All eyes are on the petrodollar agreement as the future of the US dollar depends on Saudi Arabia’s decision to accept the currency for global trade or give opportunities to local currencies. The Chinese yuan is looking to play a central role in transactions in the oil and gas sector. The US dollar faces uncertainties as local currencies look to uproot it from the world’s reserve currency status.

Also Read: BRICS Advances De-Dollarization: Aims To Empower ‘Unheard Countries’

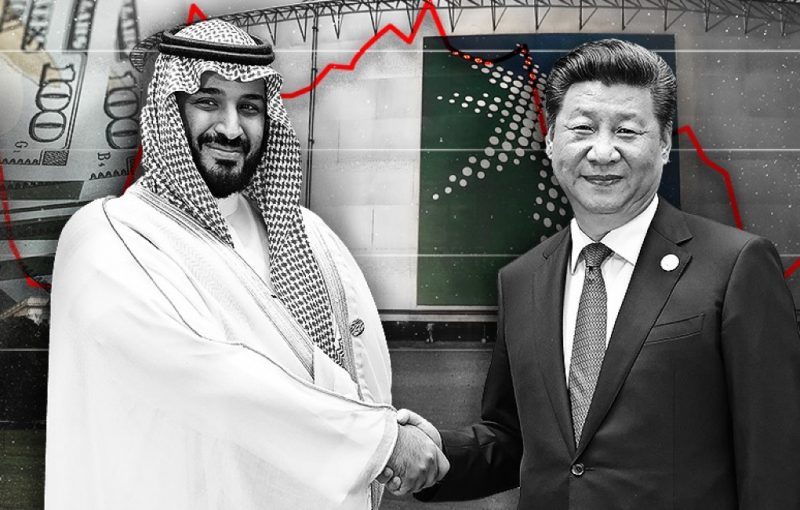

China is now Saudi Arabia’s top customer for oil trade and initiates billions worth of deals each year. As of 2024, China accounts for 20% of all Saudi Arabia’s oil exports making it wield influence in the sector. China’s close ties with Saudi Arabia coincide with the end of the petrodollar agreement putting the US dollar’s prospects in jeopardy. The global oil sector could experience a paradigm shift if Saudi Arabia extends accepting Chinese yuan for oil trade.

Also Read: ASEAN: Trade With China Hits $300 Billion, Increase 8.5% in 2024

US Dollar vs Chinese Yuan: Saudi Arabia’s Petrodollar Agreement In the Spotlight

Saudi Arabia needs the US dollar more than the Chinese yuan for oil despite the end of the petrodollar agreement. However, Atlantic Council‘s Hung Tran wrote that the US influence is waning while China establishes closer ties with Saudi Arabia. He explained for this reason, Saudi Arabia might extend accepting the Chinese yuan, after the petrodollar along with the US dollar.

Also Read: BRICS: 19 Countries Enter Advanced Stages of CBDC Testing

“China has become Saudi Arabia’s largest oil customer, accounting for more than 20% of the kingdom’s oil exports. Beijing has established close, trade-driven relationships throughout the Middle East, where US influence has waned,” wrote Tran.

If that happens, the US dollar’s clout will gradually decline leading to the rise of the Chinese yuan. The end of the petrodollar is now in Saudi Arabia’s hands, which can dictate the future of the US dollar. “How Saudi Arabia approaches the petrodollar remains an important harbinger of the financial future,” Tran summed it up.