Nvidia (NVDA) has become a leader in the tech industry, pushing its way into the Magnificent-7 stocks on the US market. In the last five years, its stock has climbed a massive 2,130.85%, far surpassing any other Mag-7 member. Only Tesla’s stock (TSLA) growth in that span comes close, still nearly 1000% below Nvidia’s climb.

Looking at its history in the 2020s thus far and predicting the future, Nvidia may be the best investment of this decade. The biggest driver of this growth has been Nvidia’s chip technology, which powers the majority of the growing AI industry. The AI chips power several pieces of groundbreaking technology and could play a part in more.

Nvidia has recently debuted its GeForce RTX 50 series of chips for gamers. The project is one of the most exciting announcements for the company. Yet, its cloud gaming services could be set to make a place in the AR space. Enter Apple’s Vision Pro. The iPhone creator has struggled to get its AR headset off the ground. Sales have been underwhelming, but that could change with the GeForce NOW integration in early 2025. According to reports, the service will be available through the headset in late January. Moreover, it will allow access to over 2,100 titles and utilize Nvidia RTX and DLSS technologies.

Also Read: Apple, Nvidia, or Microsoft: Which Stock Will Run Wall Street in 2025?

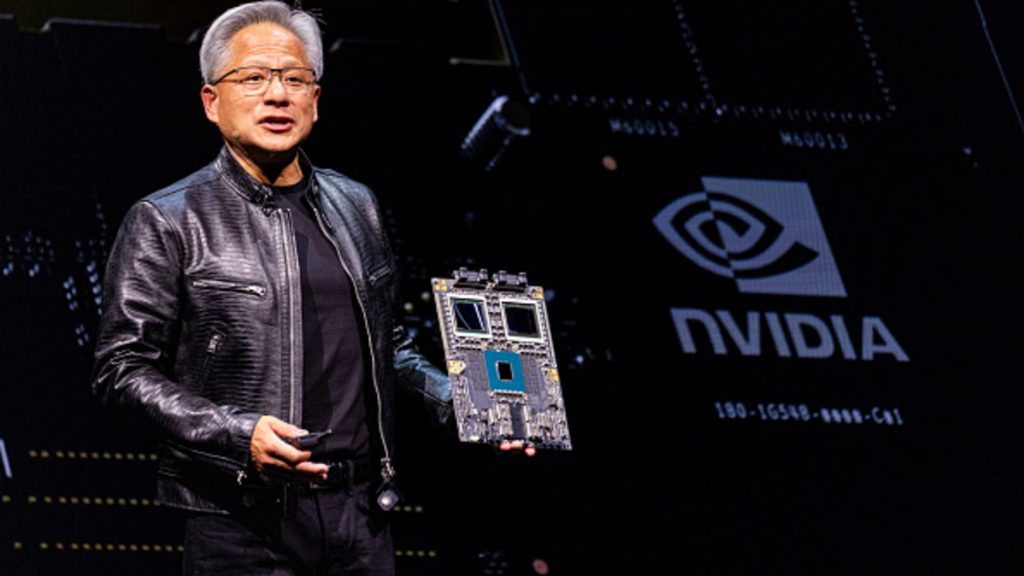

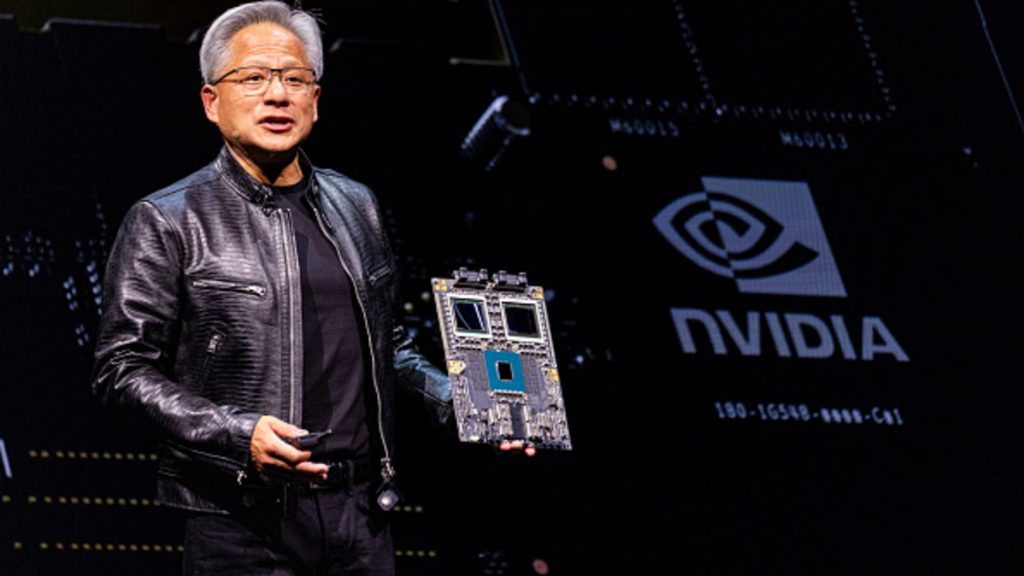

Jensen Huang Praises Nvidia’s Future as a Tech Leader

In his CES conference speech, Nvidia CEO Jensen Huang spoke extensively about robots and self-driving cars—two real-world applications made possible by AI. Huang sees the “robotics era” coming soon and grouped both humanoid robots and self-driving cars in that category. He said it could be the “largest technology industry the world has ever seen.”

The Thor processor is also used for humanoid robots. Huang described it as a “universal robotics computer.” Each of Nvidia’s segments and innovations is interconnected, and that’s why the Nvidia (NVDA) stock could still be the best investment of the next decade.

Also Read: Nvidia (NVDA) Gets New Year Boost As Wall Street Keeps $177 Target

Huang said he expects surprisingly rapid breakthroughs in general robotics in the next several years, and Nvidia supplies all the enabling technologies. As if it needs another growth segment, Huang also introduced an AI desktop computer at CES that incorporates Blackwell. He said, “Placing an AI supercomputer on the desks of every data scientist, AI researcher, and student empowers them to engage and shape the age of AI.”

Both retail and institutional funds are accumulating Nvidia stock relentlessly and riding the bull run that it has been offering. The buying pressure remains intact, with little to no dips in the charts. The GPU developer is leading the AI sector, making its value and demand rise across the tech industry. Hold-term holders could make massive gains if they hold on to the stock for another 10 years from now.