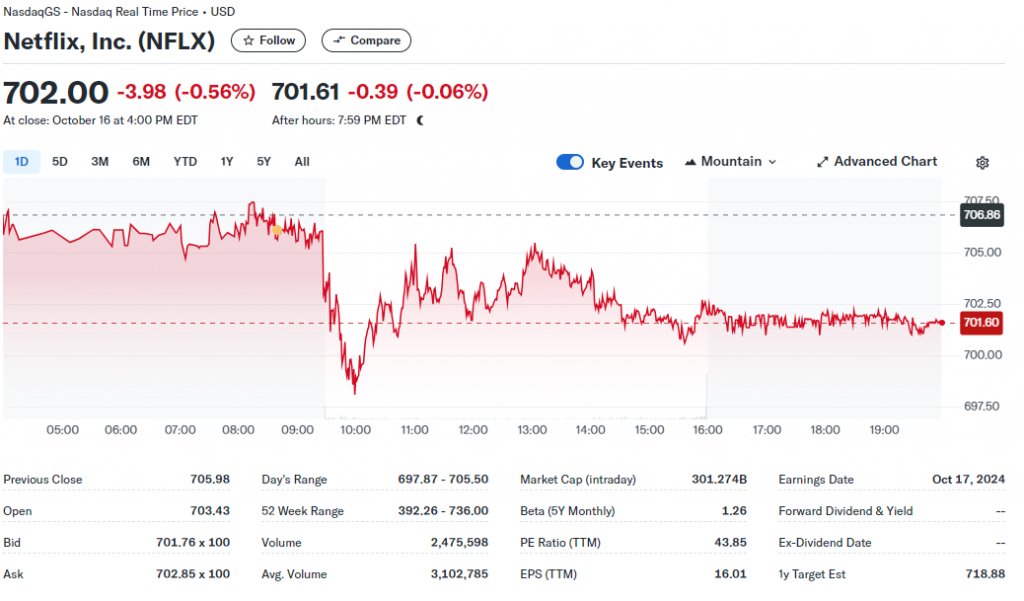

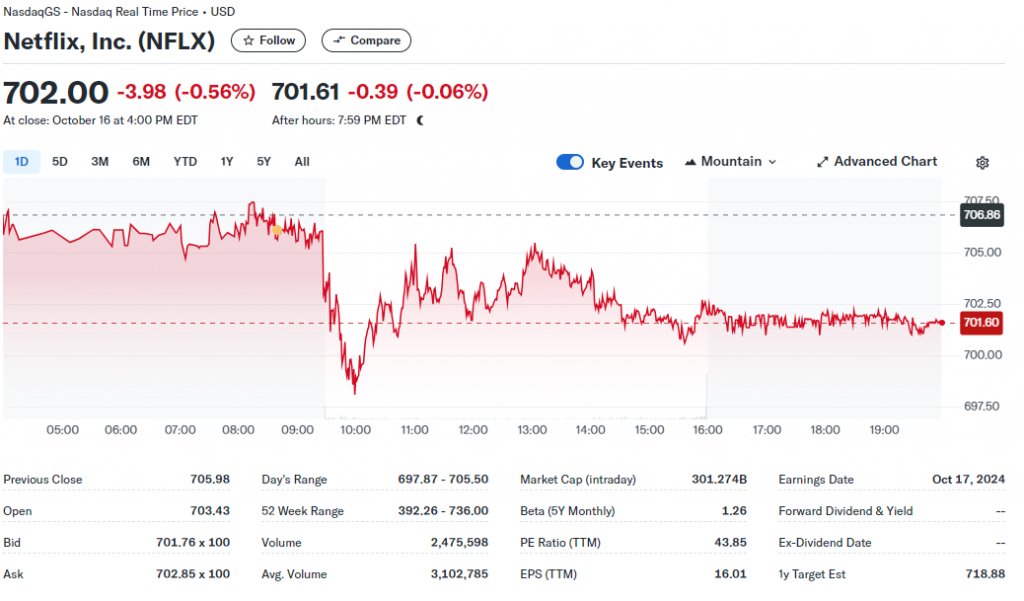

Netflix stock price is attracting attention as analysts update their forecasts before Q3 earnings. The streaming giant’s performance in NFLX earnings, subscriber growth, and revenue growth are key factors shaping stock forecasts.

Also Read: Nvidia Dominates Earnings: Up 16% in a Month. Time to Buy or Sell?

Analysts Revisit Netflix Stock: Earnings, Forecasts, and Subscriber Growth

Mixed Analyst Opinions

Wall Street analysts disagree on Netflix’s outlook. Benchmark’s Matthew Harrigan has a ‘sell’ rating with a $545 target. KeyBanc’s Justin Patterson is more optimistic, raising his target to $760.

[Image placeholder 1: Analysts comparing Netflix stock charts]Subscriber Growth and Ad Revenue

Netflix added 17.4 million new accounts in the first half of 2024. Growth may slow in coming months. The company now focuses on its ad-sales business, which grew faster than overall revenue last quarter.

Harrigan notes:

“Advertising contribution is presently relatively nascent as the ability to monetize rapidly growing advertising inventory is lagging scaling momentum.”

