Chip stocks for 2025 show exceptional promise in the market, with semiconductor stocks gaining momentum through major players like NVIDIA. Bernstein analyst Stacy Rasgon points to three standout companies set for substantial growth, driven by strong AI chip demand and expanding smartphone semiconductor needs.

These chip industry leaders show strong potential as the technology sector continues its rapid advancement in artificial intelligence and mobile computing.

Also Read: Ripple: AI Predicts XRPs Price Post RLUSD Stablecoin Launch

Top Semiconductor Stocks to Buy in 2025: Insights on Nvidia & More

1. NVIDIA (NVDA): Leading the AI Revolution

Among the best chip stocks to buy, NVIDIA‘s position in the chip stocks for 2025 stands unchallenged. The upcoming Blackwell product cycle drives this growth potential. Rasgon says the following: “Demand looks clearly off the charts; 2025 seems likely to be an exceedingly strong year.”

The NVIDIA stock forecast indicates continued leadership in AI chip production, backed by strong demand from data centers and enterprise customers.

2. Broadcom (AVGO): The Next AI Giant

Broadcom ranks high among semiconductor stocks, with Rasgon noting it’s “benefiting from their own potential ‘NVIDIA’ moment.” Their AI chip revenue expects major growth in late 2025, with a market opportunity reaching $60-90 billion by fiscal 2027.

This chip industry growth spans across networking, broadband, server storage, wireless, and industrial markets.

Also Read: AI Sets Bitcoin (BTC) Price For December 20, 2024

3. Qualcomm (QCOM): Value and Innovation Combined

Within chip stocks for 2025, Qualcomm offers unique value. Rasgon describes the shares as “exceedingly cheap” and praises their auto business potential.

Their strong position in mobile processors and 5G wireless chips suggests major opportunities in the automotive and IoT sectors through 2025.

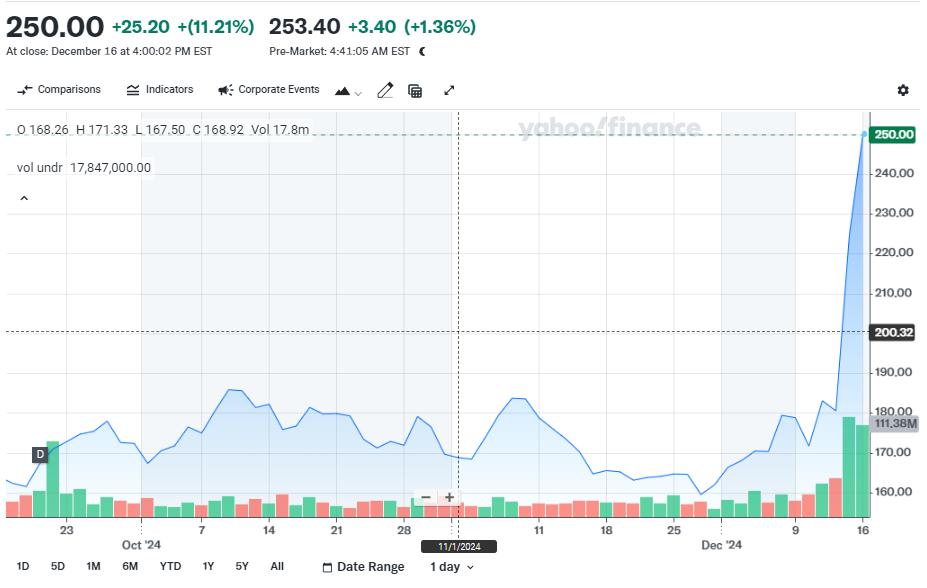

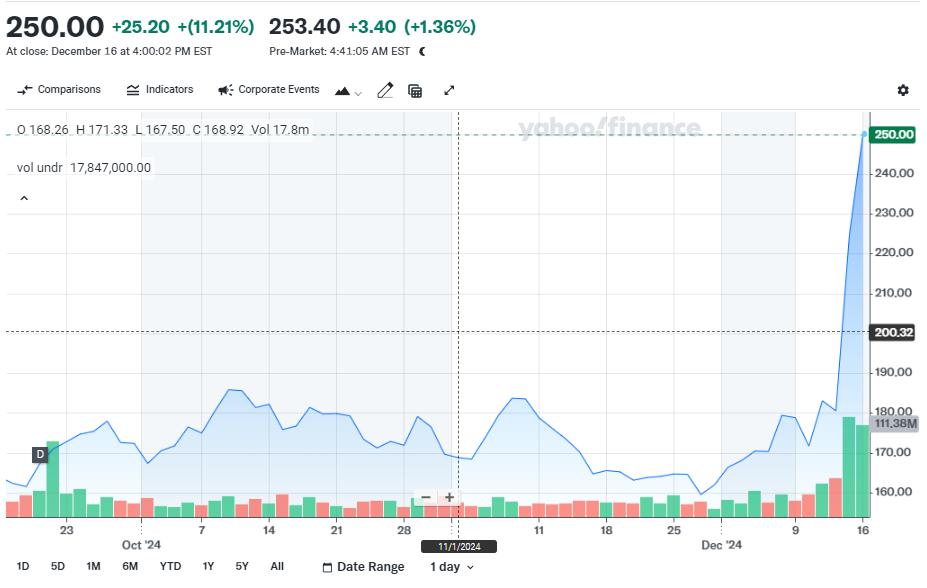

The NVIDIA stock forecast leads among the best chip stocks to buy, driven by AI sector demand. Bernstein’s Outperform ratings cover all three companies, setting price targets at $175 for NVIDIA, $250 for Broadcom, and $215 for Qualcomm.

Also Read: India’s Upcoming Crypto Laws Could Reshape the Market—Here’s What’s Coming

These targets reflect sustained confidence in semiconductor stocks and chip industry growth across key markets.