The world of cryptocurrencies was shaken up after the collapse of $LUNA and stablecoin $UST. The regulators worldwide became more attentive to the required legislation in the country to protect investors and the economy. Treading this fine line was Nigeria whose Securities and Exchange Commission [SEC] released a new rulebook, “New Rules on Issuance, Offering Platforms and Custody of Digital Assets,” to issue regulatory clarity for this market.

As per the report, the digital assets are classified as securities regulated by the SEC.

With this, the trading of crypto assets acquired some legal standing and offered clarity to the citizens, which can in turn boost trading in the country. Nigeria already ranks among the biggest markets for digital assets and with clear regulations, more people can get involved. To put things in perspective, Nigeria accounted for the largest volume of cryptocurrency transactions outside of the United States, as per Paxful.

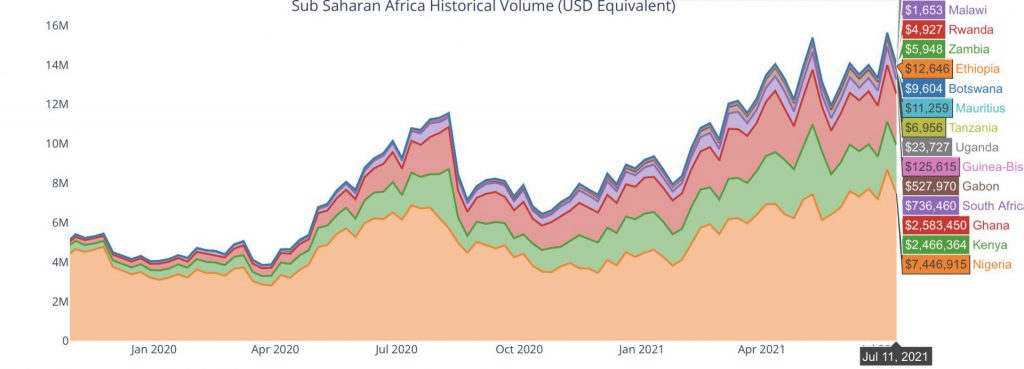

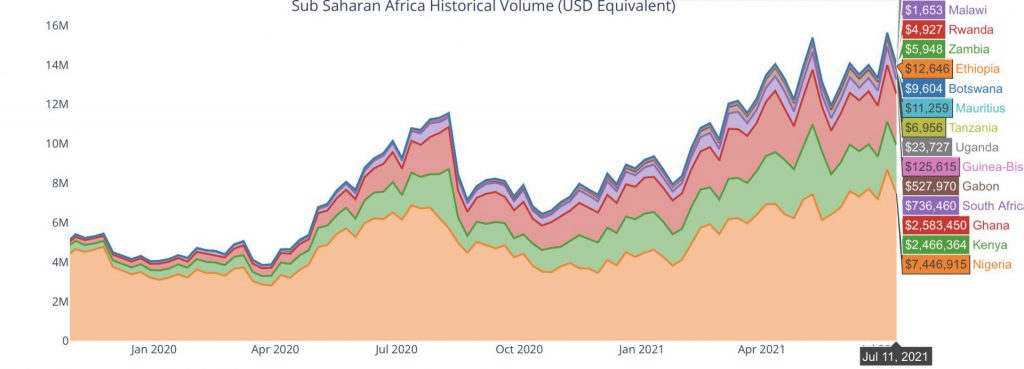

The above chart indicated the historical peer-to-peer volume in sub-Saharan Africa as recorded on Paxful. As can be noted, Nigeria was among the most popular region with a high volume of crypto trade, $7.44 million, and was followed by Kenya [$2.46M] and Ghana [$2.58M].

The strong volume was despite the Nigerian central bank’s order to commercial lenders to stop transactions and operations in cryptocurrencies. In 2021, the central bank had taken these stringent actions citing threats to the financial system and the SEC claimed to seek to protect investors and make the market more transparent. The current actions by the regulators could be in line with its previous comments.

Per the rules, all exchanges registered in Nigeria need to be capitalized with at least NGN 500,000 [$1,204] in paid-up capital and post a fidelity bond for at least 25% of this amount. The SEC also required exchanges to be fair, reasonable, and transparent with their fees and need to provide a list of assets they intend to trade and get a “no-objection” letter for each asset.

As per reports, Digital asset players will now include Digital Asset Offering Platforms (DAOPs), Digital Asset Custodians (DACs), Virtual Assets Service Providers (VASPs), and Digital Assets Exchange (DAX). The rules will apply to all platforms supporting trading, exchange, and transfer of virtual assets.

The new rules cover the issuance of digital assets as securities, the registration of platforms and digital asset custodians, exchanges, and virtual asset service providers. With this vast range of clarity between investors and businesses, Nigeria could see another wave of blooming investment and bring along crypto adoption with it. The country manager for Nigeria at crypto exchange Luno, Owen Odia told publication,

The regulations “could act as the precursor for a surprise move from the central bank to reverse its approach, providing critical foundations for mass crypto adoption across the country.”