Potential Price Hikes

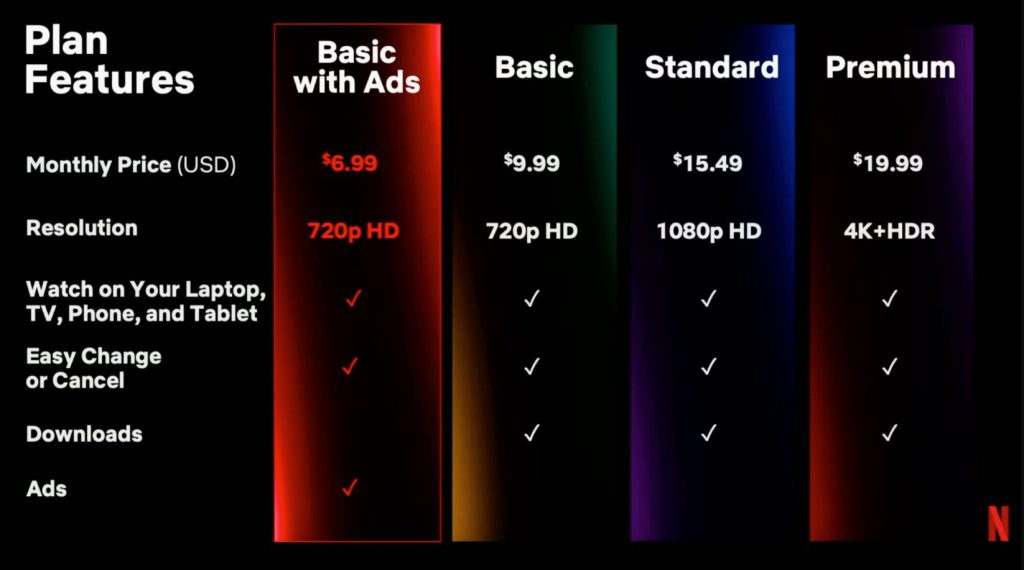

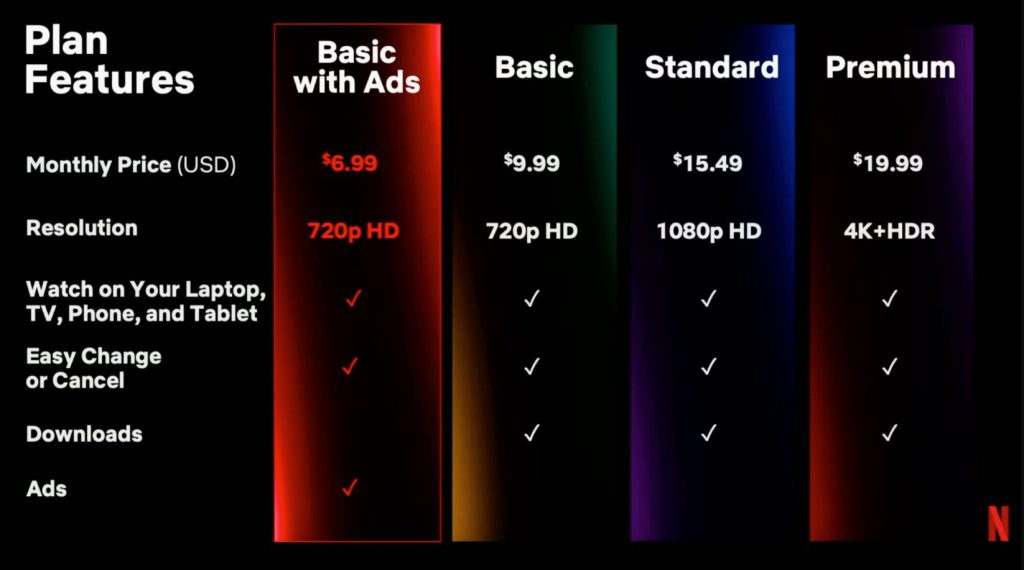

Netflix may raise prices to boost profits. U.S. prices haven’t changed since 2022. The basic ad-tier costs $6.99 monthly, while the standard ad-free version is $15.49.

“The market will be especially attentive to any price hike announcements when Netflix reports,” Harrigan says.

Also Read: Top 3 Cryptocurrencies That May Rally Over 30% This Weekend

Live Sports and Content Slate

Netflix’s move into live sports, including a Christmas Day NFL game, could boost subscribers. Patterson believes, “Netflix’s strengthening content slate should drive better viewership and support improved monetization.”

Q3 Earnings Expectations

Analysts expect Netflix to report $5.12 earnings per share, up 37.3% year-over-year. Revenue is forecast to rise 14.4% to $9.77 billion. Subscriber gains are estimated at 4.1 million.

Patterson adds, “We believe raising prices on both the ad-supported and standard price plans could alleviate concerns about ad [average revenue per user] dilution and support 2025 revenue growth in the low-teens percent.”

Also Read: BRICS Saudi Arabia: Official Announcement on Membership

As earnings approach, investors watch for growth signs in streaming services and potential price changes that could affect NFLX stock performance.