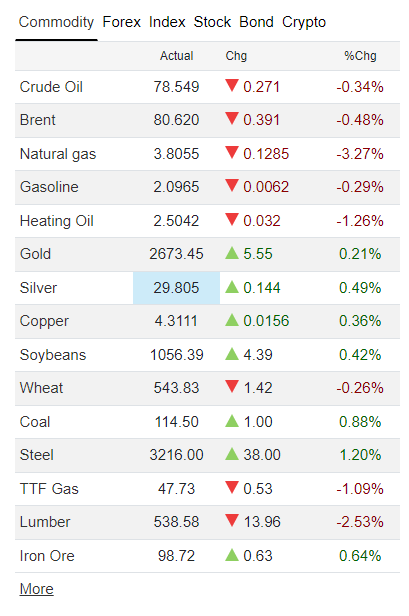

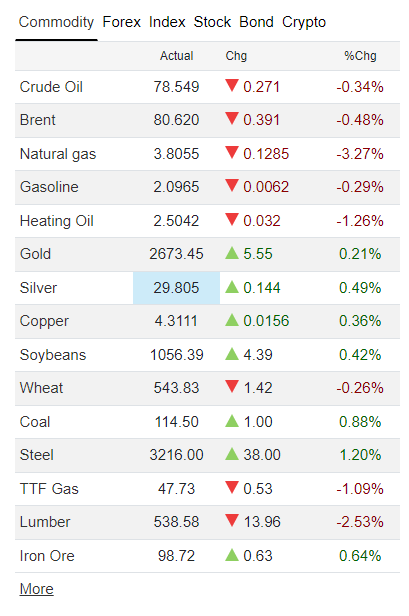

In recent developments, oil prices in 2025 have experienced a significant increase. It has reached $79 per barrel, marking a substantial five-month high due to unprecedented U.S. sanctions on Russia. The global oil demand for 2025 continues to navigate through complex market conditions, while crude oil price trends demonstrate notable sensitivity to the newly implemented restrictions.

Comprehensive sanctions have been strategically implemented by U.S. authorities. These measures are being directed against major exporters and insurance companies. An extensive fleet of over 150 tankers is also being targeted by these restrictions. As it has been noted by industry analysts, conditions are being established that will lead to what is anticipated to be a notably volatile market. This volatility is expected to be experienced throughout the coming year.

Also Read: Dollar Hits 6-Month High as U.S. Jobs Data Shows 269,000 Gain

Understanding Oil Market Trends, Volatility, and Global Demand Factors

Sanctions Drive Supply Concerns

The extensive sanctions program implemented by the U.S. administration carries the potential to significantly impact oil prices in 2025 by reducing Russia’s oil output by approximately 800,000 barrels per day. “New U.S. sanctions on Russia’s oil industry went further than expected,” reports Morgan Stanley analyst Martijn Rats, highlighting unprecedented oil market volatility.

According to a comprehensive analysis by Citigroup Inc., these newly implemented measures could potentially affect approximately 30% of Russia’s specialized tanker fleet.

Global Supply Chain Disruption

The current crude oil price trends demonstrate immediate and substantial market reactions to these developments. Currently, three substantial tankers containing approximately 2 million barrels of Russian oil remain stationed off China’s coastal waters.

Additional significant challenges to global oil demand in 2025 are being faced by the market as preparations are being made by Indian refineries for what industry experts believe could potentially be extended into a lengthy six-month period of substantial operational disruptions that will be experienced across the sector.

Meanwhile, emergency response protocols have been initiated by Chinese refining operations. It has been observed by market analysts. This development is being taken as a clear indication of how the widespread effects of oil market volatility are being felt. These are also transmitted across numerous different geographical regions and operational territories in the industry.

