Morgan Stanley CEO James Gorman is singing a different tune from JP Morgan’s CEO, Jamie Dimon, who called Bitcoin ‘worthless.’ On the bank’s third-quarter earnings call on Thursday morning, James Gorman defended Bitcoin.

“I don’t think crypto is a fad,”

he said while speaking to analysts and investors.

Gorman also stated that he doesn’t think Bitcoin is going away. He also added,

“…the blockchain technology supporting it is obviously very real and powerful.”

These statements were a contrast to his counterpart James Dimon who, like other political and business leaders, has publicly bashed cryptocurrency technologies.

While speaking at the Institute of International Finance annual event earlier this week, he said,

“I personally think that Bitcoin is worthless.”

Dimon has previously referred to Bitcoin as ‘fool’s gold’ and called the technology ‘a fraud.’

Former President Donald Trump shares Dimon’s sentiments visible when he had nothing good to say about cryptocurrencies in August. John Paulson, hedge fund manager, also shares the same disdain at one point, even predicting cryptocurrencies’ value would ‘go to zero.’

Bitcoin is Not Going Anywhere

Despite the difference in opinions of both CEOs, both their banks offer crypto-related products to their clients. JP Morgan allows its customers access to six cryptocurrency products. The bank, however, will not hold Bitcoin. However, JP Morgan’s disdain for digital assets does not do the bank any good as it puts off many crypto bulls. Morgan Stanley became the first bank to give its customers access to crypto services and is currently investing its own money in BTC.

Mr. Gorman admitted that Morgan Stanley is not yet seeing as much client demand for crypto products. He explained that the bank doesn’t directly trade cryptocurrency, but it offers investors ways to buy crypto through various funds.

Morgan Stanley’s CFO, Jonathan Pruzen, shared in April that as the interest increases, the bank would work with regulators to add more appropriate services.

The investment bank and financial services company currently offer clients exposure to BTC through external crypto funds. These two external funds are limited to firms with $5m or individuals with at least $2m. The cap on BTC investment on an individual’s net worth is 2.5%.

Jane Fraser of Citigroup Inc also expressed some reservations toward BTC.

“We’re fairly cautious around crypto as a bank,”

she said adding, “We proceed with great caution on that one…”

More on BTC

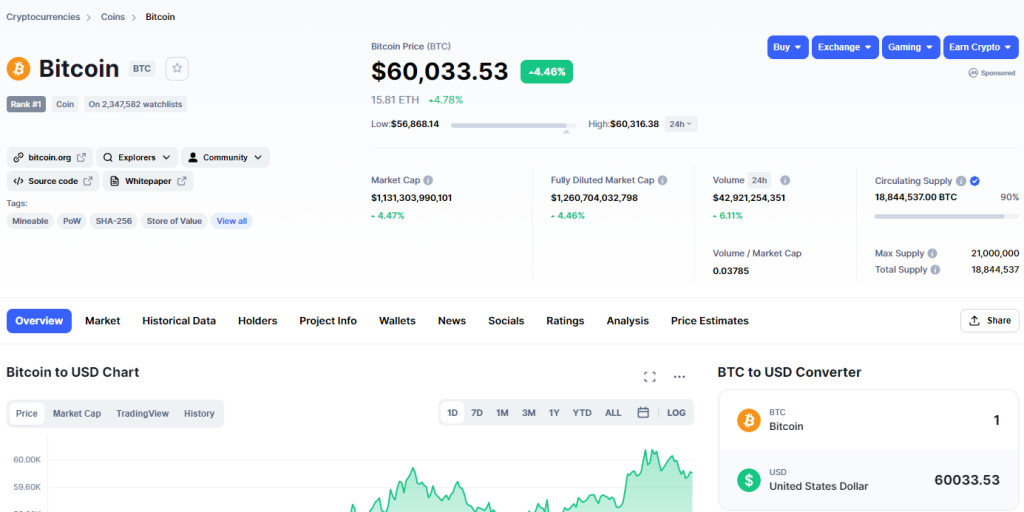

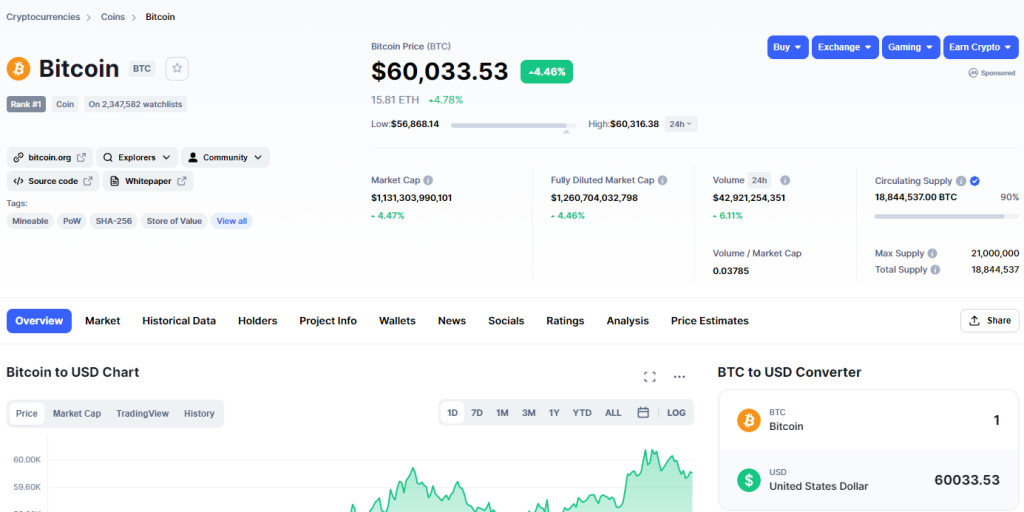

BTC is currently trading above $60,000, which is an increase of 4% over the past 24 hours. This is an improvement by 27.9% for BTC, which had fallen below $30,000 this summer. The current trading is a few figures shy of its highest record back in April. Ethereum was also up by 1% over the past 24 hours, currently trading for $3,771. According to CoinMetrics data, ADA and XRP are down by 2%.

The first US BTC futures are to begin trading next week as allowed US Securities and Exchange Commission (SEC).