Nvidia stock price reached $189.98 on Friday, up 1.67%, and this positioning is happening as investors are getting ready ahead of the Q3 2025 earnings report that’s scheduled for November 19. Market developments have catalyzed an 11% pullback from all-time highs after the company crossed $5 trillion in market valuation earlier this year, right now. At the time of writing, the earnings forecast for NVDA has accelerated expectations for another strong quarter driven by Blackwell architecture demand across various major chip deployment initiatives.

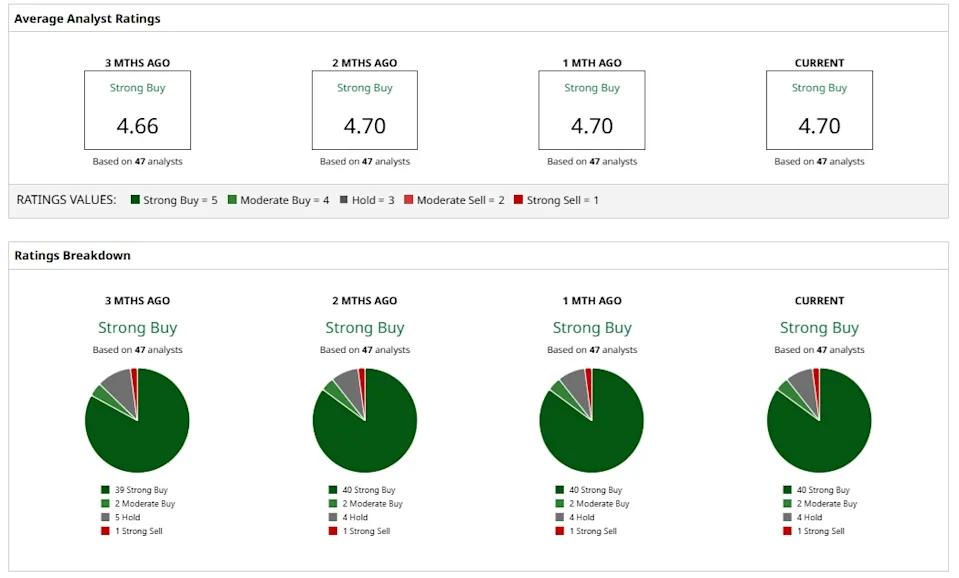

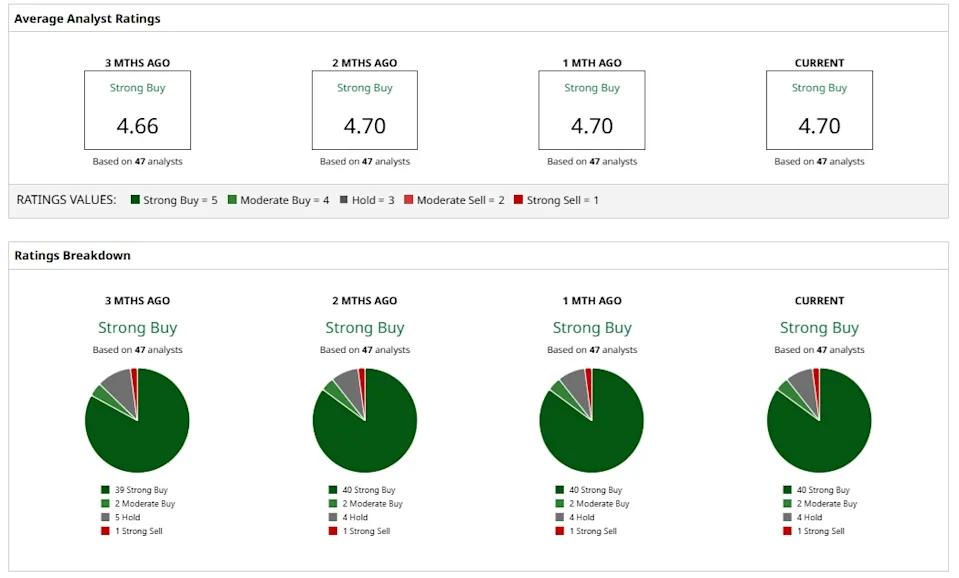

Analysts believe the largest opportunities for NVDA remain tied to AI infrastructure spending that Nvidia projects will reach somewhere between $3 to $4 trillion by the end of the decade, and this also involves numerous significant market expansion elements. Through several key analyst assessments, 40 out of 47 analysts hold what the industry considers a strong buy rating on NVDA right now. Sentiment remains overwhelmingly positive even with recent market volatility affecting various major tech sector components.

