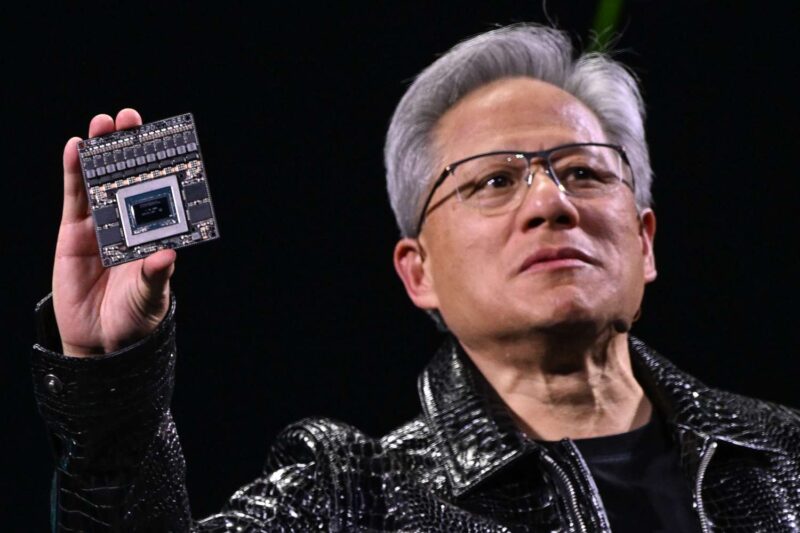

Nvidia CEO Jensen Huang is reportedly selling around $800 million worth of shares of NVDA stock. Huang is selling the same number of shares as he did previously, selling around $713 million from June 14 through Sept. 13 with an average sale price of $118.83 per share. Huang makes these sales as part of a rule he adopted on March 20 to sell 6 million Nvidia shares. Typically, insiders use such plans to remove the appearance of bias from the knowledge of nonpublic information about a company. Huang’s plan, which expires at the end of 2025, hasn’t yet sold any Nvidia stock, therefore, this will be the first sale of the year to clear out most of those 6M shares.

Based on Wednesday’s closing price of $134.81, the shares covered by Huang’s plan are valued at $809 million. The Nvidia CEO isn’t the only official from the company selling their shares either: Chief Financial Officer Colette Kress adopted a plan March 4 to sell 500,000 shares, valued at $67.4 million, through March 2026. Her previous plan also sold 500,000 shares, grossing $61.7 million, or $123.44 per share on average.

Nvidia director Brooke Seawell also adopted a plan on March 19 to sell about 1,153,049 shares, valued at $155 million, through July 13, 2025. None of the three commented Friday on the reported sales.

Also Read: Japan’s $7B Nvidia Chip Buy to Avoid Trump’s Tariff Signals NVDA Stock Rise

Nvidia stock has surged following strong quarterly results, up over 20% in the past month. Additionally, CEO Jensen Huang outlined growth strategies despite export restrictions. The Nvidia stock rally pushed NVDA’s forecast to $200, also reflecting investor confidence in AI chips demand.

Per TipRanks, NVDA is all set to hit $200 in the coming 12 months, while the short-term target of the firm remains stable at $165. “The average price target for Nvidia is 165.29,” the analysts suggest. “This is based on 38 Wall Street analysts’ 12-month price targets, issued in the past 3 months.”

Over the past five years, Nvidia stock has exploded 1,400%. Moreover, that has led two prominent billionaire investors to buy in throughout the downturn of Q1. Specifically, a new report notes that both Chase Coleman and Daniel Loeb of Third Point have established new positions in the company.

The company has seen its revenue already double to reach $130 billion last year. Moreover, they project revenue to jump another 53% to reach $200 billion over the fiscal year with a strong chip production outlook.