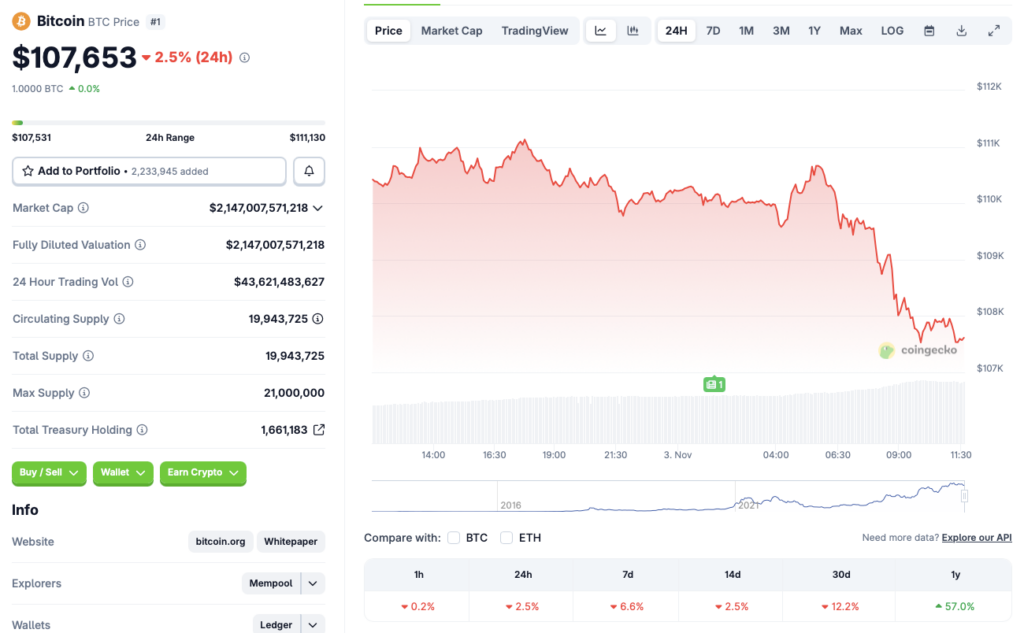

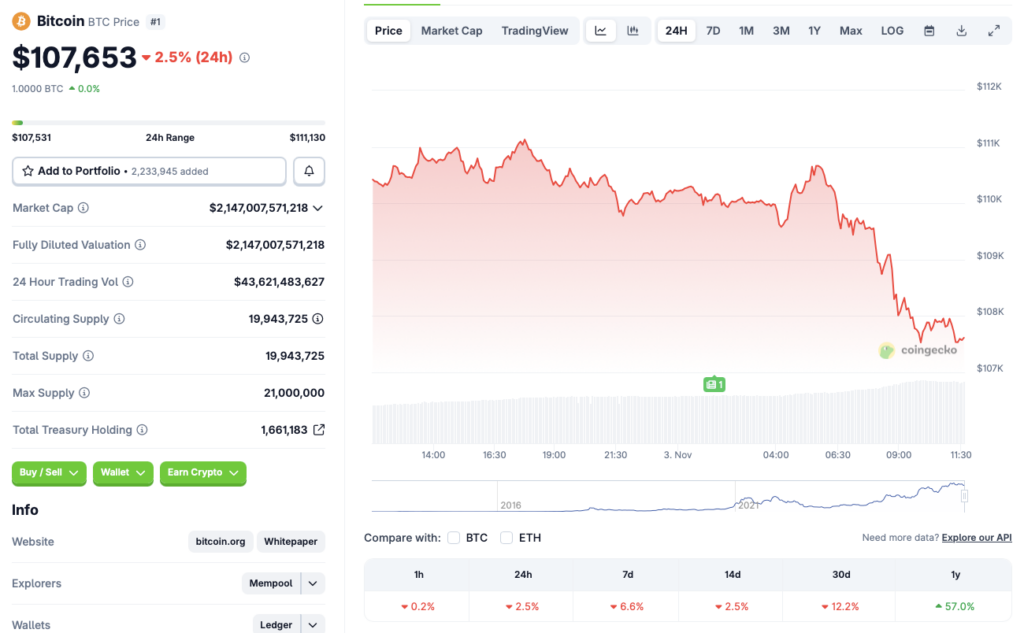

The cryptocurrency market continues its lackluster performance as we enter November 2025. Bitcoin (BTC) is struggling to gain momentum and is trading in the red zone across nearly all time frames. According to CoinGecko, the original crypto is down 2.5% in the last 24 hours, 6.6% in the last week, 2.5% in the 14-day charts, and 12.2% over the previous month. October, once considered a bullish month for crypto, has gone the other way around in 2025. Given the current market environment, it would appear there is no recovery in sight for Bitcoin (BTC) or the larger crypto market.

