Volatility has been the name of the game over the last couple of days. During the early hours of Monday, top tokens from the crypto market started losing their value. Resultantly, at press time, the crypto market’s capitalization stood exactly at $900 billion, down by 8% when compared to Sunday. The largest crypto Bitcoin—on its part—was down by 7% in the same timeframe.

Apart from traders and investors, the drop in the price of Bitcoin impacts miners as well. Whenever miners have to pay up for expenses, they usually sell their Bitcoin HODLings, as that is their major source of revenue.

Outlining the costs of Bitcoin miners

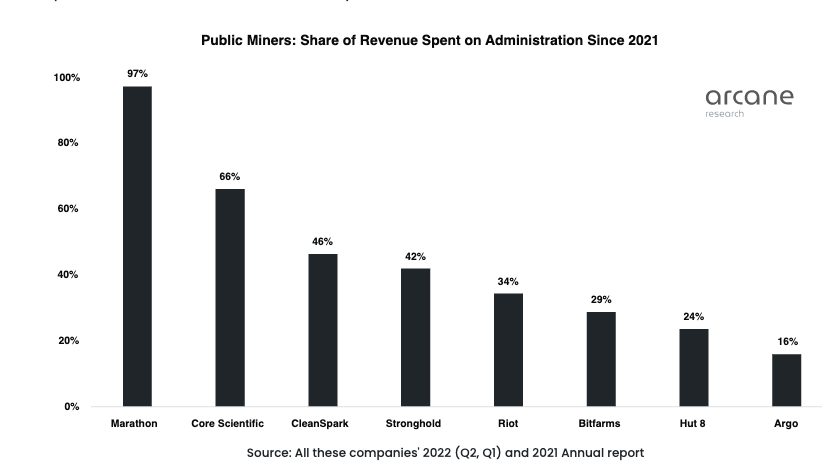

Per a recent Arcane Research report, some public Bitcoin miners spend more than half their revenue on administrative costs. As illustrated below, a majority of public bitcoin miners have been spending between 20% to 50% of their revenues on administration since last year.

However, towards the end of both sides of the spectrum companies with an effective and non-effective cost-cut strategy stand. Agro, on one hand, has diverted merely 16% towards administrative expenses. Marathon, on the other hand, has ended up spending almost its entire revenue [approx. 97%] catering to administration costs since 2021.

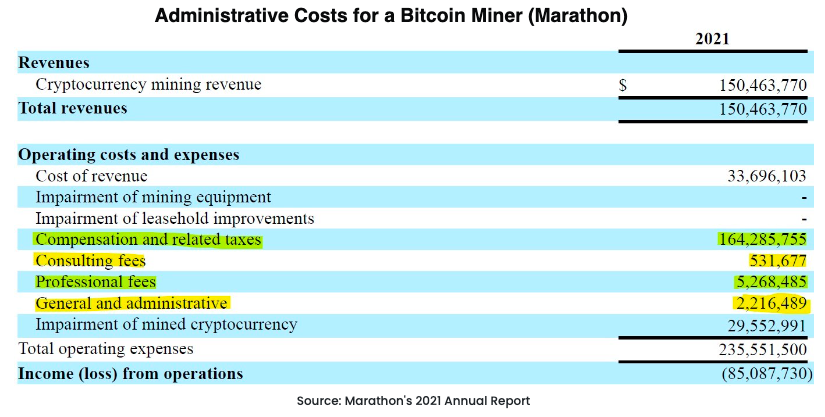

Per Marathon’s annual report from last year, administrative costs (SG&A expenses) constituted a major chunk. The break-up of the same into various sub-heads like compensation and taxes, consulting and professional fees, and general and admin expenses are illustrated below.

Viewing from the investors’ lens

Over the years, investors have understood why it is not wise to put all the eggs in one basket. So, apart from diverting funds towards Bitcoin, they have also been considering other investment vehicles that provide them indirect exposure to crypto. Alongside various funds, mining company stocks have proven to be quite a compelling option.

So, from an investor perspective, knowing how much revenue a Bitcoin company spends on administrative costs is important because it directly impacts mining stock prices and the RoI to be fetched by them.

Secondly, costs incurred indirectly help in shaping the buy/sell trend in the Bitcoin market. To cater to, say, $X of costs, miners will have to spend more coins during bearish phases, intensifying the sell-pressure in the BTC market. The same usually bears an effect on investor sentiment and the price of the asset. So, at end of the day, it is quite critical for companies to cut down costs.

The same has, in fact, dented the profitability aspect of companies as well. Chalking out the same, Arcane Research’s report concluded by highlighting,

“Most public miners have never made a profit, even after the super-profitable profitable 2021, partly due to their high administrative costs.”