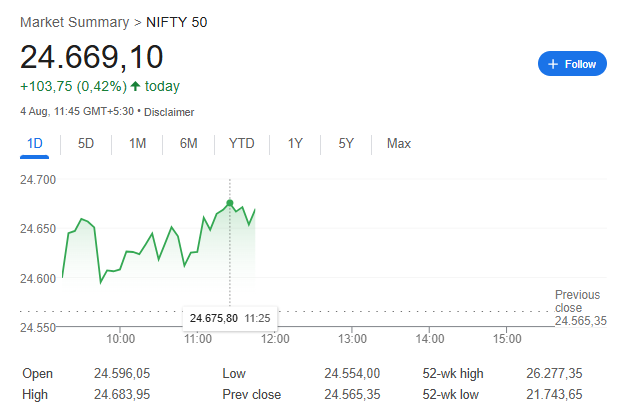

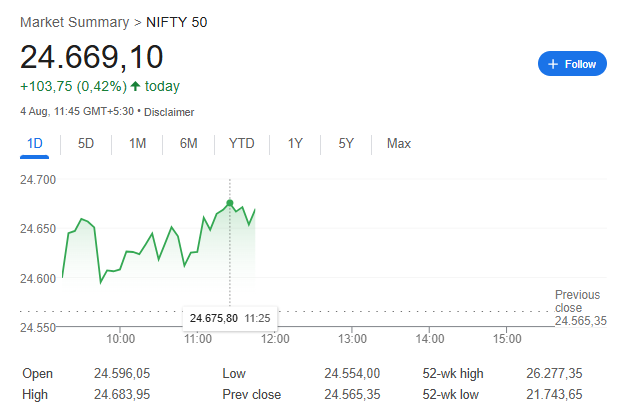

Nifty 50 gained over 40 points in Monday’s session while the Sensex struggled below 81,000, actually highlighting divergent performance as markets await the RBI policy decision on August 6. The Nifty 50 trades just 100 points from its June 13 low of 24,473 after five consecutive weekly losses were recorded by traders.

Also Read: Palantir Stock Forecast: Analysts Say Sell and Buy Amazon

Sensex Today Live: Share Price Moves, Moneycontrol Signals, More

Current Market Performance Shows Mixed Signals

The Nifty 50 showed resilience despite broader market weakness, with trading volumes being elevated ahead of key earnings right now. Sensex today movements reflected anxiety over US President Trump’s tariff concerns, along with disappointing June quarter earnings that were released recently.

Market participants are closely monitoring Sensex share price action, particularly in banking stocks that are sensitive to the upcoming RBI decision. The Nifty 50 remains vulnerable near support levels as investors assess corporate results, even though some recovery signs have emerged.

Corporate Earnings Actually Drive Market Activity

Federal Bank provided detailed guidance during their earnings announcement, at the time of writing. Venkatraman Venkateswaran from Federal Bank stated key points about their outlook:

“Credit cost guidance of 55bps for FY26 with slippages below 1%. We believe the worst is behind us. Agri-MFI segment stress peaked in May. June & July has seen better collections in Agri-MFI segment.”

The bank also indicated regarding interest rate impact, along with margin expectations:

“Limited impact from 50 bps June rate cut. NIMs expected to decline by 10 bps in Q2. CASA ratio improving, RoA projected at 1.15% by year-end.”

Power Sector Updates Impact Broader Indices

Tata Power’s leadership addressed power demand concerns that are affecting the energy sector right now. MD & CEO Praveer Sinha stated during the earnings call:

“Power demand in FY26 is likely to remain muted. An extended monsoon has affected the summer season. Recovery in power demand expected in August & September.”

Sinha also highlighted operational performance metrics:

“Our plants are operating at high PLFs, with availability above 90%. Mundra has stopped operations post removal of Section 11. Hoping to sign PPAs with all 5 states in August.”

JSW Steel announced expansion plans with a ₹4,300 crore investment in CRGO manufacturing, which was seen as supporting steel sector sentiment within the broader market.

Technical Analysis Shows Mixed Outlook

Market guru Prakash Diwan gave a stock wise advice which is influencing Sensex Moneycontrol signals at present. With respect to PNB Housing Finance opportunities, Diwan said:

“It does offer an entry point, if you like the business. But remember, there have been some issues in terms of the PE exits, the kind of rethink that is coming, ever since Carlyle got into the space.”

On Federal Bank, Diwan had this to say about potential opportunities:

“I believe it’s a good entry point, though there have been downgrades and all of that, but if you take a slightly contrary view, you’ll probably start seeing value from a longish perspective if the market gives you that opportunity based on these earnings.”

Also Read: Tesla Sales Weaken Again in Europe: TSLA Stock Continues Skid

The coming week would be crucial in terms of Nifty 50 performance, in addition to Sensex today live pursuit as a determination by the RBI is nigh. The submission of the US jobs numbers that have been lower than expected has contributed pressure as well and the Sensex today is likely to be on shaky grounds till policy environment is clearer at the central bank.