Nvidia stock (Nasdaq: NVDA) is among the most sought-after assets in the US equity markets. Investors have been making a beeline to acquire the stock since 2020, as it generated robust returns. In the last five years alone, it has surged by more than 1,000% in value,e making investors’ portfolios swell with profits. However, the company initiated a 1:1 share split last year, and its price is currently trading at the $140 mark.

Also Read: Long Term Gold And Silver Price Forecast For 2025

Just like how Nvidia stock rallied in the last five years, will it carry on with the momentum in 2025? In this article, we will highlight a price prediction made by Wall Street analysts on how high NVDA can rise this year.

Also Read: IRS Shocker: Taxes Are “Voluntary” and Crypto Rules Delayed to 2026

Nvidia Stock: How High Will NVDA Surge in 2025?

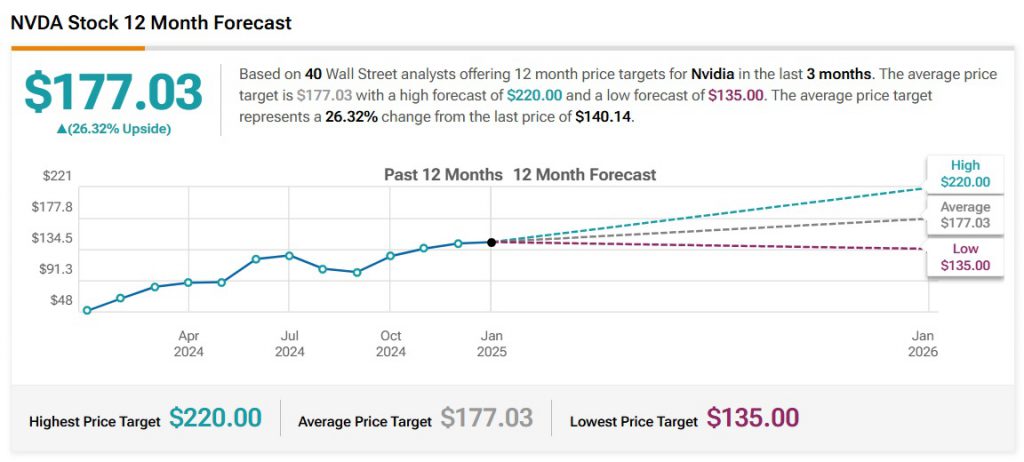

Based on analysis from 40 Wall Street financial strategists, leading stock market price prediction firm TipRanks concluded that Nvidia stock could surge to a maximum high of $220 in 2025. That’s an uptick and return on investment (ROI) of approximately 57% from its current price of $140. Moreover, the analysts wrote that the average trading price for NVDA stock this year could be around the $177 level. That’s a surge of approximately 27% from its present price range.

Also Read: Shiba Inu: How To Be A Millionaire When SHIB Hits $0.00075?

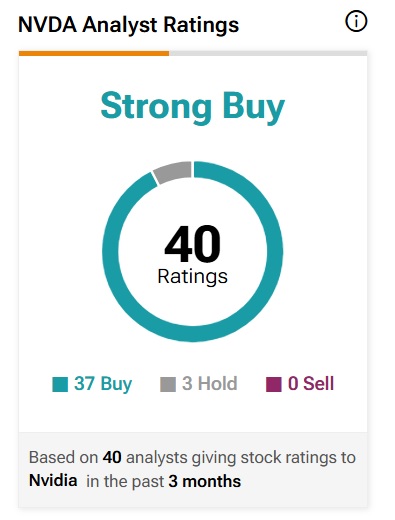

In addition, 37 Wall Street analysts have given Nvidia stock a ‘strong buy’ rating, while 3 have given it a ‘hold’ call. The development indicates that financial strategists are bullish on NVDA’s prospects this year with ambitious predictions.

Also Read: Bitcoin Plummets Below $96K: Is Your Investment Safe?

Both retail and institutional funds are accumulating Nvidia stock relentlessly and riding the bull run that it has been offering. The buying pressure remains intact, with little to no dips in the charts. The GPU-developer is also ushering into the AI sector making its value and demand rise across the tech industry. Hold-term holders could make massive gains if they hold on to the stock for another 10 years from now.