Nvidia has suffered the most catastrophic capital loss in recent times. With China unveiling its DeepSeek AI, the launch disrupted the US stock markets, hitting Nvidia (NVDA) with a major blow. Post the launch of DeepSeek, its popularity skyrocketed to new highs, with investors doubting Nvidia, which later prompted a series of investment outflows that resulted in the loss of nearly 900 million dollars. This incident has compelled Morgan Stanley to readjust its Nvidia stock rating lowering its earlier predicted price target.

Also Read: 3 Made In USA Cryptocurrency Coins Eyeing National Reserve Spot

Morgan Stanley on Nvidia

Per the Kobeissi Letter, Morgan Stanley has predicted a new stock path for Nvidia. The banking giant has readjusted its price rating for NVDA following the latest DeepSeek AI blunder. MG has reduced NVDA stock valuation from $166 to $152, post the DeepSeek apocalyptic mayhem.

“BREAKING: Morgan Stanley has cut their Nvidia, $NVDA, price target from $166 down to $152 due to DeepSeek. They note DeepSeek’s AI innovations might be deflationary and could lead to export controls or reduced AI spending.”

BREAKING: Morgan Stanley has cut their Nvidia, $NVDA, price target from $166 down to $152 due to DeepSeek.

— The Kobeissi Letter (@KobeissiLetter) January 28, 2025

They note DeepSeek's AI innovations might be deflationary and could lead export controls or reduced AI spending. https://t.co/uLLAcyrgf2

The DeepSeek Impact on Nvidia’s Market

The platform later outlines the stark difference that ultimately led to this massive stock crash. Per KL, China is a highly regulated country, which is currently battling a trade war with China. The platform states that in such a case, Nvidia may likely have sold its less advanced H800 chips to China, rather than its premium H100 chips, with which the nation managed to curate a highly nuanced AI that could create codes in a matter of seconds. This development sparked a major controversy, sowing seeds of doubts in the US’s AI competence quotient.

BREAKING: Morgan Stanley has cut their Nvidia, $NVDA, price target from $166 down to $152 due to DeepSeek.

— The Kobeissi Letter (@KobeissiLetter) January 28, 2025

They note DeepSeek's AI innovations might be deflationary and could lead export controls or reduced AI spending. https://t.co/uLLAcyrgf2

“Clearly, DeepSeek has become a leader in AI innovation, with Nvidia calling it an “excellent AI advancement. In theory, AI advancement is BULLISH for Nvidia because it means more chip demand. The issue is that DeepSeek is in China, a highly regulated country in the midst of a trade war with the US. This means Nvidia can likely only sell their weaker H800 chips in mass quantities to DeepSeek, not the leading H100 chips that are $30,000+ each. Even as DeepSeek holds less advanced chips, China was effectively able to generate an AI model that is 96% more efficient and 90%+ cheaper. Meanwhile, their AI model is FREE compared to relatively expensive ($200+ per month) and less efficient AI models like ChatGPT. It appears that China has begun to innovate at speeds that were previously believed to be impossible. US tech assumed its dominance was impossible to dethrone.”

This development triggered mass investment mayhem, with rumors sparking on how China is capable of dethroning the US when it comes to evolving tech innovation.

Also Read: VeChain to $0.13? Why VET May Be Nearing a Bullish Reversal

The Firm’s Price Path This February

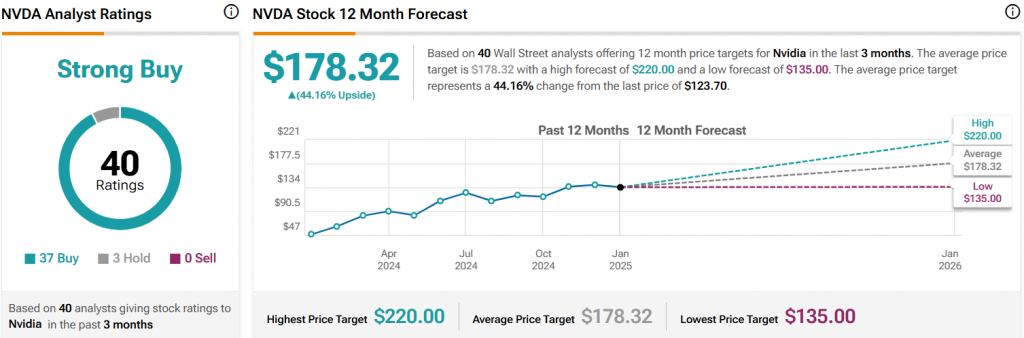

Per TipRanks, Nvidia is still aiming for the long haul, targeting $220 in the long haul.

“The average price target for Nvidia is $178.32. This is based on 40 Wall Street analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $220.00; the lowest forecast is $135.00. The average price target represents a 44.16% increase from the current price of $123.7.”

Also Read: Fed Chair Jerome Powell: Banks Can Serve Crypto Customers