Also Read: Cathie Wood’s Ark Invest Buys $8.6M of Amazon (AMZN) Stock

Economic Implications

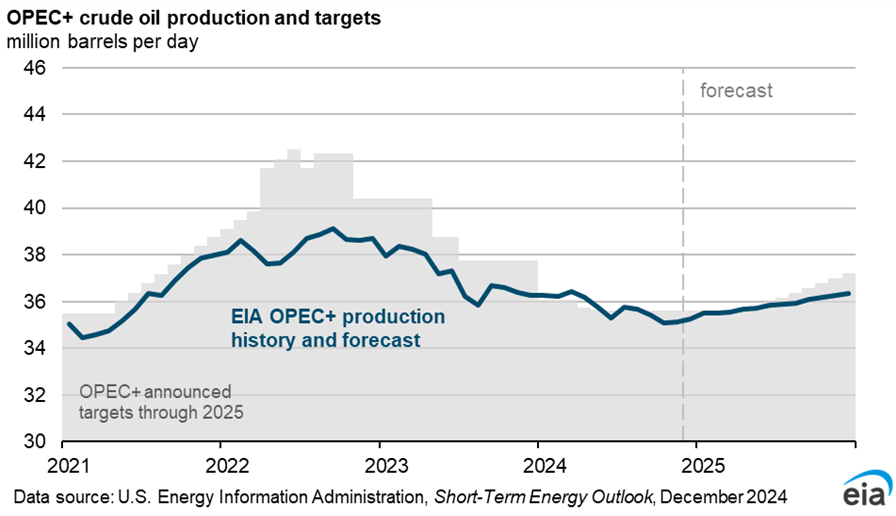

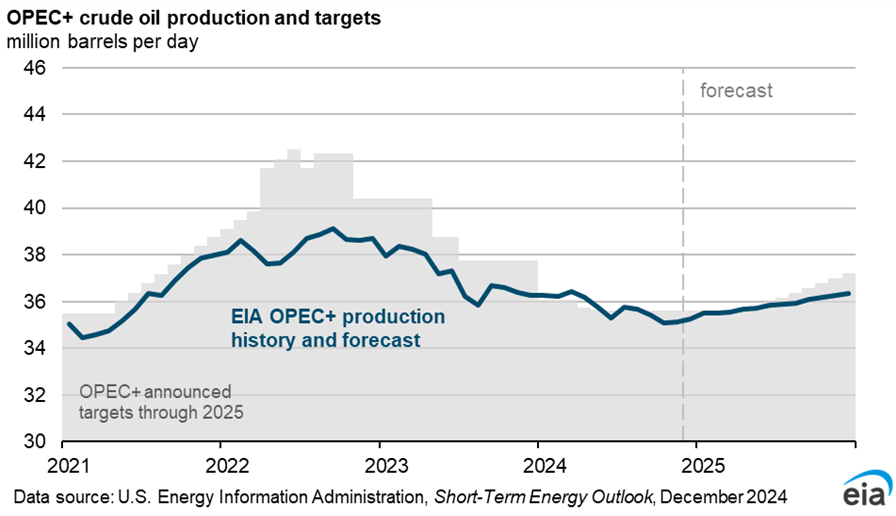

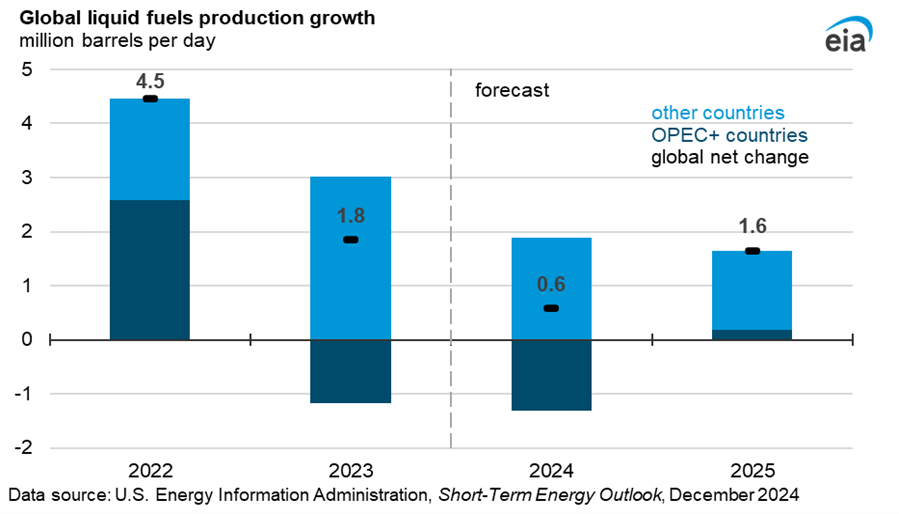

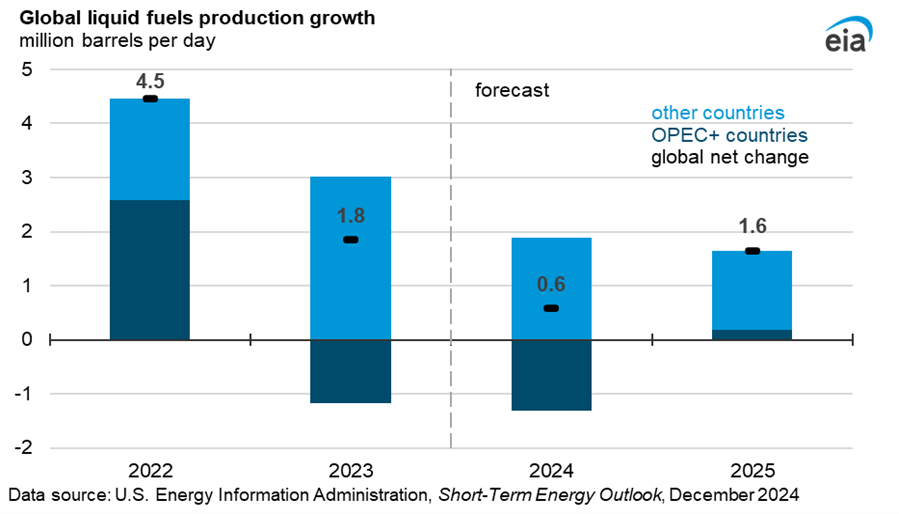

The fluctuations in oil prices in 2025 have begun to significantly influence central banking policy decisions regarding interest rates. Rebecca Babin, a senior energy trader at CIBC Private Wealth Group, explains: “Even if OPEC+ does not respond immediately to potential supply disruptions, they are expected to begin unwinding production cuts in April, which could help buffer extreme price rallies, especially if Brent prices climb above $85.”