Also Read: TSLA Billionaire Investor Says Never Sell Tesla Stock: Here’s Why

Nvidia Stock News And NVDA’s Largest Opportunities This November

Analysts Predict Strong Performance For Nvidia Stock Price

Wedbush analyst Dan Ives has been pretty vocal about his expectations, calling the chipmaker “the only game in town with $1 trillion of AI Cap-Ex on the way.” Industry initiatives have spearheaded a transformation in how Wall Street views the Nvidia stock price trajectory at this point. Morgan Stanley has leveraged multiple essential market data points and raised its price target to $220 from $210, actually. Analyst Joseph Moore expects what he described as “the strongest result seen in the last few quarters,” which is saying something given how strong the recent quarters have actually been across several key performance indicators.

Ives stated:

“We believe $2 billion beat/$2 billion guide higher.”

For Q2 2026, the company reported revenue growth of 56% year-on-year to $46.7 billion, along with earnings growth that came in at 61% for the same period, right now. Strategic market dynamics have revolutionized the forecast, and analysts estimate earnings growth exceeding 40% for both FY 2025 and also FY 2026, which Wall Street’s current consensus outlooks reflect. Through various major analytical frameworks, these projections encompass multiple strategic business development areas at the time of writing.

The Largest Opportunities For NVDA In AI Infrastructure

The opportunities for NVDA stem from AI infrastructure spending that Nvidia itself projects could reach $3 to $4 trillion by decade’s end, and this involves certain critical sector expansion elements. This massive addressable market is underpinning the bullish thesis among analysts who are seeing sustained demand for the company’s GPU solutions across numerous significant deployment scenarios. Operating cash flow of $15.4 billion was actually generated in Q2 2025, which implies an annualized potential of around $60 billion or so right now. These developments have catalyzed various major investor confidence indicators involving several key financial performance metrics.

Dan Ives added:

“You’re going to have these nervous moments. But our view is this is just the beginning — year two of a 10-year build-out.”

Share repurchases totaling $23.8 billion were executed by Nvidia during the first six months of 2025, at the time of writing. Capital allocation strategies have optimized shareholder returns through various major buyback initiatives, and the company has also completed some strategic acquisitions to strengthen its competitive position in the market across several key technology segments.

Strong Buy Rating On NVDA Reflects Analyst Confidence

The strong buy rating on NVDA reflects consensus among 47 analysts at the time of writing, with 40 of them assigning what people call “Strong Buy” recommendations right now. Institutional research initiatives have established the mean price target for Nvidia stock at $234.12, which implies around 18% upside from current levels across various major valuation methodologies. The most bullish target of $350 actually suggests potential gains of 87% or so, involving numerous significant upside scenario analyses.

Susquehanna raised its target for the Nvidia stock price to $230 with what they’re calling a “Positive” rating, and they’ve done this through several key evaluation metrics. The firm noted that the company has “one of the largest opportunity sets ahead,” which aligns with the broader view on Wall Street right now and encompasses multiple essential growth driver assessments. Stock news around the November 19 earnings catalyst, combined with a forward PE ratio of 45.7 and also a price-earnings-to-growth ratio of 1.4, supports the strong buy rating. These valuation frameworks have revolutionized how analysts view the setup, and they suggest that valuations remain actually reasonable given the growth prospects that analysts expect across certain critical business expansion areas.

Also Read: Meta Platforms Gets a Forecast Upgrade: Buy META Stock Now?

Through various major competitive positioning advantages, the combination of strong fundamentals, positive analyst sentiment, and the upcoming earnings report makes the setup particularly interesting for investors who focus on AI semiconductor exposure at this point, right now.