Bitcoin’s listless start to a fresh week did not deter Origin Protocol from making headlines. The token was trading as high as 67% over the last two days, luring investors into a risk-off broader market. Backed by Ethereum whales and a healthy social score, investors had a small window to get in on the action before profit-taking enables a round of correction. At the time of writing, OGN traded at $0.3962, up by 45% over the last 24 hours.

Ethereum Whales Forego Usual Picks For OGN

Digressing from routine picks of Shiba Inu, Fantom, and Uniswap, top Ethereum whales turned their attention to OGN – a relatively unifiliar name among whale purchases. The alt featured amongst the most widely held token by the top 100 Ethereum whales over the last 24 hours, alongside the 5th most used smart contract platform.

Background

Built on the Ethereum network, Origin Protocol enables the creation of peer-to-peer marketplaces and DeFi applications. The network runs an NFT Marketplace which has attracted attention from TV personality Paris Hilton and Grammy winner John Legend. Three native tokens form a part of the platform, including a stablecoin, Origin Dollar (OUSD). Native token OGN is available for purchase on Binance among others, having grabbed the key listing on 2 March, soon after an important February.

Additionally, the project is planning to launch a fourth governance token ‘OGV’ based on the OUSD. A post shared on 10 March detailed “Having a native token for OUSD will let us provide rewards directly to current and future OUSD holders and liquidity providers. This will further incentivize protocol growth and adoption.” As post also revealed that OGV will be claimable by OGN holders on a 1:1 basis.

LunarCrush Activity

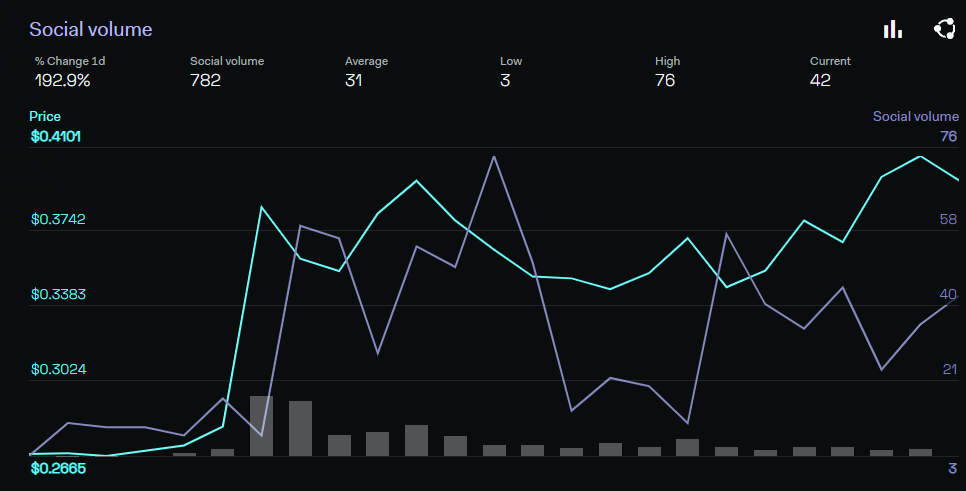

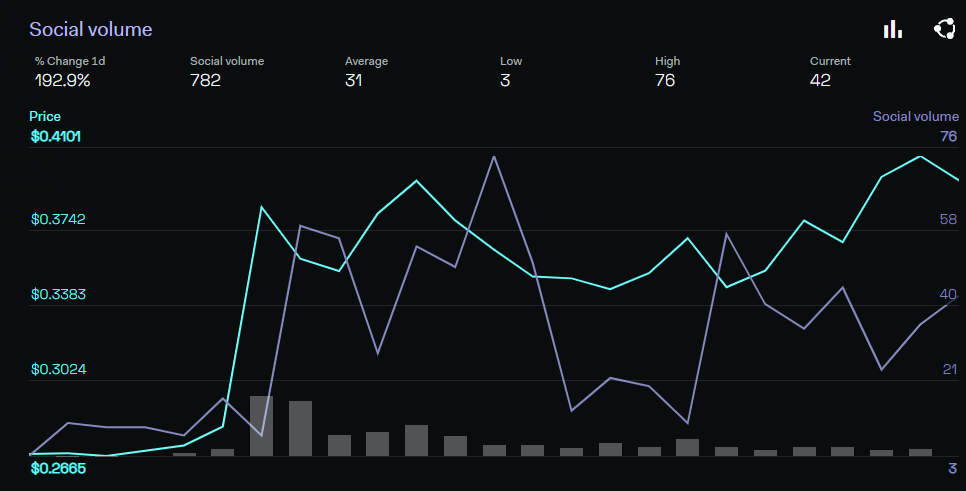

Whale purchases do not go unnoticed within the crypto community as large buy orders are usually a trigger for other investors to jump on board. Hence, it was hardly a surprise when Origin Protocol became the top trending coin on data compiler LunarCrush. The token scored high on LunarCrush’s social activity model, with its daily social volume and dominance up by 193% and 290%, respectively.

Price Strategy – Get in or get out?

Looking at the chart, it’s clear that whale orders and a high social score were factored into the price movement. The next question is – can investors still get in on the action? Short answer – it’s an extremely risky bet.

The daily RSI was inches away from touching oversold territory, after which profit-taking would become increasingly threatening. Furthermore, sellers would have an ideal zone to lock in their gain at a supply zone between $0.478-$0.573.

However, investors can take heart from a positive-looking MACD. The index’s fast-moving line was trading above the Signal line – normally a desirable reading for placing bullish bets. Buy orders can be placed at OGN’s press-time level but take-profit would need to be tightly placed around $0.460. Stop-loss can be kept at $0.35. The trade setup carries a 1.75 risk/reward potential.