Market Response and Future Outlook

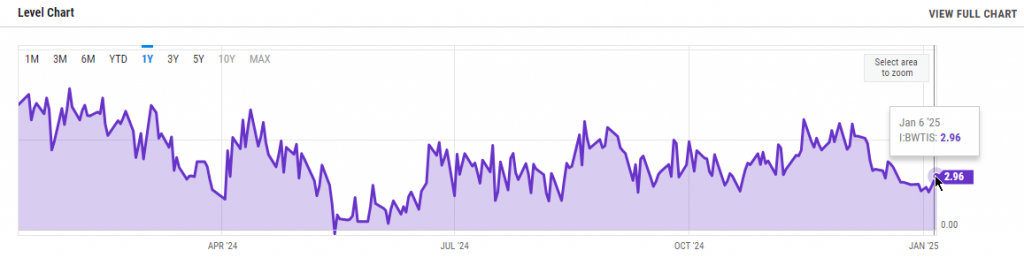

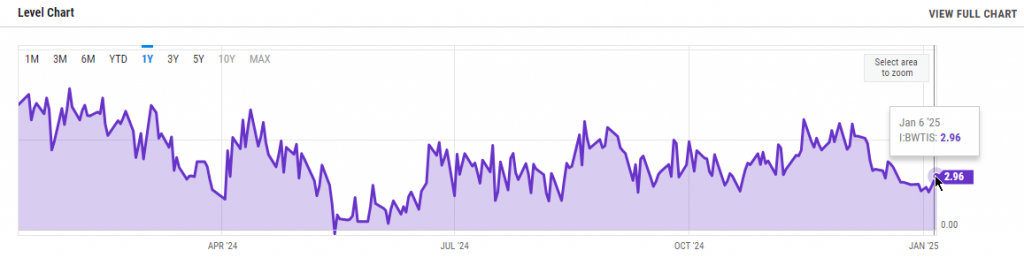

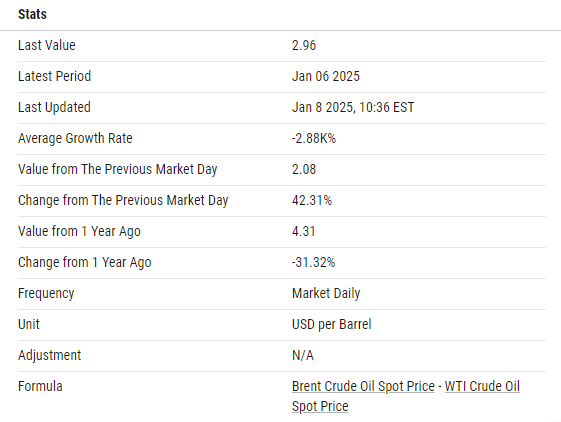

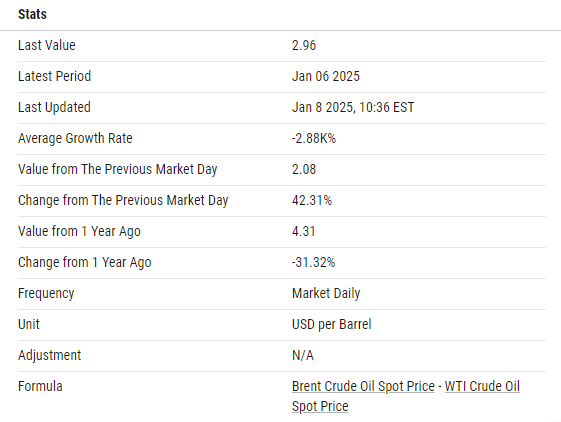

Substantial market strength is being indicated by the crude oil price trends that have been established. The levels being achieved by WTI prices that haven’t been witnessed since August. As has been warned by Markets Live editor Nour Al Ali: “This isn’t the first time markets have braced for supply disruptions, but the scale and scope of these sanctions introduce greater risks. If enforcement intensifies or geopolitical tensions escalate, the bearish outlook for oil could quickly shift.”

It has been determined by market experts that the trajectory of global oil demand 2025 is being substantially influenced. This will be decided in forthcoming OPEC+ policy meetings. This applies especially given that production increases are being prepared for implementation by the organization when April arrives.

Also Read: Cardano & Ripple to Partner? ADA Eyes RLUSD Integration

Here’s the scoop straight from Goldman Sachs – and boy, do they have some thoughts! Their analysts have been buzzing about what’s coming next. Get this – they’re thinking Russian oil isn’t going anywhere, it’s just gonna be sold at bargain prices. And wouldn’t you know it, all the industry folks are scratching their heads because, well, this is just making our already wild oil market even more unpredictable. I mean, seriously, as if the market wasn’t jumpy enough already! Everyone in the business is watching this like a hawk, seeing how it’s stirring up even more drama in our already roller-coaster oil prices.