Prominent Bitcoin proponent and MicroStrategy former CEO Michael Saylor announced another sizable BTC purchase this week.

Saylor announced the purchase of 3,000 BTC worth $155 million for the firm’s holdings. According to a tweet from Saylor, the purchase was executed at an average entry price of $51,813.

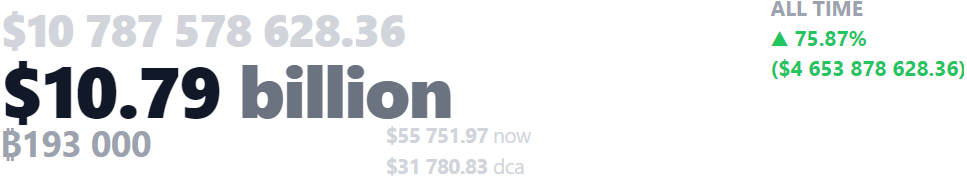

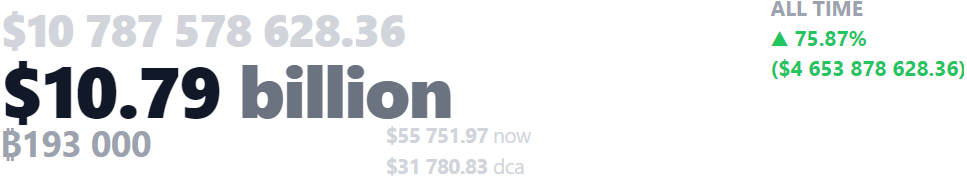

With the latest acquisition, MicroStrategy now claims total ownership of approximately 193,000 Bitcoin acquired across all purchases for $6.133 billion. This equates to a remarkable average cost per BTC that the company paid of $31,780.

Also read: Ethereum: How High Can ETH Go in March 2024?

MicroStrategy Bitcoin holdings stand at $4.65 billion unrealized profit

As per data aggregated by Saylortracker, at current market prices of around $55,840, MicroStrategy’s position now commands a total valuation exceeding $10.79 billion.

This means the company sits on tremendous unrealized profits of $4.65 billion on paper – reflecting a gain of almost 76% yield-to-date from an investment allocation started under Saylor back in 2020.

As the prominent business leader consistently acquires additional coins, MicroStrategy continues to lower its cost basis while greatly expanding its exposure to Bitcoin in the process.

Also read: Cryptocurrency: 3 Coins That Could Surge in March

With almost $4.7 billion in unrealized profit already on the books, shareholders and analysts continue monitoring how sizable the profits could ultimately become as Bitcoin adoption progresses.

Saylor himself remains staunchly convicted of substantially higher valuations over the long-term time horizon based on his views around digital gold.

The price of Bitcoin has surged by 8.5% in the last 24 hours. BTC has spiked from a 24 hour low of $50,931 to a high of $56,728 before falling to its current price.