The Ethereum network is gradually transitioning its consensus mechanism from Proof of Work to Proof of Stake. As per the Ethereum Organization, the said upgrade to the “consensus layer” [formerly known as Ethereum 2.0] is set to ‘ship’ by the second quarter of this year.

Alongside a host of dynamic and technical transitions, the merge between the Ethereum mainchain and the Beacon chain would aid the Ethereum network in becoming even more scalable, secure, and sustainable.

Now, post the merger of both the chains, Coinbase expects an increase in staking yields. As per the exchange, the numbers are set to double. In their recent note, they said,

“Following the merge of Ethereum’s mainnet with the Beacon Chain expected around June of this year, we should see ETH staking yields increase as rewards will incorporate net transaction (ex-base) fees currently paid to miners.”

Specifically outlining the numbers, Coinbase noted,

“We estimate that staking yields could rise from 4.3-5.4% APR to upwards of 9-12% APR.”

The current ‘stake’ of affairs

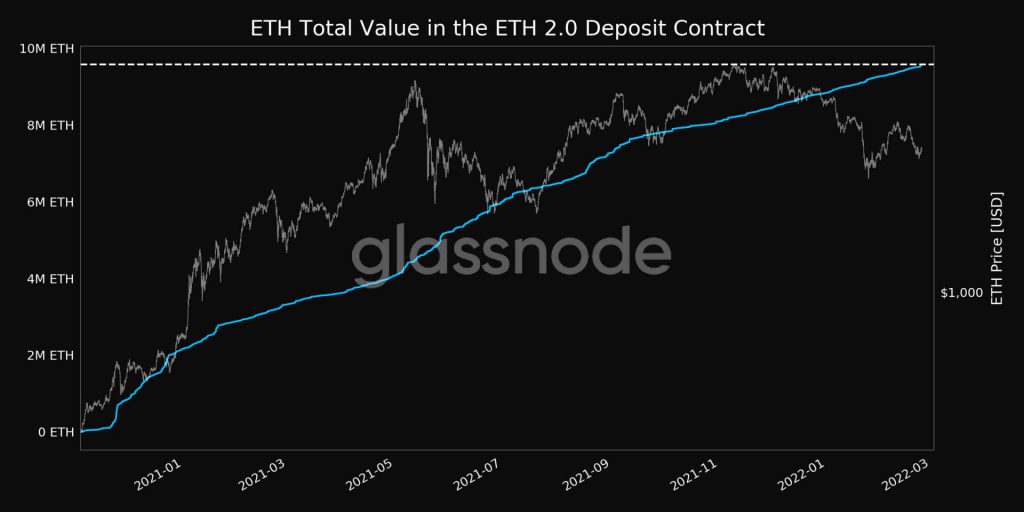

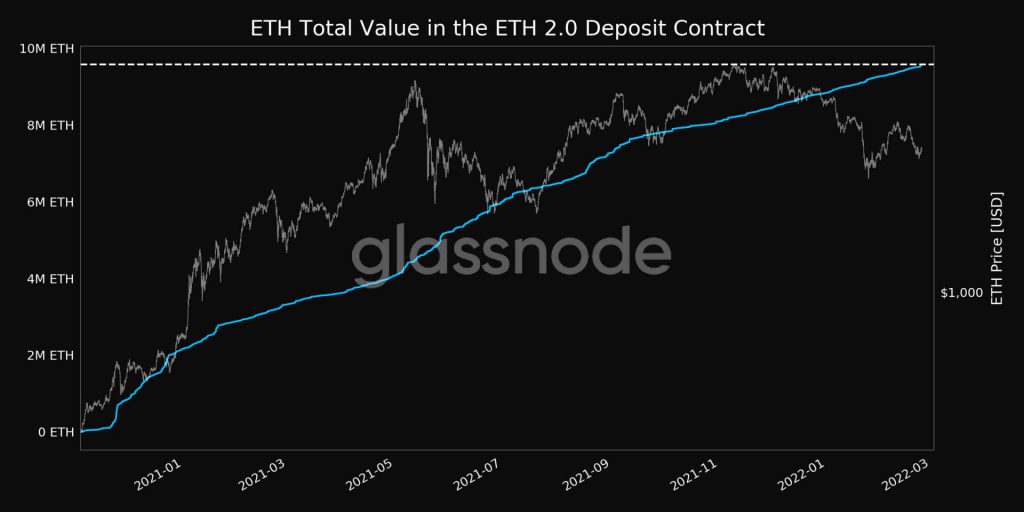

Currently, over 9 million ETH [9,574,866, to be specific] are deposited in the Ethereum 2.0 deposit contract. The said ATH level was achieved a couple of hours back, with blockchain data aggregating platform Glassnode bringing to light the same.

