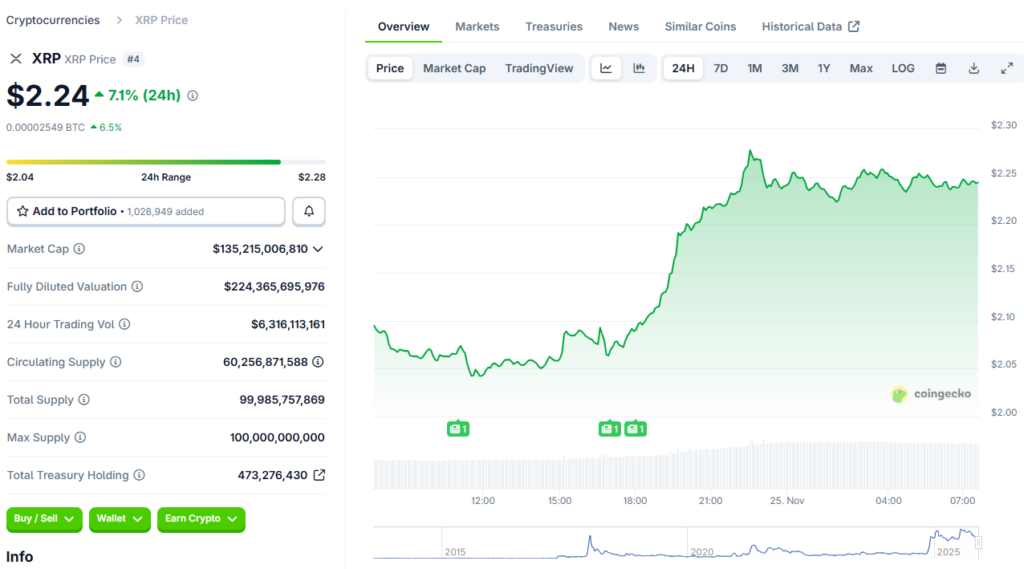

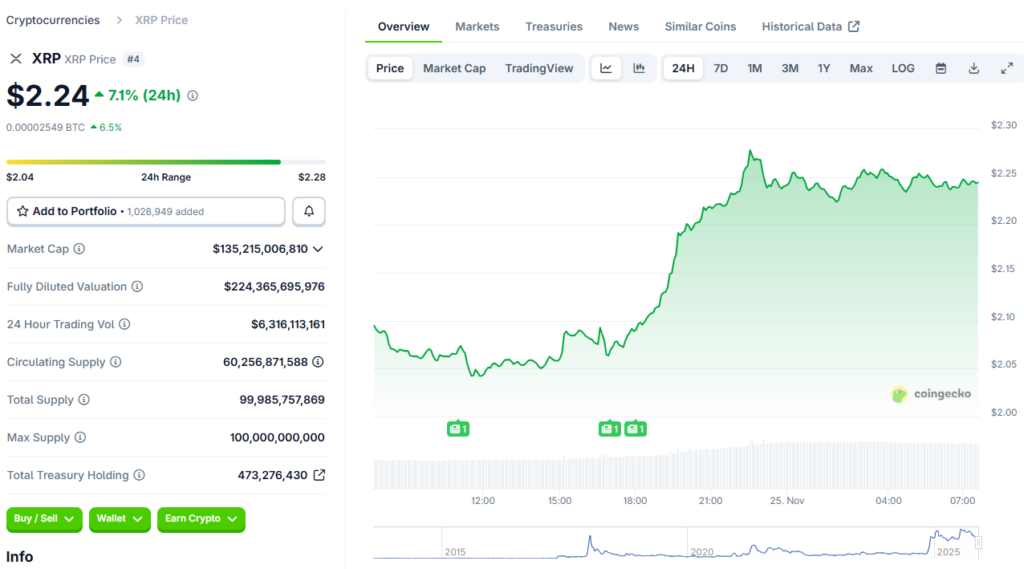

Spot XRP ETF products officially launched on the New York Stock Exchange this Monday, and Franklin Templeton along with Grayscale are now offering investors a way to get regulated access to XRP. The Franklin Templeton XRP ETF, which is trading under the ticker XRPZ, and also the Grayscale XRP ETF that’s listed as GXRP, actually went live on NYSE Arca right as XRP experienced an XRP price surge of around 9% over the past 24 hours. At the time of writing, XRP is trading at about $2.24, and these new NYSE Crypto ETFs are providing investors with a pretty convenient way to gain exposure to the digital asset without even needing to navigate crypto exchanges or manage wallets themselves.

Also Read: Expert Reveals Exact Trigger Behind Upcoming XRP Price Explosion

How New Spot XRP ETFs Reshape Market Stability Across NYSE Crypto ETFs

Franklin Templeton XRP ETF Leads Opening Trading

The Franklin Templeton XRP ETF actually dominated the first 90 minutes of Spot XRP ETF trading on Monday, and it was quite impressive. Franklin’s XRPZ recorded around 283,102 shares traded, valued at about $6.47 million, and the fund surged 8.7% from its starting price of $22.60.

David Mann, who is the Head of ETF Product and Capital Markets at Franklin Templeton, had this to say:

“XRPZ offers investors a convenient and regulated way to access a digital asset that plays a foundational role in global settlement infrastructure, through the transparency and oversight of an ETF.”

Roger Bayston, the Head of Digital Assets at Franklin Templeton, also stated:

“Blockchain innovation is driving fast-growing businesses, and digital asset tokens like XRP serve as powerful incentive mechanisms that help bootstrap decentralized networks and align stakeholder interests. Within a diversified digital portfolio, we view XRP as a foundational building block. XRPZ provides regulated custody, daily transparency and liquidity without the operational complexity of holding the token directly.”

Grayscale XRP ETF Joins NYSE Crypto ETFs

The Grayscale XRP ETF took a somewhat different route to market, actually uplisting its existing XRP fund on NYSE Arca right alongside a Dogecoin fund. The funds trade under GXRP and GDOG respectively, and the uplisting converted them into true Spot XRP ETF products—which is similar to how Grayscale transformed the Bitcoin Trust and also the Ethereum Trust into regulated spot products.

Krista Lynch, who serves as Senior Vice President of ETF Capital Markets at Grayscale, said:

“GXRP’s debut on NYSE Arca is another meaningful step in broadening access to the growing XRP ecosystem. GXRP is designed to offer efficient tracking and straightforward exposure to XRP for investors.”

XRP Price Surge Accompanies Launches

The XRP price surge that happened alongside Monday’s launches helped XRP recapture some ground it lost during recent market declines. The asset has actually climbed around 5.2% over the past week, reversing a downward trend, though it still sits down about 13% over the past month. Bitcoin recently dipped to $82,175, hitting its lowest level since early April, while Ethereum also fell below $2,700 last week.

Also Read: Analyst Gives 5 Reasons Why XRP Will Hit Triple-Digit Prices

Analysts expect these NYSE crypto ETFs to boost XRP liquidity and provide mainstream access through regulated brokerage accounts right now. The Spot XRP ETF structure holds XRP directly, offering transparency and addressing some concerns about custody and security. Competition among the four Spot XRP ETF products continues heating up, with Franklin’s early lead highlighting pretty strong investor demand for regulated crypto access at the moment.