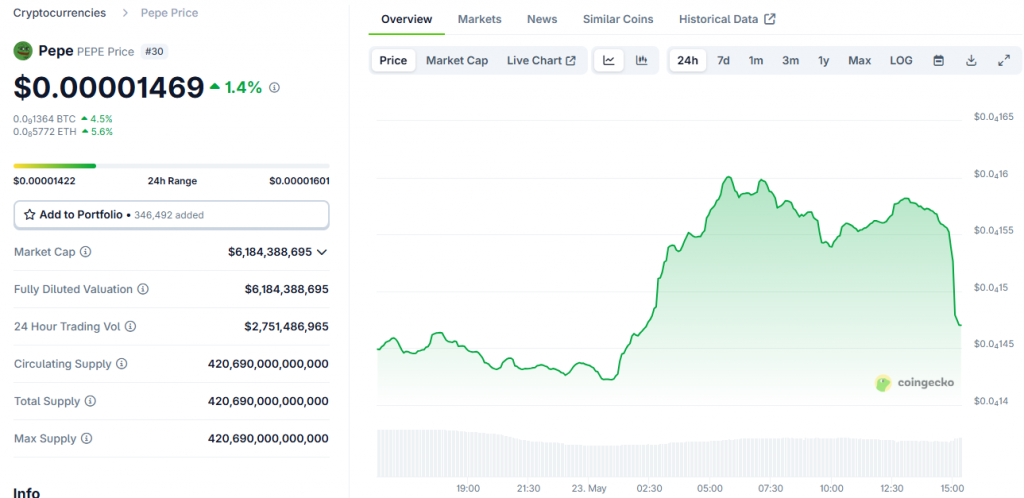

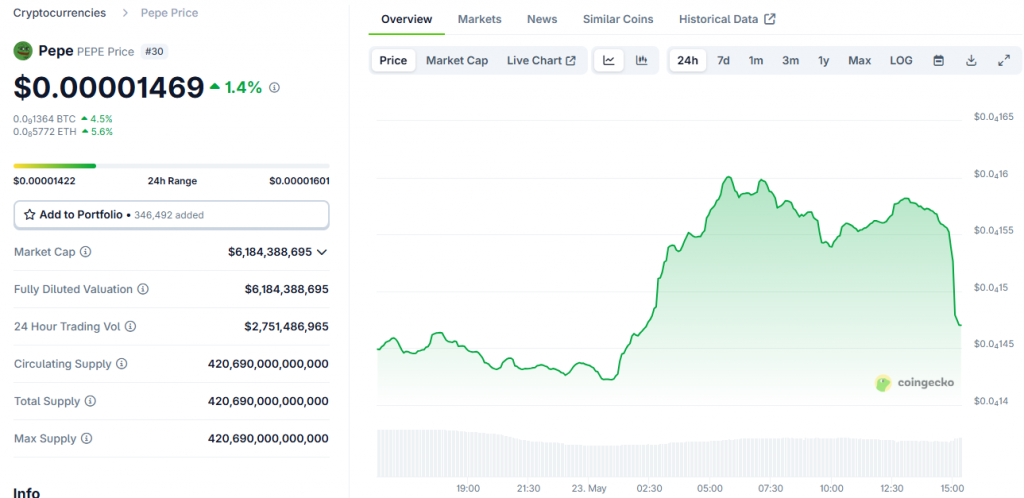

PEPE price prediction suggests the meme token could reach $0.00001550 after posting impressive 45% gains from its $0.00001000 base earlier this month. The PEPE coin has been consolidating near current levels, and right now, technical indicators show mixed signals as bulls eye higher Fibonacci targets. This meme coin rally has brought PEPE back into focus, though momentum indicators are starting to flash some early caution signs. The PEPE crypto breakout has been backed by rising volume in this ongoing crypto market update.

Also Read: AI Predicts Pepe Coin Price For The End of May 2025

Will PEPE Coin Breakout Spark Another Meme Coin Bull Rally?

The recent PEPE price prediction scenario shows quite an impressive clean reversal from multi-month lows. The token has successfully broken past both the 23.6% and also the 38.2% Fibonacci retracement levels, which is really quite bullish for PEPE. The meme coin rally has also reclaimed that important psychological $0.00001200 mark, and this area previously acted as support before the February selloff happened.

The breakout from the $0.00001020–$0.00001200 range has been backed by rising volume, and this suggests bulls are attempting quite a big reversal move. At the time of writing, the PEPE coin is climbing toward the 50% retracement zone near $0.00001800, which represents good upside potential for the token.

The structure has been solid, and traders are noting that speculative capital has moved back into high-risk assets like PEPE crypto. This shift happened following Bitcoin’s move above $110K, and it’s providing extra support for the meme token ecosystem right now.

Also Read: PEPE Set for 372% Rally: What $1,000 Could Earn By July 2025

Daily Timeframe Shows Exhaustion Warning Signs

On the daily chart, as revealed by CoinGecko, PEPE’s price spikes accelerated after clearing quite an impressive falling wedge formation, and the token successfully retested support zones near $0.00001050. However, the current candle shows quite an obvious long upper wick, and this suggests intraday selling pressure around the $0.00001600 level.

The RSI is approaching overbought territory near 68.7 right now, and the MACD histogram remains elevated but is beginning to flatten. This early sign indicates that the vertical push may be cooling off in this crypto market update, and bulls need to defend the $0.00001400–$0.00001450 area for this PEPE price prediction to materialize.

Key Levels Define Short-Term Price Action

Right now, the key near-term support for this PEPE price prediction sits around $0.00001430–$0.00001450, and further demand is expected near $0.00001370. A breakdown below $0.00001320 would trigger broader liquidation, and this would drag the price back toward the $0.00001260 area.

On the upside, bulls must overcome resistance at $0.00001590, and then aim for the next key level near $0.00001750. Beyond that level, the 50% Fibonacci retracement at $0.00001800 remains the next major upside target for this meme coin rally scenario.

Also Read: Turned $1,000 into Pepe Coin After Musk’s First Meme? Here’s What It’s Worth Today

The current meme coin rally momentum remains intact for now, but lower-timeframe indicators are flashing caution signs. The PEPE coin has reclaimed its 50 and also the 100 EMA clusters on the 4-hour chart, and the surge above $0.00001350 invalidated the descending channel structure quite decisively.

Until PEPE breaks cleanly above $0.00001600 with volume confirmation, traders can expect tight-range consolidation and volatility. The PEPE crypto ecosystem continues to benefit from speculative capital rotation, though this crypto market update suggests bulls must tread carefully in the near term as momentum indicators show mixed signals across timeframes.