The entire globe has been embracing crypto. Despite the ongoing bear market, the adoption of these assets has been going on in full swing. Amidst this, regulators across the globe have been drafting and implementing clearer laws governing the industry. The U.S., however, continued to confuse both, the community as well as prominent players of the crypto-verse. Succumbing to this confounded environment, Nexo decided to depart from the U.S.

Nexo was in the headlines following its recent blog post. The crypto lender announced that it would phase out its U.S. products as well as services in the next few months. The platform decided to take this drastic step as it was hitting a “dead end” with regulators in the country.

The firm announced that starting tomorrow, it would stop accepting new American clients for its Earn Interest Product in eight states: Indiana, Kentucky, Maryland, Oklahoma, South Carolina, Wisconsin, California, and Washington. According to the firm, withdrawals and account access won’t be impacted.

As per the announcement, the platform did not make this decision in a haste. Nexo wrote,

“Our decision comes after more than 18 months of good-faith dialogue with US state and federal regulators which has come to a dead end. Despite inconsistent and changing positions among state and federal regulators, Nexo has engaged in significant ongoing efforts to provide requested information and to proactively modify its business in response to their concerns.”

The platform believed that the U.S. denies paving a path for blockchain-based businesses. Therefore, Nexo couldn’t offer its customers the confidence that the country’s lawmakers would look after their best interests.

“Inconsistent” regulators continue to “change positions” on crypto

This isn’t the first time that U.S. financial watchdogs were being called out for their stance on crypto. Ripple’s Brad Garlinghouse has time and again expressed his issues with the existing regulatory system in the U.S.

More recently, Garlinghouse’s movement garnered attention from other prominent industry players like Brian Armstrong of Coinbase. When Senator Elizabeth Warren took a dig at the industry for the FTX debacle, Armstrong called out the lack of clarity from the Securities and Exchange Commission. Due to this, most trading activity in the U.S. occurs outside the country.

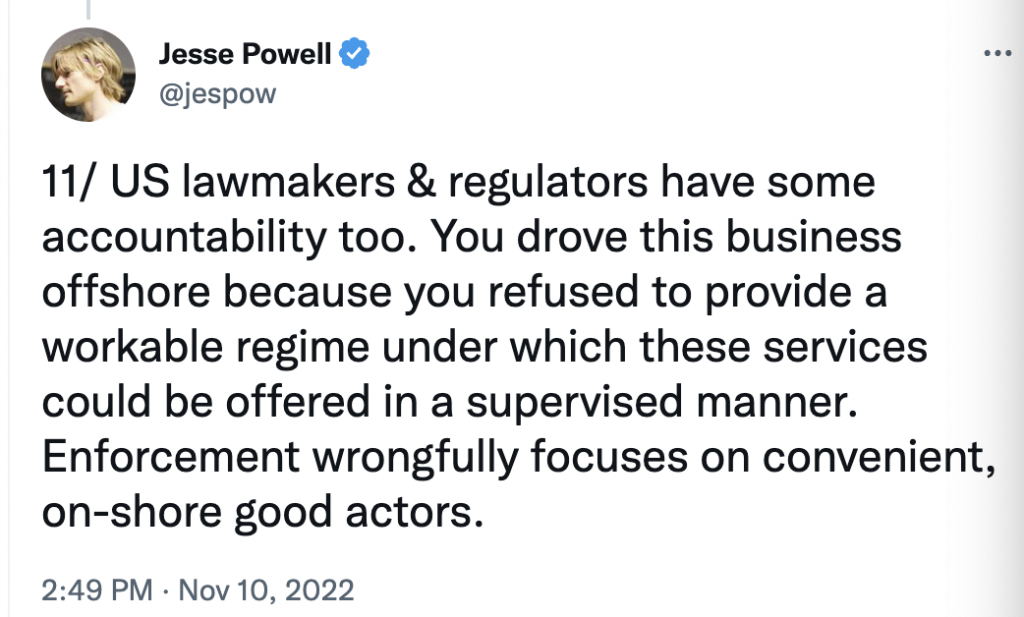

Kraken’s co-founder Jesse Powell was also visibly enraged with these lawmakers. He went on to tweet,

If the U.S. fails to put forth better laws before the industry, prominent crypto platforms are likely to migrate to other nations.