Nigeria and its inclination towards crypto isn’t news. The cash shortage issue that the country has been facing further prompted citizens to embrace crypto. The government also promotes the usage of digital assets. This, however, was the government-controlled eNaira, the country’s CBDC.

On April 13, Lazerpay declared that it would close down its operations. The CEO of the crypto startup, Emmanuel Njoku, took to Twitter to make the announcement. The reason behind this decision was attributed to the firm’s inability in raising enough funds.

The firm seems to have shut down a few months after carrying out layoffs in November 2022. The inability to generate money when the main investor decided to walk was the reason behind the company’s layoffs. In the latest statement, the Nigeria crypto firm’s CEO said,

“We are immensely grateful for the connection we have made and the impact our platform has made in the crypto ecosystem. We fought hard to keep the lights on for as long as possible, but unfortunately, we are now at the point where we need to shut down.”

Lazerpay debuted in October 2021. Njoku claimed that throughout its existence over 3000 firms have signed up with Lazerpay, and the firm has completed over $1 million in transactions. More recently, Paxful, a prominent P2P firm also shut shop. With the closure of a plethora of crypto-related firms, Nigerians will undoubtedly be left with limited exposure to the digital asset industry.

Will Nigerians be forced to steer away from crypto to CBDC?

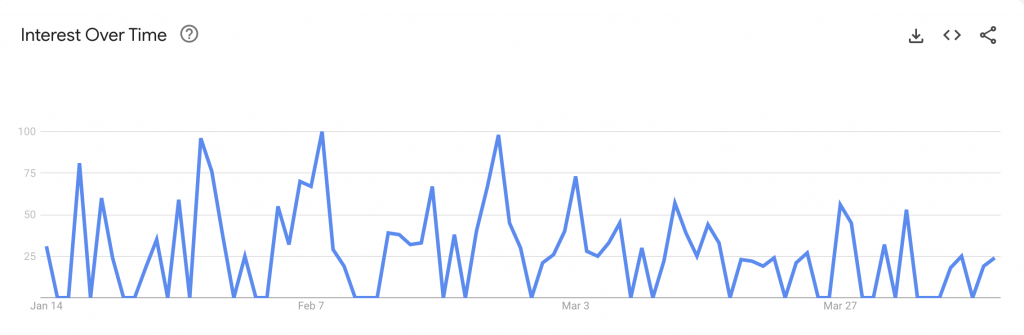

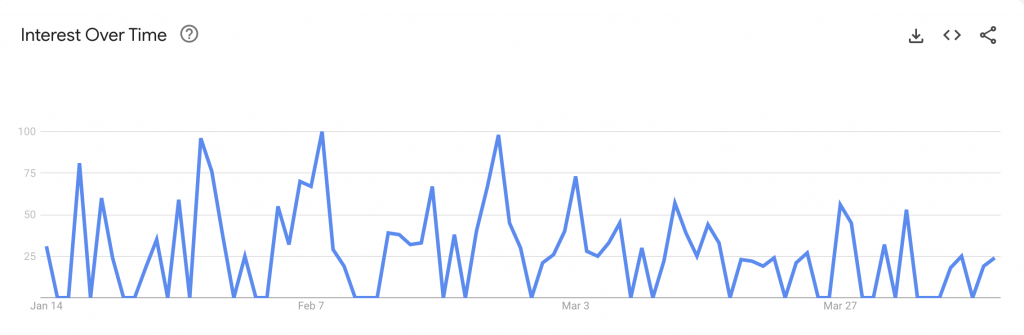

As seen over the last couple of months, Nigerians have been urged to employ eNaira. The increased cash shortage further prompted them to use the CBDC. The hype around the central bank-issued asset has also been rising.

A recent Bloomberg report noted that the value of eNaira transactions climbed 63% to 22 billion naira or $47.7 million in a nation where cash still represents nearly 90% of transactions.