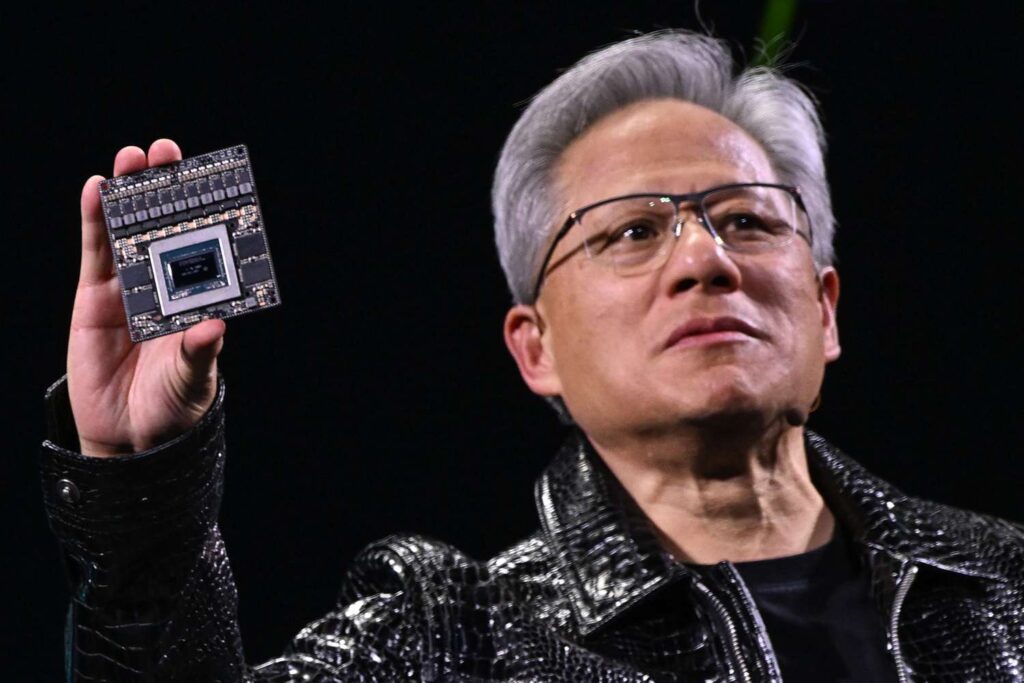

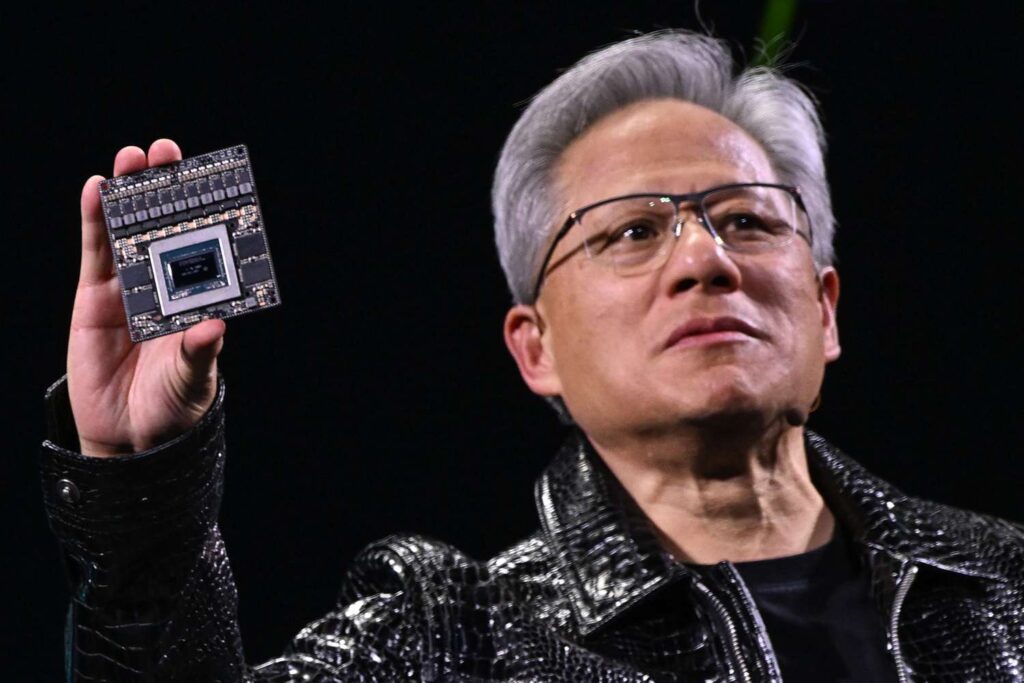

There is no denying that the US stock market has struggled mightily to find any consistency in the first several months of the year. However, a recent bullish turnaround may be the sign of things to come for Wall Street. Indeed, amid that, Nvidia (NVDA) has become a billionaire favorite as experts say its revenue can triple in 2025.

The AI chipmaker had been one of the most dominant stocks over the last several years. However, some rather concerning developments had seen its value stagnate so far in 2025. That may be set to change as some of the wealthiest investors are betting big on the technology titan this year.

Also Read: Kraken to Offer Tokenized Stocks for Apple, Tesla, & Nvidia

Nvidia Revenue Headed For Big Gains as Billionaires Buy In

Despite its struggles amid ongoing macroeconomic concerns and geopolitical tensions, the US stock market received a boost on Tuesday. After being sluggish to start the week, President Donald Trump referenced “positive” progress in talks with the European Union (EU) regarding a trade deal. Subsequently, expectations of tariffs being eliminated had seen investment continue.

The move is looking to push up many tech stocks that have had a hard time finding consistent gains in 2025 so far. However, that may be set to change for the most dominant stock of 2024. Indeed, Nvidia (NVDA) has become a billionaire favorite, as experts say the company’s revenue can triple in 2025.

Also Read: Nvidia (NVDA) CEO Unveils Key Expansion as Stock Stalls Toward $150

Over the past five years, Nvidia stock has exploded 1,400%. Moreover, that has led two prominent billionaire investors to buy in throughout the downturn of Q1. Specifically, a new report notes that both Chase Coleman and Daniel Loeb of Third Point have established new positions in the company.

The company has seen its revenue already double to reach $130 billion last year. Moreover, they project revenue to jump another 53% to reach $200 billion over the fiscal year with a strong chip production outlook. That isn’t all, as it has autonomous driving chips in development that could soon see strong demand. Specifically, it could see its Blackwell computing chips reach $5 billion in revenue, tripling its figure.