At today’s price, that is nearly $22.625 billion in the capital looking to secure the proof-of-stake network and gain further exposure to Ethereum’s native asset.

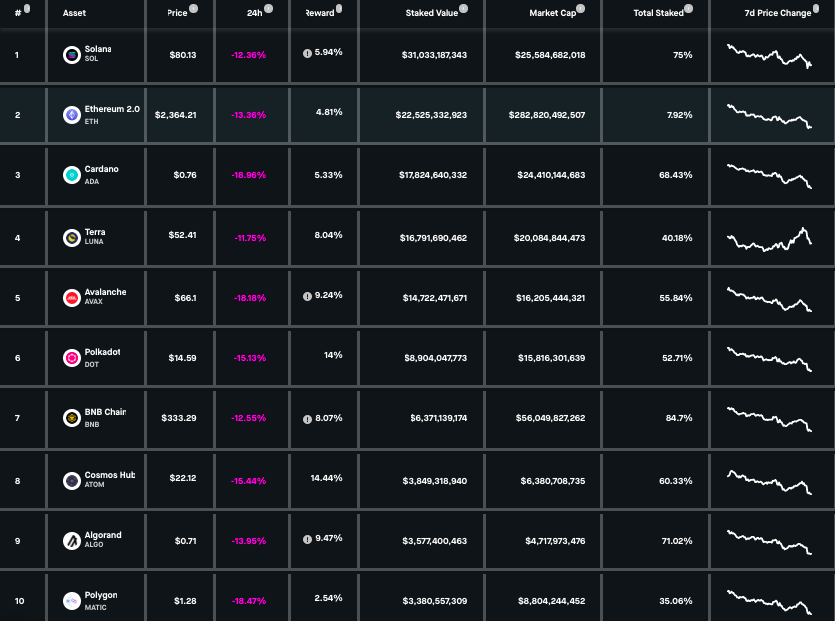

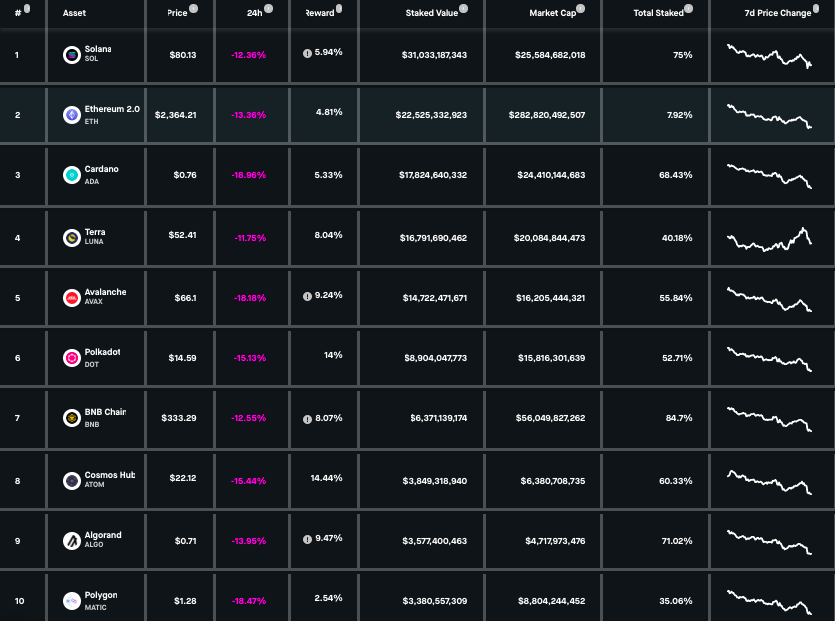

As per data from StakingRewards, other networks provide much higher rewards to stakers. Solana’s rewards, for instance, revolved around 5.94% at the time of press, while that of Cardano reflected a value of 5.3%. Terra, Avalanche, Polkadot, and Cosmos’ numbers were even higher and typically oscillated between 8%-14% each.

Chain effects that can be expected

Now, if a two-fold increase in Ethereum’s rewards indeed materializes as Coinbase says, it would eventually attract more stakers. As the number of stakers increases, the amount of staked Ethereum would also increase. In effect, as more and more tokens get locked, a gradual supply crunch would shape up. Alongside, the Ethereum tokens being burnt would additionally add on to the deflationary pressure, and over the long-term, would likely rub off positively on the asset’s price.