With Nvidia (NVDA) becoming one of the fastest-rising companies in the world, can it be the first to reach a $4 trillion market cap, outpacing Apple (APPL) and Microsoft (MSFT) in the process? All of these companies are vying for the position of the most valuable on the planet. Yet, does the AI chipmaker have the clearest path to the top spot?

Currently, analysts don’t favor the idea of any of the companies reaching the coveted market value milestone in 2025. However, the prospect of a company topping the marker is just a matter of time. Moreover, can Nvidia repeat the performance that saw it surpass $3 trillion in market cap this year?

Also Read: Nvidia: Analysts Project This Company to Surpass NVDA in 2025

Nvidia, Apple, or Microsoft: Which Will Be the First $4 Trillion Company?

In 2018, Apple became the first company to reach a $1 trillion market cap. Its dominance in the tech and manufacturing industry would be unquestioned, as it became the first company to exceed a $3 trillion market cap in 2023. Now, it faces questions about its ability to break the mold yet again.

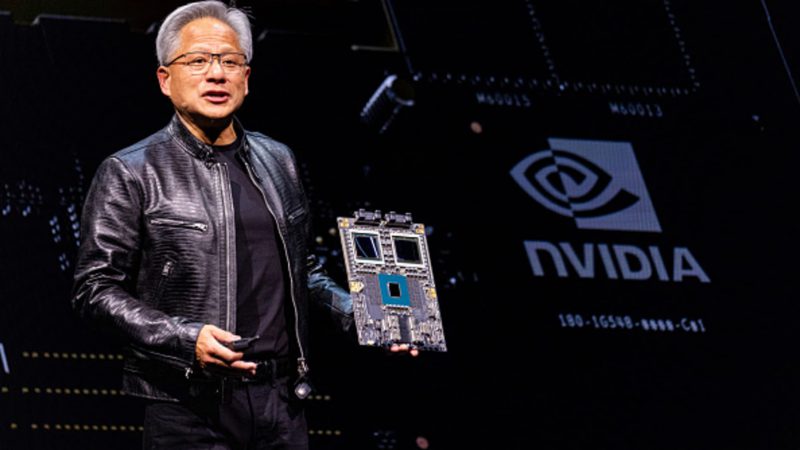

With the rising popularity of generative AI, the stock market has shown it values a different kind of company. Perhaps no firm has benefitted more from that shifting demand than Nvidia (NVDA). The company’s stock is up more than 180% year-to-date and up 223% from October 2024.

That has led many to inquire if Nvidia could be the first company to reach a $4 trillion market cap, exceeding both Apple and incoming Microsoft. All three currently sit above the $3 trillion mark. Moreover, they all are in prime positon to benefit from the booming popularity of AI.

Also Read: Apple: How Analysts Expect APPL to Compare to Nvidia, Microsoft in 2025

According to a recent analysis by Investors Business Daily, Microsoft is projected to have the highest market cap over the next 12 months. Specifically, they project it to lead the information technology sector at a $3.71 market value. In second, they project Nvidia to follow closely with a $3.68 value.

What is important to note about the forecast is how it projects the growth of all three stocks. Specifically, they expect Nvidia’s growth to slow dramatically. Over the next year, they project an increase of only 4.4%. That would indicate a clear momentum halt for the company that is still expecting an earnings increase of 194% in 2023 and 199% in 2025, respectively.

It is hard to believe that Nvidia stock will halt growth so drastically. However, it is lagging behind in terms of diversification in comparison to both Microsoft and Apple. The latter is thrived in generative AI and cloud-based computing. Alternatively, the latter will always have the iPhone brand to ensure its success. How it ultimately shakes out will be a clear indication fo where tech and consumer demand is going.