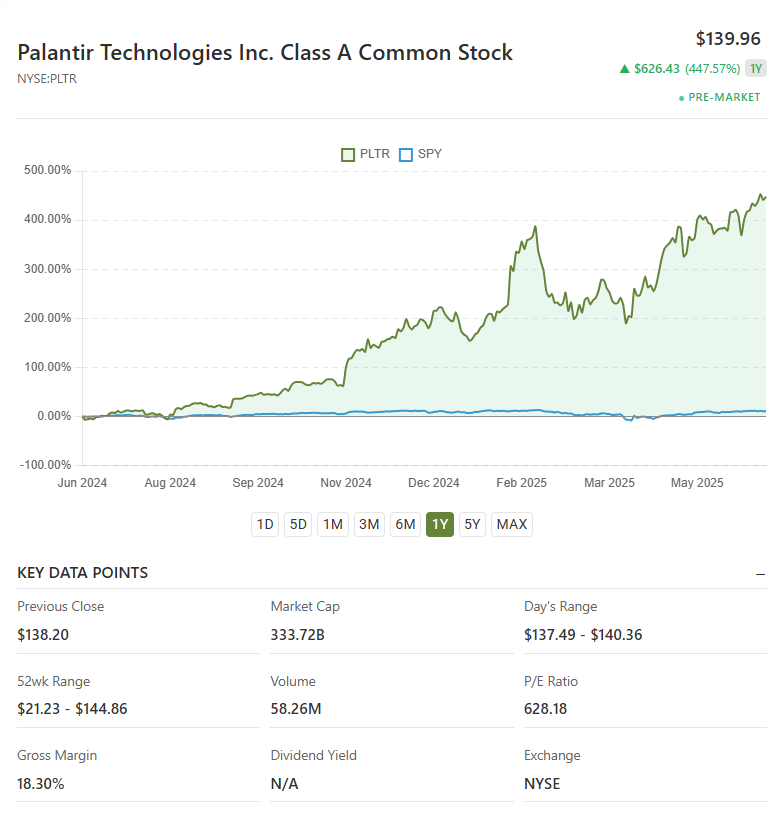

PLTR stock has been on an incredible run, and it’s surged 437.55% over the past year, with analysts now setting some pretty aggressive price targets that could actually double a $5,000 investment. Loop Capital recently raised their Palantir price prediction to a street-high $155, which represents potential upside from current levels around $140. The Palantir stock forecast also reflects growing confidence in the AI company’s government contracts and commercial expansion right now.

Also Read: Daniel Ives: Buy Palantir (PLTR) After $795M US Army Deal

Palantir Stock Forecast, Targets & Price Prediction Guide for Investors

Wall Street Sets Ambitious PLTR Price Target Range

The Palantir analyst target consensus shows some significant variation, and with 17 analysts maintaining mixed ratings on PLTR stock at the time of writing. Price targets range from $40 to $155, with the median Palantir price prediction sitting at $104.27. This wide spread also reflects uncertainty about the company’s high valuation, currently trading at a forward P/E ratio of 250.

Wedbush analyst Dan Ives had this to say:

“[Palantir is] one of our top tech names to own”

Three analysts assign “Buy” ratings, 10 maintain “Hold” positions, and four recommend “Sell” on PLTR stock right now.

Strong Revenue Growth Supports Optimistic PLTR Stock Outlook

Palantir’s Q1 2025 results demonstrated some impressive momentum, with 39% year-over-year revenue growth driving the positive Palantir stock forecast. U.S. commercial business surpassed a $1 billion run rate, growing 71% year-over-year, while government revenue also expanded 45%.

Palantir reports Q1 2025 revenue growth of 39% y/y, U.S. revenue growth of 55% y/y; raises FY 2025 revenue guidance to 36% y/y growth and U.S. comm revenue guidance to 68% y/y, crushing consensus expectations.

— Palantir (@PalantirTech) May 5, 2025

In Q1 2025, U.S. commercial revenue grew 71% y/y and 19% q/q and U.S.… pic.twitter.com/REQeWsPDLK

CEO Alex Karp stated:

“We are delivering the operating system for the modern enterprise in the era of AI”

The company raised its 2025 guidance to $3.89-$3.9 billion, exceeding previous forecasts and supporting bullish PLTR price target projections at this time.

Government Contracts and AI Platform Drive Future Growth

Palantir’s government segment contributes 55% of revenue, and with recent high-profile contracts including a $30 million ICE deal and NATO’s AI platform adoption. These wins also reinforce the positive Palantir analyst target outlook and support continued PLTR stock appreciation right now.

The company’s AI Platform (AIP) completed 139 deals worth $1 million or more in Q1, with customer count increasing 69% to 593. This commercial expansion also validates the optimistic Palantir price prediction among Wall Street firms.

Also Read: PLTR: Palantir Falls 3% on $178M Army AI Deal, BofA Eyes $150

For investors considering the $155 analyst target on a $5,000 investment, the potential represents some meaningful upside from current PLTR stock levels, though high valuations warrant careful consideration of risk tolerance at the time of writing.