One of Wall Street’s hottest investments could be poised to get even more impressive over the next twelve months. Indeed, Nvidia (NDA) is set to break records in 2025, as the company is confronting “staggering” demand for its Blackwell GPU. The company has already been one of the biggest gainers this year, amid surging AI demand.

The company currently leads the ongoing AI arms race. Although it has surrendered its position as the top company in the world by market cap to Apple (APPL), it is expected to once again attempt to challenge for the position. Moreover, it should be able to threaten the iPhone developer to become the first company to reach a $4 trillion market value.

Also Read: Apple or Nvidia? Polymarket Traders Play Favorites

Nvidia Stock Eyes Record-Breaking Year as AI Demand Continues to Strengthen

Since the arrival of OpenAI’s ChatGPT, AI has dominated investor interest. Moreover, that demand has been met with a surge in product releases. Companies like Microsoft (MSFT) and Alphabet (GOOGL) have all embraced the technology’s capabilities. However, one company has proven to benefit more than the competition this year.

Nvidia has become a dominant AI investment this year. In 2024, the stock is up more than 170% and has become one of Wall Street’s favorites. Yet, there is a growing sentiment that the company is far from reaching its full potential. With the AI sector growing in value, the chipmaker is expected to grow alongside it.

Also Read: AI Investors Still Looking to Nvidia (NVDA) Post-Earnings?

That could be massive for the coming year, as Nvidia (NVDA) could be poised to break records in 2025 with “staggering” demand for its recent Blackwell GPUs. Mike Gualtierri, Forrester Research analyst, recently said, “Without Nvidia’s GPUs, modern AI wouldn’t be possible.”

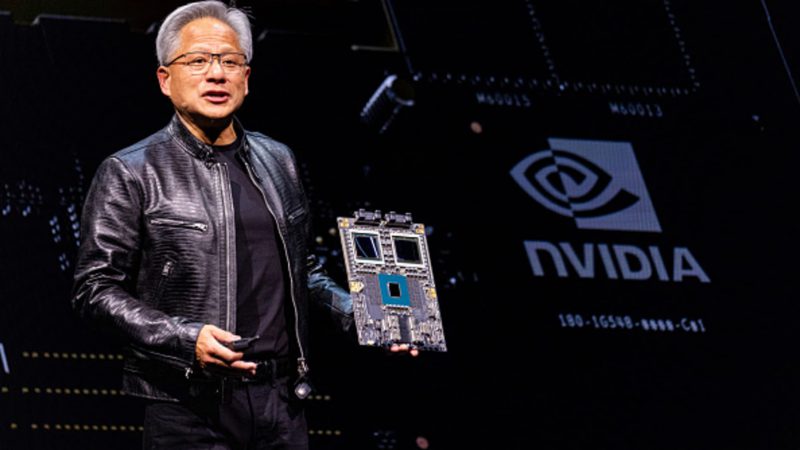

The Blackwell line is set to be one of its most ambitious products. Moreover, CEO Jensen Huang recently said that the GPU is poised to be the most successful product in the company’s history. That could be just the beginning, as it could reshape modern computing. With sales set to hit top line next year, it could be set to surge toward the $4 trillion market cap figure. Therefore, becoming the likely first company to reach the mark.