When Will Bitcoin Enter a Recovery Phase?

The current market environment is quite surprising. The Federal Reserve lowered interest rates by an additional 25 basis points after its October meeting. Interest rate cuts often lead to Bitcoin (BTC) and other cryptocurrencies rallying as borrowing becomes easier and investors take more risks. However, this time the trend is quite different. It is possible that Federal Reserve Chair Jerome Powell’s hawkish speech may have spooked investors. Powell highlighted the slow economic growth and challenges from rising inflation. Moreover, the chances of another interest rate cut have substantially dropped.

Bitcoin’s (BTC) lack of a recovery could also be due to global trade disputes and macroeconomic factors. The crypto market faced its most significant single-day liquidation event after a trade spat between the US and China. Trade wars have presented substantial challenges to the crypto market over the last few months.

Also Read: Gold or Bitcoin: Which Is the Real Hedge Against a Falling Dollar?

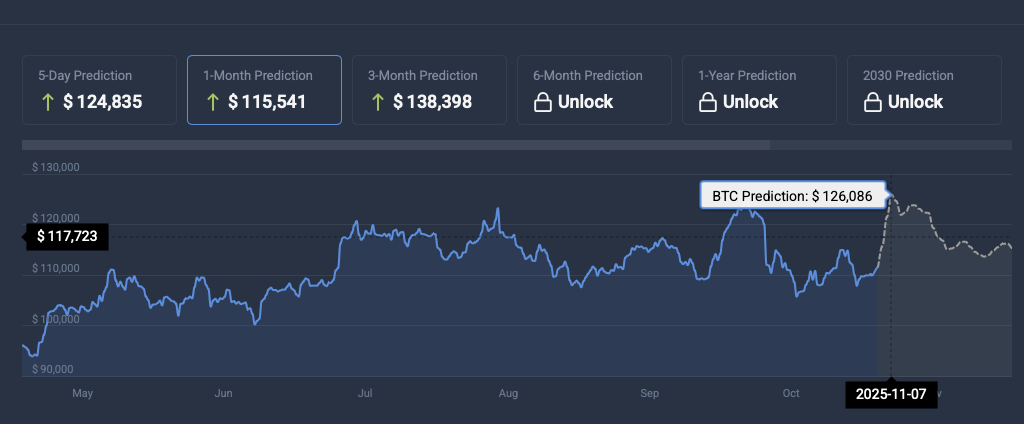

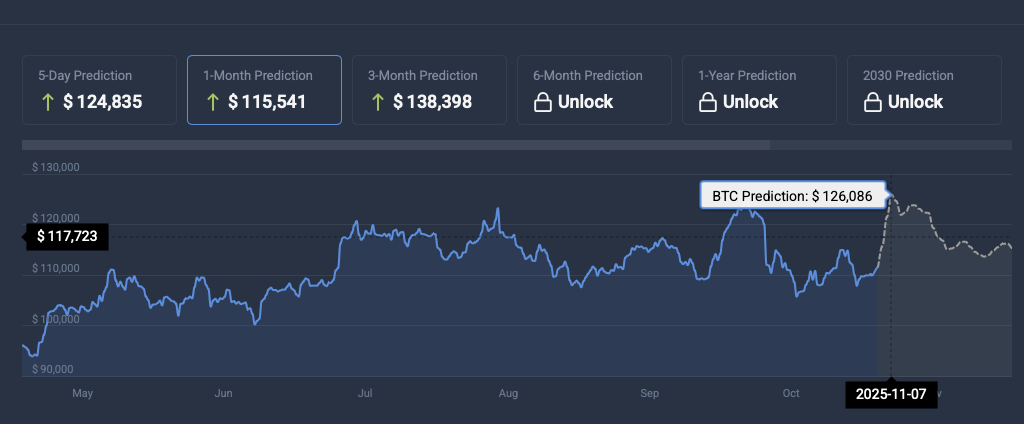

Bitcoin (BTC) may enter a recovery phase if the current challenges cool off. Economic growth and finalized trade deals could bring back investor confidence. CoinCodex analysts anticipate Bitcoin (BTC) to break out and hit $126,086 on Nov. 7. However, the platform does not expect BTC’s price to hold at the $126,000 level, predicting a correction soon after.