Microsoft stock is currently facing some mixed signals as an insider has recently sold off about $7.33 million worth of shares, while at the same time, Citi analysts have also gone ahead and boosted their price target to $380, which represents an 8% increase. This kind of development is also having an impact on the broader tech stocks landscape, including other Nasdaq-listed companies such as NVDA.

Also Read: Ethereum (ETH) Could Hit $3,000 Sooner Than Expected, Here’s Why

Citi Forecast Boosts Tech Stocks Amid MSFT Insider Selling Pressure

The Microsoft stock situation right now actually reflects the current dynamics that we’re seeing in North American tech markets. The significant insider selling creates some uncertainty for sure, yet major banks like Citi are still continuing to show confidence in the company’s growth potential going forward.

What is the Target Price for MSFT?

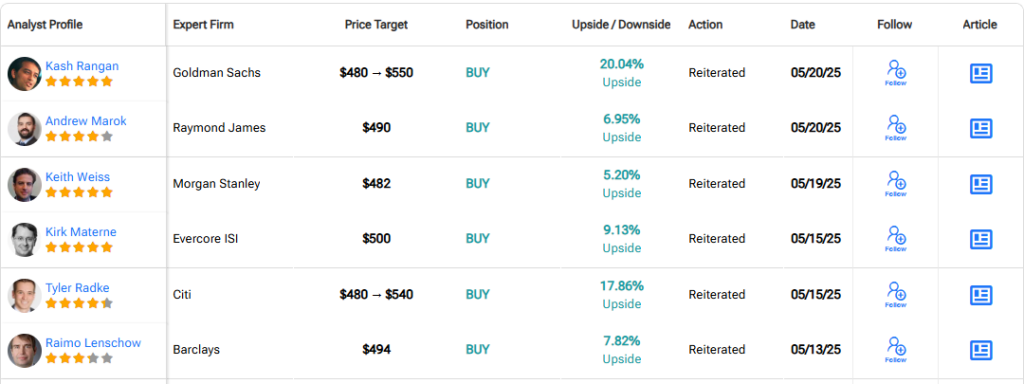

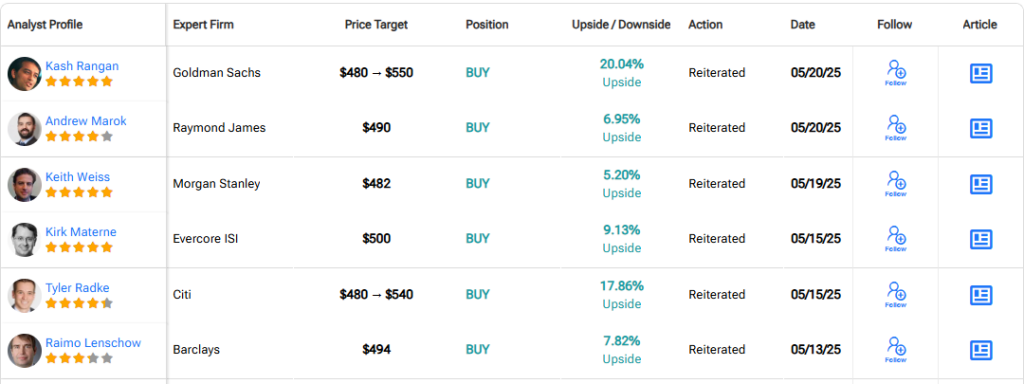

At the time of writing, Citi’s new $380 target for Microsoft stock actually sits notably below the broader analyst consensus and such. The latest market data shows an average price target of approximately $511.83 based on 35 Wall Street analysts who have been covering Microsoft stock over the past three months or so.

Also Read: Shiba Inu Claps Back at Saylor’s Bitcoin Flex With Meme Power

Is Microsoft Stock Overvalued?

