Companies from the crypto space have been focussing on building and expanding their territory of late. Even though the macro-factors are not aligned, a fair amount of tangible growth has been witnessed. A month back, Binance opened its doors to the US for its payments service. Before that, Ripple spread its wings to France and Sweden, while Coinbase stepped into Europe.

In fact, the ecosystem also welcomed a bunch of prominent players from the traditional financial space. Along with launching an Ethereum Index Fund, Fidelity Investments released ETH custody and trading services for its institutional clients.

Furthermore, Singapore’s largest bank, DBS, expanded its crypto trading services to over 100,000 clients. Alongside, German digital bank N26 introduced a crypto trading service for its customers. Notably, Austria was the first market for the said launch.

N26 To Expand Footprint

On Tuesday, the N26 announced that it would soon step into other countries. Its official Twitter thread noted,

“N26 Crypto is already available in Austria and coming soon to Germany, Switzerland, Belgium, Ireland, and Portugal!”

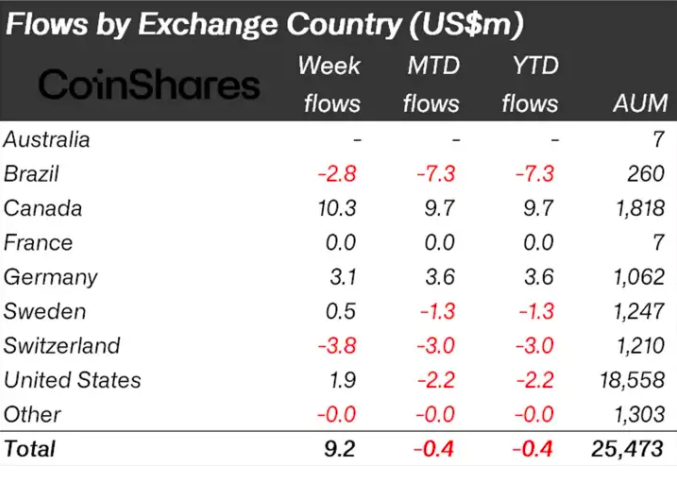

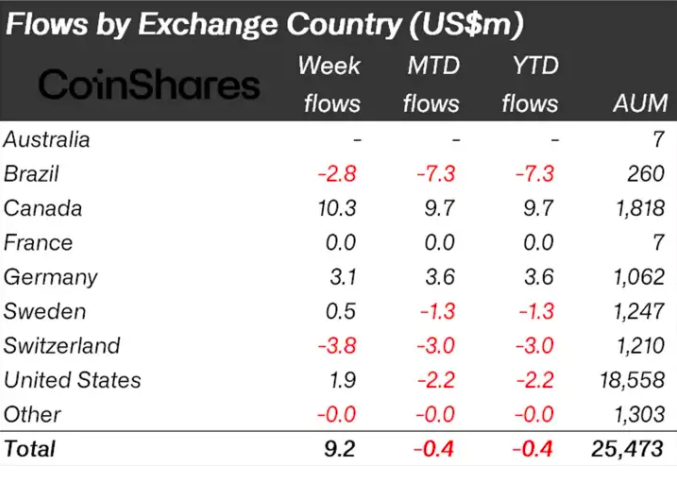

With the market’s rally still in its pre-mature stage, digital asset investment products have been noting mixed sentiments lately. CoinShares’ latest weekly report chalked out that Germany noted positive flows worth $3.1 million last week, while Switzerland registered outflows worth $3.8 million.

The inflows and outflows, serve as an exhibit that there’s a fair amount of interest with respect to crypto in the said regions. Thus, by expanding its services, N26 will be in a position to cater to the demand of local traders.

The bank would roll out its expanded crypto trading feature “gradually” over the “coming weeks.” Notably, N26 uses crypto exchange Bitpanda’s trading and custody platform to give bank’s customers access to crypto.

Last year, Gilles BianRosa, N26′s Chief Product Officer, revealed that users were “extremely interested” in the ecosystem. Despite being in a macro bear market, she stressed, interest remained “super high.”

BianRosa further noted that the bank’s crypto brokerage feature allowed users to “dip their toes into the water in a way that’s not frothy.” He added that the bank has a “pretty long-term view” with respect to crypto, and the latest announcement justifies the same.

Read More: Germany’s $9B worth N26 bank to launch Bitcoin, Ethereum trading