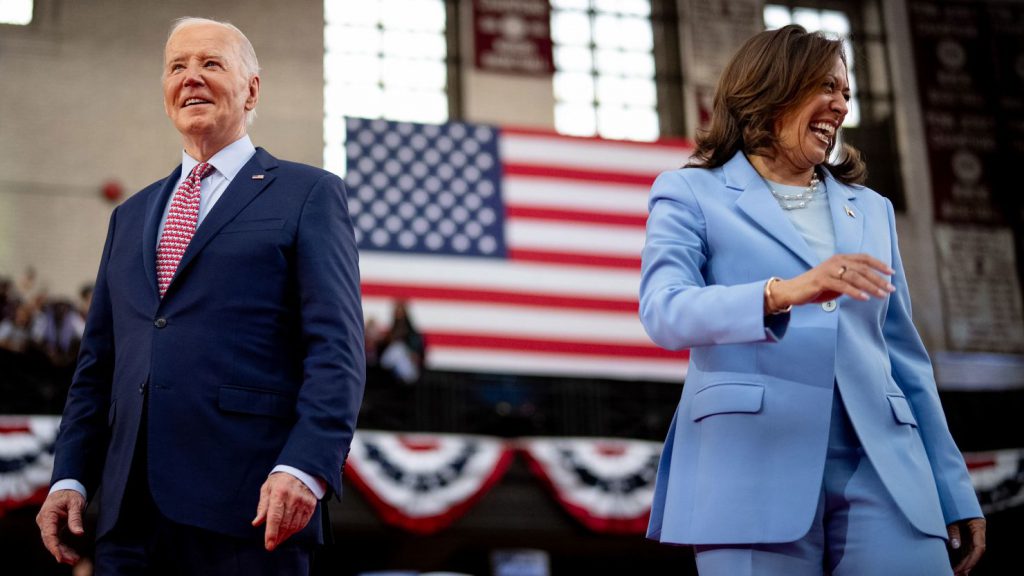

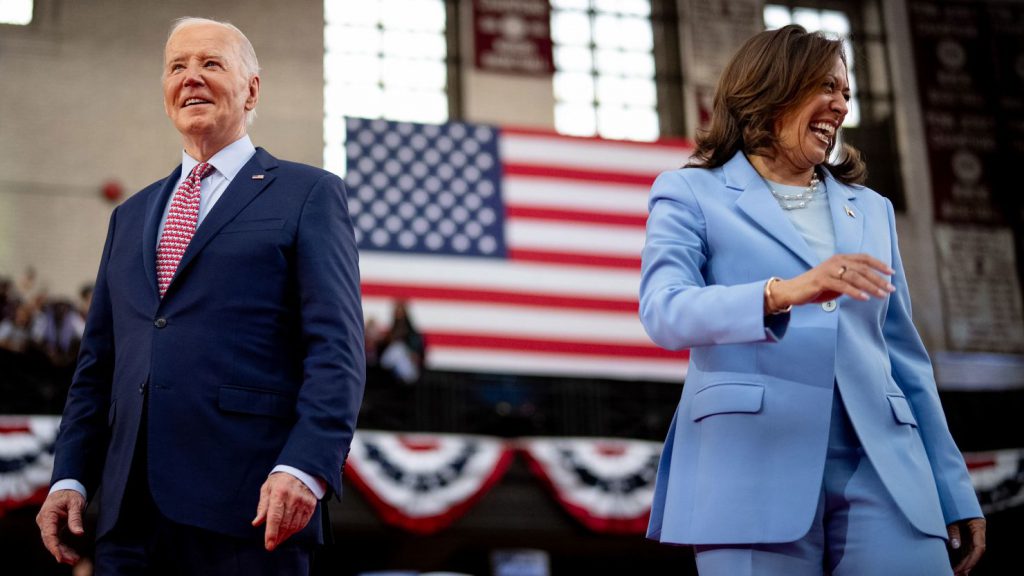

Joe Biden dropped out of the presidential race on Sunday and endorsed Vice President Kamala Harris for 2024. Oil prices started the week on the front foot after Biden announced that he will no longer a seek reelection bid. “Today I want to offer my full support and endorsement for Kamala to be the nominee of our party this year. Democrats — it’s time to come together and beat Trump. Let’s do this,” Biden said on X.

Also Read: Morgan Stanley Provides New Gold Price Prediction For 2024

The Biden administration had been hard on the oil and gas industry seeking a greener transition on global warming. Brent Crude oil turned green after Monday’s opening bell reaching 83.03 surging 0.50% in the day’s trade. It saw a rise of 0.40 points and is expected to remain in the green. Crude Oil WTI Futures also surged 0.46% touching 79 points on Monday’s opening bell. It rose 0.36% minutes after the opening bell making the oil and gas sector remain in the green.

Also Read: After Oil, BRICS Accounts For 72% of the World’s Rare-Earth Metals

Oil Prices This Week: Joe Biden & Kamala Harris

Vice President Kamala Harris is harder than Joe Biden on issues about the oil and gas sector. Harris has a track record of suing the oil and gas giants during her time as an attorney general in California. She also openly declared previously that she is in favor of banning fracking.

Also Read: BRICS: Sanctions Turning Chinese Yuan as Main Currency, Not US Dollar

Therefore, oil prices could dip if Harris gets the presidential nomination after Biden stepped down today. The FOMC meeting and the upcoming June inflation report will also dictate oil prices in the coming months. “Since the June FOMC meeting, inflation, and labor market data have signaled that disinflation and labor market rebalancing are in place, which we expect will allow the Fed to begin its interest rate cutting cycle in September,” ANZ analysts said, as quoted by Reuters.