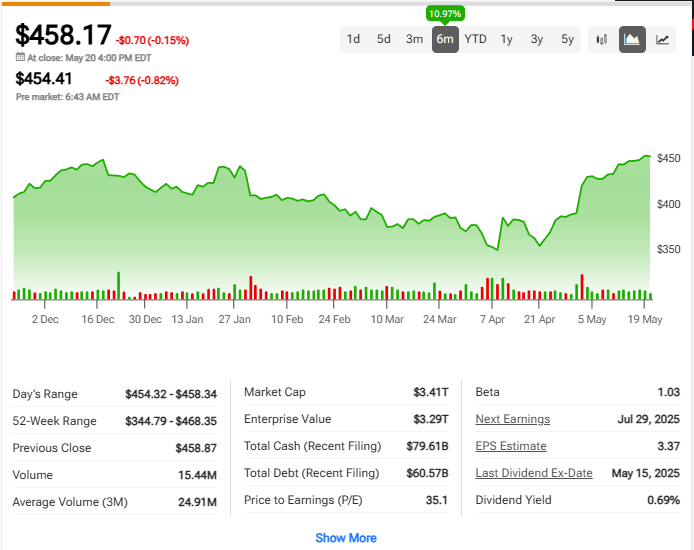

With Microsoft stock currently trading at around $458 and a P/E ratio of about 35.1, opinions remain somewhat divided among experts. Some analysts are pointing to potential challenges in the company’s recent guidance and more.

Is Microsoft a Buy, Hold, or Sell?

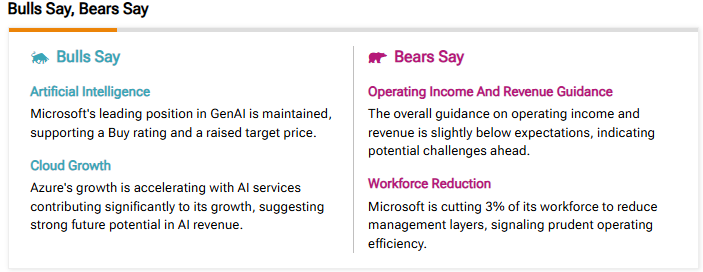

The consensus among analysts right now strongly favors a Buy recommendation for Microsoft stock. Out of the 35 analysts, about 30 of them rate it as a Buy, while 5 suggest a Hold, and none of them actually recommend Sell at this point.

Tyler Radke from Citi stated:

“We maintain our Buy rating with a target of $380-$540, projecting a 17.86% upside based on Microsoft’s continued cloud momentum and AI integration efforts.”

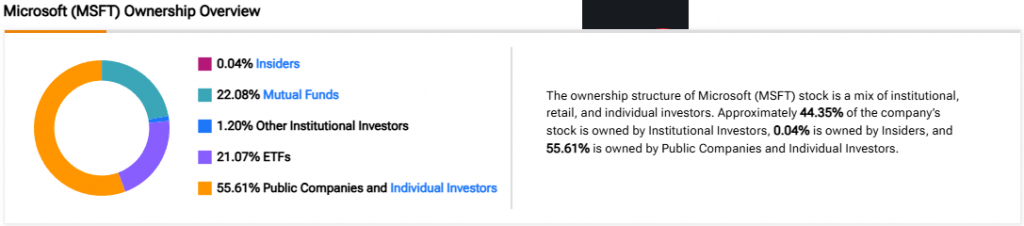

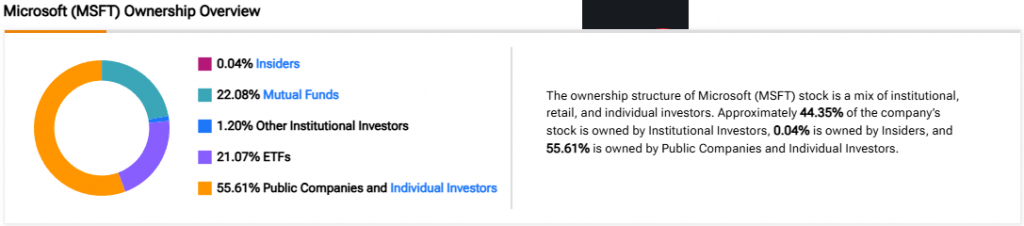

Who Owns the Most Shares of Microsoft?

Institutional investors currently hold the majority of Microsoft stock, with companies like Vanguard Group, BlackRock, and also State Street among the largest shareholders. The recent $7.33 million insider sell represents only a small fraction of Microsoft’s massive $3.41 trillion market capitalization.

Also Read: Ripple: Can XRP Reclaim $3 If Bitcoin Hits $110,000?

Despite the insider selling that we’ve seen recently, the Microsoft stock outlook remains mostly positive among analysts, with its AI initiatives and cloud services continuing to drive the bullish sentiment in the tech stocks sector.