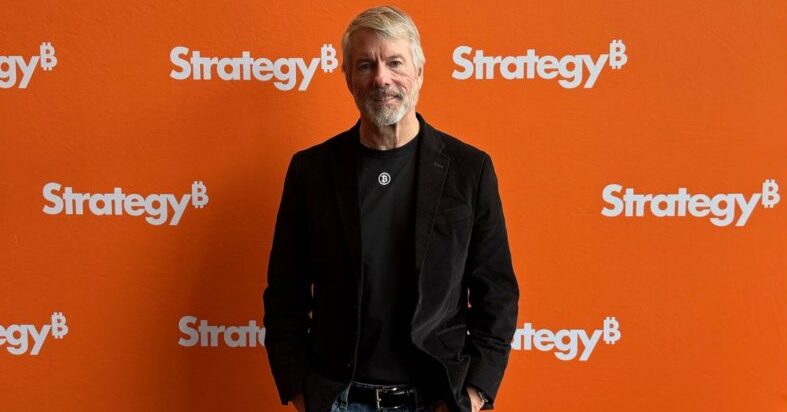

Michael Saylor’s Bitcoin purchase has just sent significant ripples through the crypto world as Strategy (formerly MicroStrategy) acquires 22,048 Bitcoin worth about $1.92 billion. This latest move further strengthens the company’s position as the largest corporate Bitcoin holder right now, during a time when institutional investment in cryptocurrency continues to grow despite ongoing market volatility and uncertainty.

JUST IN: Michael Saylor's 'Strategy' buys 22,048 Bitcoin worth $1.92 billion.

— Watcher.Guru (@WatcherGuru) March 31, 2025

Also Read: Shiba Inu: SHIB Price Prediction 6 Months From Now

How Saylor’s Bitcoin Bet Impacts Investors & Crypto Markets

Building a Bitcoin Fortune

Strategy’s Bitcoin holdings exceed 528,185 BTC at the time of writing. The company has spent over $35.6 billion on Michael Saylor’s Bitcoin purchase strategy, acquiring coins at an average price of about $67,458. Another recent acquisition was also funded through a stock sale that raised around $592.6 million, with each Bitcoin purchased at an average price of $84,529.

$MSTR has acquired 22,048 BTC for ~$1.92 billion at ~$86,969 per bitcoin and has achieved BTC Yield of 11.0% YTD 2025. As of 3/30/2025, @Strategy holds 528,185 $BTC acquired for ~$35.63 billion at ~$67,458 per bitcoin. $STRK $STRF https://t.co/1sfyBIglnt

— Michael Saylor⚡️ (@saylor) March 31, 2025

Saylor stated:

“It becomes a fait accompli. It’s one of those geopolitical moves that when you embrace the network, you force all of your allies first to adopt it, and then all your enemies have to adopt it.”

Market Effects

Michael Saylor’s Bitcoin purchases have previously triggered positive market movement. Strategy’s stock jumped 4.8% in premarket just last week as Bitcoin climbed above $87,000. Other crypto-related companies like Coinbase and Robinhood also saw some gains following the previous announcements. Such large acquisitions often create buying pressure that serves as a bullish signal for hesitant institutional investors who are still on the fence about cryptocurrency.

This time, however, Strategy (MSTR) shares are still down by over 4% in pre-market trading after collapsing by 11% on Friday amid a brutal stock market correction.

Also Read: Ripple: With SEC Lawsuit Settled, Will XRP Hit $4?

A $200 Trillion Vision

Saylor’s Bitcoin institutional investment strategy extends well beyond just corporate treasury management. He envisions Bitcoin eventually becoming a $200 trillion asset class by 2045, serving as a global settlement layer for AI-driven interactions and transactions.

Saylor had this to say:

“When Bitcoin spreads… and there’s a trillion dollars of digital capital in the banking system, it won’t just be in the U.S. It’s a virus. And so the virus spreads. And in this case, that means you’re going to have hundreds of thousands of banks and trillions of dollars that are held by a billion people.”

President Trump’s executive order establishing a U.S. Bitcoin Strategic Reserve has certainly strengthened this vision. The order essentially directs the Treasury to never sell U.S. Bitcoin and develop additional ways to acquire more, marking a significant milestone for crypto market impact and institutional adoption.

Saylor’s influence now extends beyond just corporations, as he actively advises nations on Bitcoin strategic reserves. His aggressive Bitcoin holdings expansion may well become the blueprint for other corporations and governments, validating many optimistic Bitcoin price predictions in the coming years.

Also Read: De-Dollarization: Trade Settlements In Chinese Yuan Up 0 To 30%