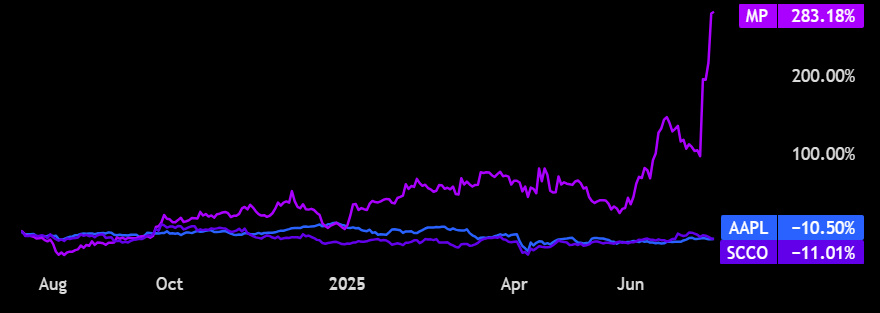

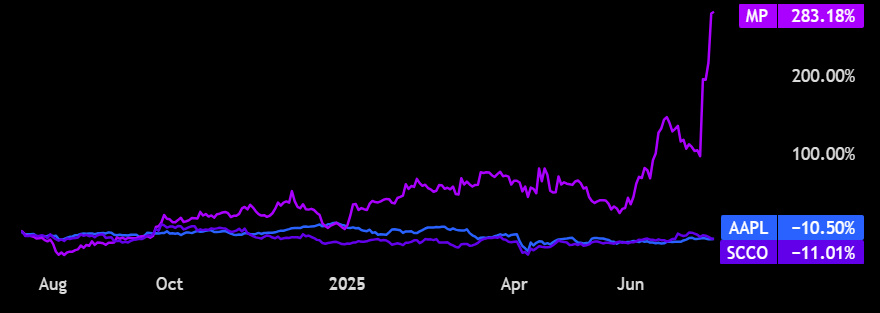

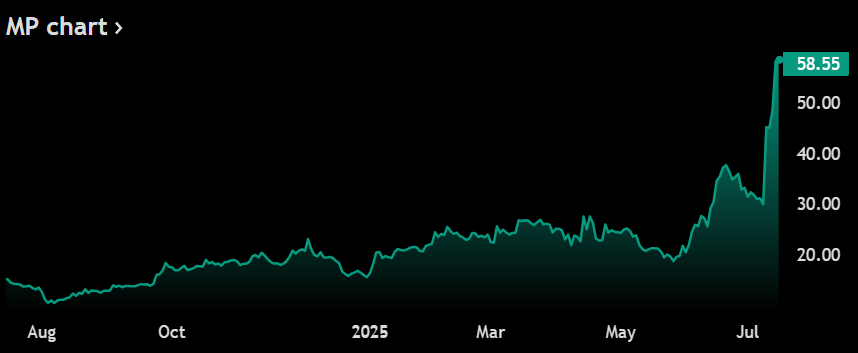

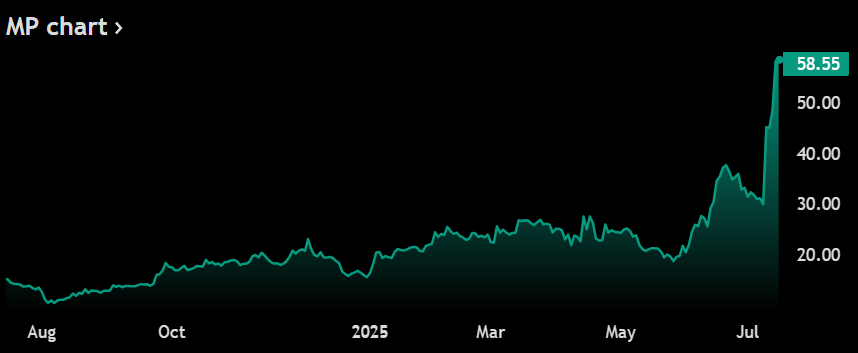

MP Materials stock offering comes right now as the Pentagon-backed rare earth producer capitalizes on an extraordinary 283% stock surge. The MP Materials stock offering represents a strategic $500 million public offering, and it highlights rare earths market outlook along with Pentagon supply chain risks amid growing geopolitical tensions.

MP Materials $500M Stock Offering Highlights Rare Earths Market Outlook and Pentagon Supply Chain Risks

Record Rally Fuels Strategic Capital Raise

The MP Materials stock offering timing follows an extraordinary rally that has actually positioned the company as a key player in addressing Pentagon supply chain risks. This rare earths market outlook reflects growing investor confidence in domestic rare earth production capabilities, and also shows how the market has been responding to supply chain concerns.

At the time of writing, MP Materials rally analysis shows the company’s unique position as America’s only scaled rare earth mining operation. The Pentagon supply chain risks have become increasingly apparent as defense officials recognize critical vulnerabilities in rare earth supply chains, even as the company continues expanding its operations.

Also Read: Apple (AAPL) Stock Down 16%: Will Earnings Spark a Rebound?

Strategic Positioning Amid Supply Chain Concerns

The current rare earths market outlook actually favors domestic producers like MP Materials, which benefits from Pentagon backing and also strategic government support. The MP Materials Pentagon contract discussions have been accelerating as defense planners address supply chain vulnerabilities right now.

Pentagon supply chain risks have driven increased investment in domestic rare earth processing capabilities, and the government has been actively supporting these initiatives. The MP Materials rally analysis reveals strong institutional backing for the company’s expansion plans along with processing infrastructure development.

Also Read: Circle (CRCL) Stock Surges After House Passes Crypto Legislation

Market Impact and Future Implications

The $500 million MP Materials stock offering will be used to fund processing expansion and also vertical integration initiatives. This rare earths market outlook supports the company’s strategy to control end-to-end production processes, reducing dependence on foreign processing facilities even more.

The MP Materials stock offering capitalizes on peak market interest in critical materials security right now. Current Pentagon supply chain risks assessments favor domestic producers with proven capabilities along with government backing for strategic materials production, and this has been driving investor interest significantly.