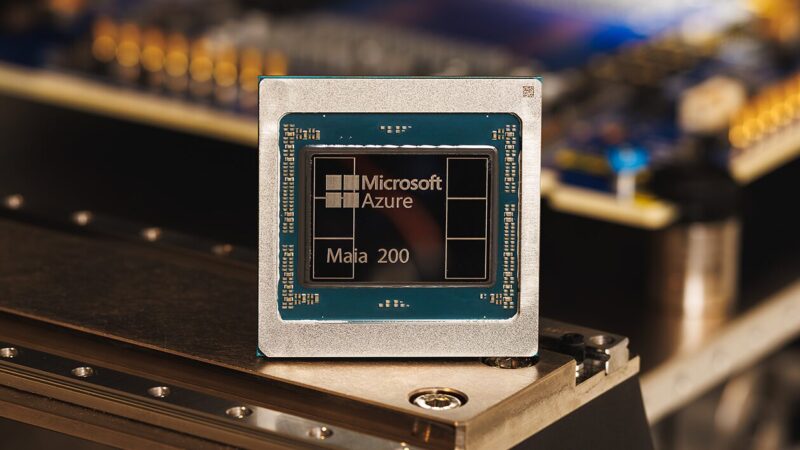

Microsoft (MSFT) has launched its Maia 200 next-gen AI chip, a move that could propel it ahead of tech rivals Nvidia, Alphabet, and Amazon. The new chip is designed to enhance inference performance across its cloud and enterprise platforms. The chip has 140 billion transistors, 216GB of HBM3e memory, and can do up to 10 petaFLOPS of work. Additionally, it is based on Taiwan Semiconductor Manufacturing Co.’s (TSMC) 3-nanometer technology.

Scott Guthrie, the company’s Executive Vice President, said that Maia 200 has “30% better performance per dollar” than current-generation technology. This makes it the company’s most economical AI processor to date. The processor will run OpenAI’s GPT-5.2 models, as well as Microsoft 365 Copilot and Foundry apps.

This concept follows Alphabet and Amazon, who are also working to end their reliance on Nvidia and make their own chips in-house. However, Microsoft says Maia 200 is cheaper to run and more efficient than the custom AI chips its cloud rivals use today. In plain terms, that means it can generate AI responses using less power and less money, which matters a lot when millions of prompts are flying through Microsoft Azure every second.

Also Read: Coreweave (CRWV) Stock Surges over 15% on Nvidia Investment

Shares in Microsoft (MSFT) rose slightly to end Tuesday’s trading session, ticking up 1%. Investors were excited that the chip is already up and running inside Microsoft’s own data centers. An ongoing active project reels in investors more than a promised project. Furthermore, Microsoft’s use of its own AI chips eats into demand for Nvidia’s chip technology, limiting reliance and hence lessening its grip on the AI industry.

Furthermore, the announcement led Wall Street bulls to turn towards Microsoft (MSFT). Indeed, analysts at Raymond James reaffirmed their Outperform rating for MSFTand $600 price target for the stock ahead of the fiscal second-quarter 2026 earnings report scheduled for January 28. The $600 target implies a potential 34% upside from Monday’s trading price of approximately $470.