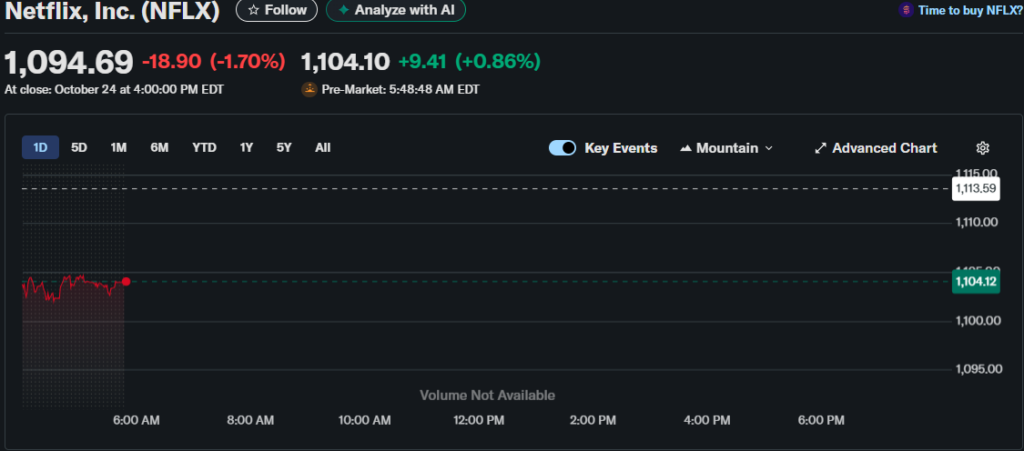

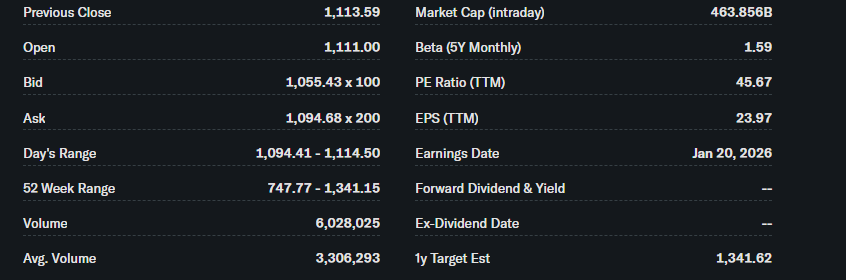

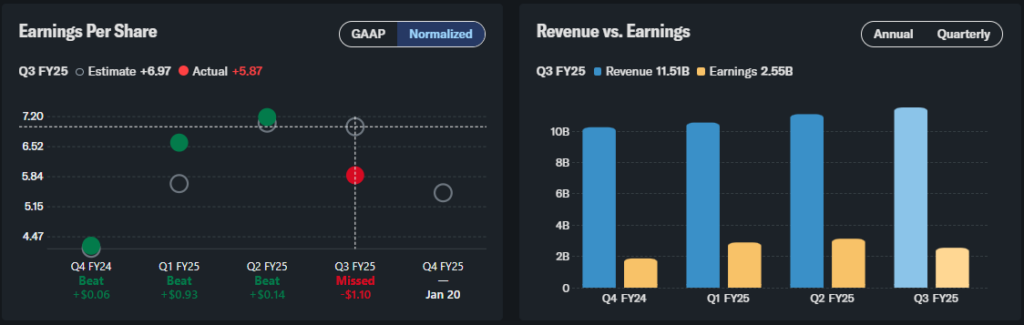

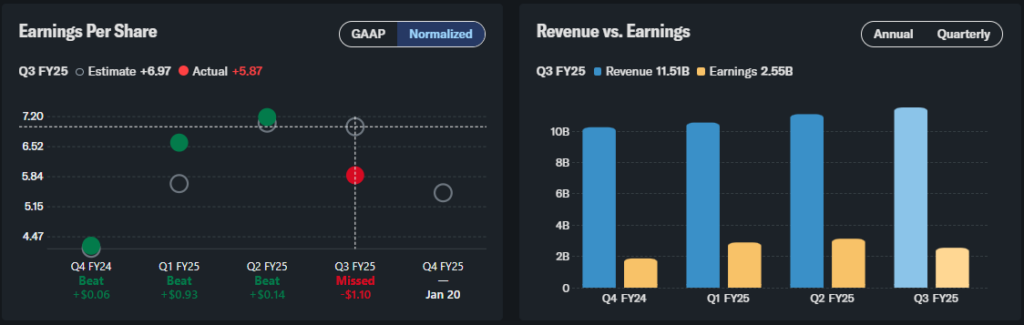

Netflix stock dropped 17% from its 52-week high after Q3 2025 earnings revealed an unexpected tax hit that caught investors off guard. The streaming giant actually posted revenue of $11.51 billion, which met analyst expectations, but earnings per share of $5.87 fell short of the $6.97 estimate. This was mainly due to a $619 million charge related to an ongoing Brazilian tax dispute.

Netflix Stock Dips on Tax Hit But Earnings Show Buy Opportunity

The Netflix earnings miss was driven by a one-time charge rather than any real operational weakness in the business. Revenue growth came in at 17.2%, which demonstrated pretty strong fundamentals, and some analysts are viewing the Netflix stock decline as a potential Netflix buy opportunity right now.

The company’s management had this to say:

”The quarter marked its best ad sales period ever, and it doubled its commitments in the U.S. upfronts, showing its ad strategy is paying off.”

Without the $619 million NFLX tax hit, Netflix would have actually exceeded its operating margin guidance of 31.5%. The streaming platform also reported some impressive viewership gains:

”View share reached a record in both the U.S. and the U.K., up 15% and 22%, respectively, since Q4 2022 to 22%.”

No Netflix Stock Split Despite High Share Price

Even though Netflix stock was trading around $1,200 before the recent decline, no Netflix stock split was announced during the earnings report. The company now has one of the highest share prices on the market, having passed $1,000 earlier this year and continuing to climb. The absence of a Netflix stock split means that shares are being kept at elevated nominal prices for now.

Also Read: Netflix (NFLX): Wall Street Upgrades Stock, Suggests 19% Upside

Strong Netflix Earnings Fundamentals Remain Intact

Netflix earnings showed some impressive operational strength beyond just the tax issue. The forecast that was provided called for revenue growth of 16.7% to $12 billion in Q4, along with an operating margin of 23.9%. Content performance was particularly strong during the quarter, as management noted:

”It released its most-watched movie in the third quarter with KPop Demon Hunters.”

Analysts have been emphasizing the Netflix buy opportunity that’s been created by this selloff, with one stating:

”When great companies sell off for nonrecurring reasons, it can create opportunities for long-term investors who focus on business fundamentals rather than short-term price movements.”

Also Read: Netflix Stock Drops as Tax Dispute in Brazil Weighs on Earnings

The NFLX tax hit has been described as a temporary issue, and Netflix stock is currently trading at a price-to-earnings ratio of 35. This is of course based on 2026 estimates. This appears pretty reasonable when you consider the growth trajectory ahead with advertising expansion and global market penetration.