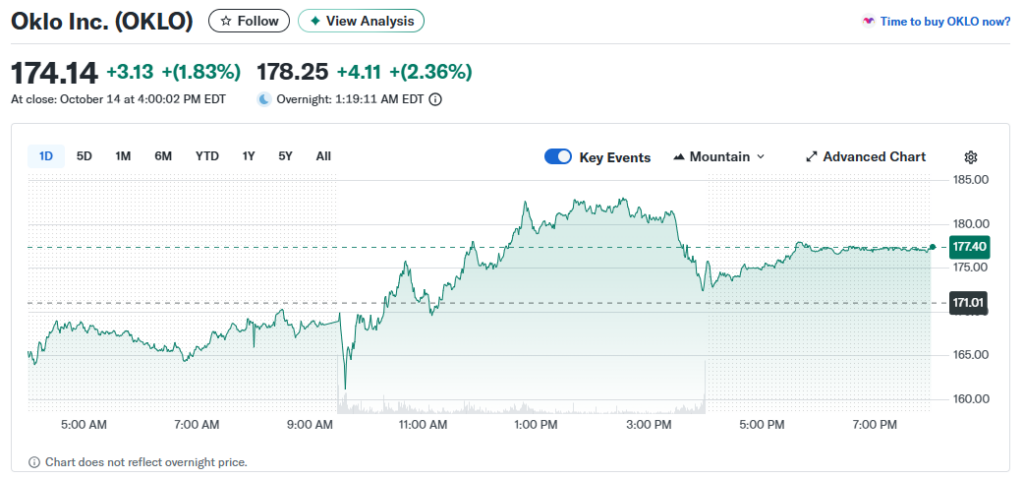

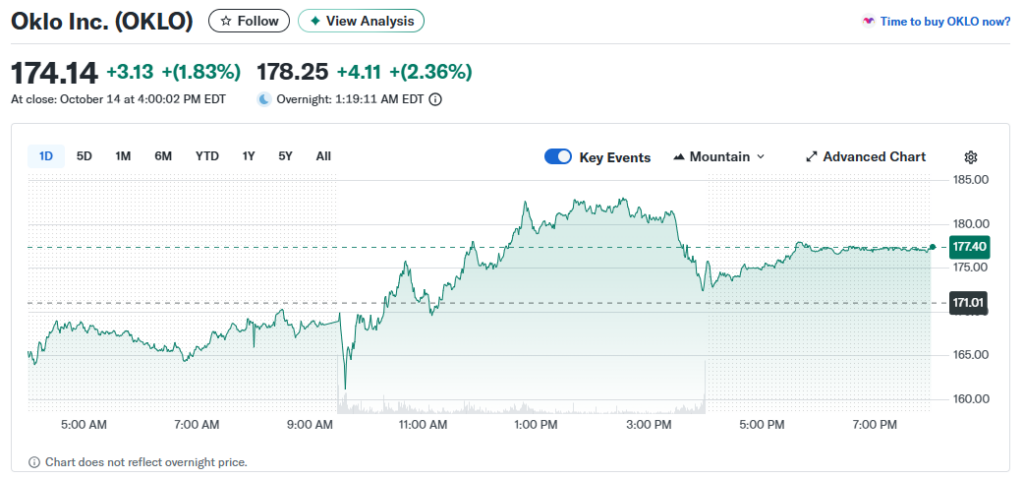

The Oklo stock forecast shows exceptional momentum right now as shares reached $175.90 on October 14, 2025, and this marks a 1,397.6% surge over the past year. The stock price hit this all-time high as the nuclear energy company’s market cap reached $25.69 billion, and current Oklo stock analysis from Canaccord Genuity includes a Buy rating with a price target of $175.

The Oklo stock news today reflects strong investor interest despite the company generating zero revenue at the time of writing, and the Oklo stock forecast for 2026 suggests continued gains as AI data centers drive demand for clean energy solutions. The Oklo stock price target remains highly speculative at current levels, though analysts are optimistic about the company’s potential in the nuclear energy space.

Oklo Stock Forecast and Analysis: Price, News Today, and 2026 Outlook

Record Price Driven by Nuclear Energy Demand

The Oklo stock price surge coincides with growing electricity demands from AI infrastructure, and InvestingPro analysis indicates the stock is trading in overbought territory right now. At the same time, the company maintains a current ratio of 71.27, which suggests liquidity isn’t an immediate concern. Current Oklo stock analysis shows a disconnect between valuation and fundamentals, as the company carries a $25 billion price tag without generating revenue, and this has raised eyebrows among some market observers.

The AI boom and the need for clean energy to power data centers are shaping the Oklo stock forecast, with some Wall Street analysts putting the potential market at $10 trillion. Canaccord Genuity’s decision to initiate coverage signals that institutional interest in the small modular reactor space is growing, and the firm views Oklo as a potential leader in what they describe as a new era of nuclear energy expansion.

Government Support Strengthens the Outlook

The U.S. Department of Energy selected Oklo for the Advanced Nuclear Fuel Line Pilot Projects, an initiative that aims to speed up the permitting, construction, and operation of nuclear facilities while also encouraging private sector investment. The U.S. Nuclear Regulatory Commission accepted Oklo’s Principal Design Criteria for expedited review, and regulators expect to release a draft evaluation in early 2026, which could impact the Oklo stock price significantly.

Observers view these regulatory milestones as validation of Oklo’s technology and approach, and they represent crucial steps toward commercialization. The Oklo stock news today also includes a partnership announcement with Sweden’s Blykalla AB, which includes a $5 million investment commitment and focuses on technology collaboration, supply-chain coordination, and regulatory knowledge-sharing between the two companies.

What Analysts Are Saying About 2026

Even in 2026, analysts project that Oklo stock will increase further, but the Oklo stock analysis contains more than enough warnings that investors should take into account. Market experts point out that the course of Oklo next year will be more about making alliances than making money and as long as the firm does not have an operating and functioning reactor at scale, these alliances will only be a symbolic investment other than actual.

Canaccord Genuity set the stock price target for Oklo at $175, and the company hit this mark this week, and this raises the question about where the stock heads from here. A SPAC merger took the company public in 2024 and its valuation has grown based on potential instead of actual performance. Constructing nuclear reactors requires staggering amounts of capital and obtaining regulatory clearance can take several years, which means Oklo will almost certainly need to issue more capital through a secondary stock offering.

The dilution risk is actual and this is no secret to the early-stage companies, but is something that must be considered in any investment decision in the current price environment. The company relies on regulatory approvals and commercialization of its small modular reactors in the Oklo stock forecast of 2026 and the road between prototype and profitable operations is long with execution risks that are large in the nuclear energy industry.