The NFT landscape has evolved by leaps and bounds over the years. As the idea of non-fungibility started taking concrete shape, the demand for such tokens started rising. And to cater to the demand and the ‘variety’ factor, novel collections have time and again been launched.

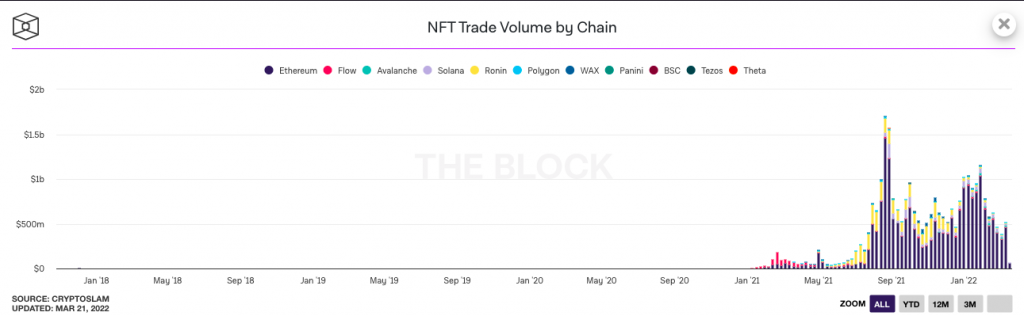

The cumulative volume numbers have undoubtedly risen on the macro frame, but seem to be lagging on the micro-frame. Since the end of January, the spikes on the volume chart have more or less been getting shorter, implying the current lack of appetite of market participants.

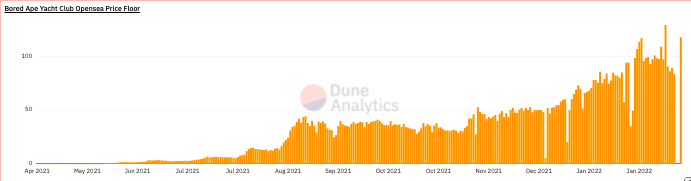

Amongst the host of collections available, BAYC remains to be the most prominent one. It, in fact, gained even more traction last week when it launched its own native ApeCoin. Following the news of the same, the floor price of this collection skyrocketed over 100 ETH.

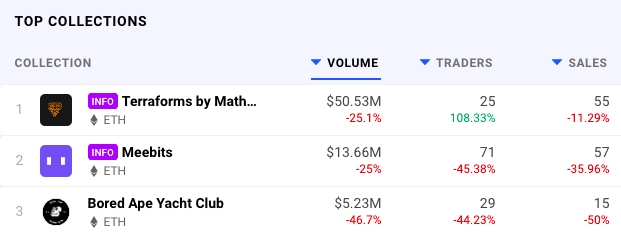

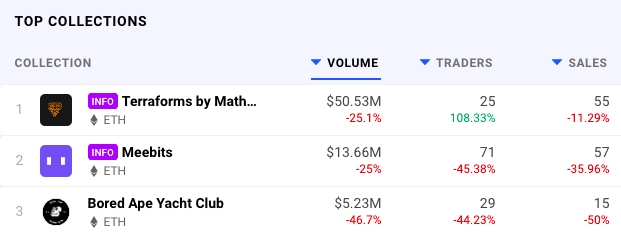

Despite that, the broader NFT market bearish sentiment rubbed off here as well. As can be seen from the snapshot attached, BAYC’s volumes have dipped by 47% over the past day. Alongside, the number of traders and the sales figures too dipped by 44% and 50% each respectively.

What the Ethereum founder has to say

The crypto community was evidently delighted when TIME magazine decided to feature Ethereum’s founder, aka “crypto prince,” on the cover of its first-ever NFT edition. One of the focal points of Vitalik Buterin’s cover story interview remained to be NFTs. In fact, he specifically spoke about BAYC—the NFT collection that was minted on the Ethereum blockchain in April last year.

He said,

“The peril is you have these $3 million monkeys, and it becomes a different kind of gambling.”

He further went on to add,

“One silver lining of the situation in the last three weeks is that it has reminded a lot of people in the crypto space that ultimately the goal of crypto is not to play games with million-dollar pictures of monkeys, it’s to do things that accomplish meaningful effects in the real world.”

Buterin did bring to light the fact that a lot of people were buying “yachts” and lambos, but he hoped that in the future crypto would be used for fair voting systems, urban planning, and universal basic income. He went on to explicitly also state that if we did not exercise our voice, then only “immediately profitable” things will be built going forward.

‘Well, the ‘greater good’ remains to be the ultimate aim of cryptos in general, and like Buterin said, if that doesn’t become the nucleus, the ecosystem would find it difficult to sustain over the long term.