Standard Chartered report, BTC could hit the $125,000 mark following a Trump victory. Correspondingly, if BTC continues this rally, MSTR’s value will also likely follow suit.