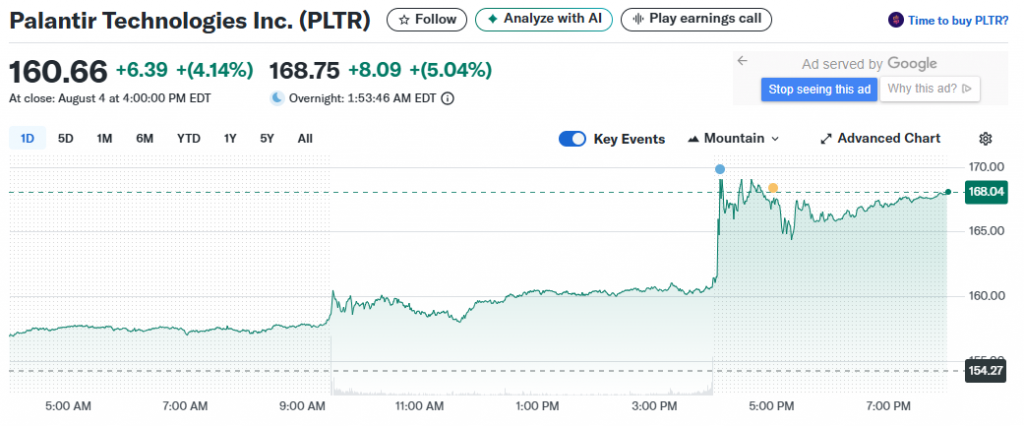

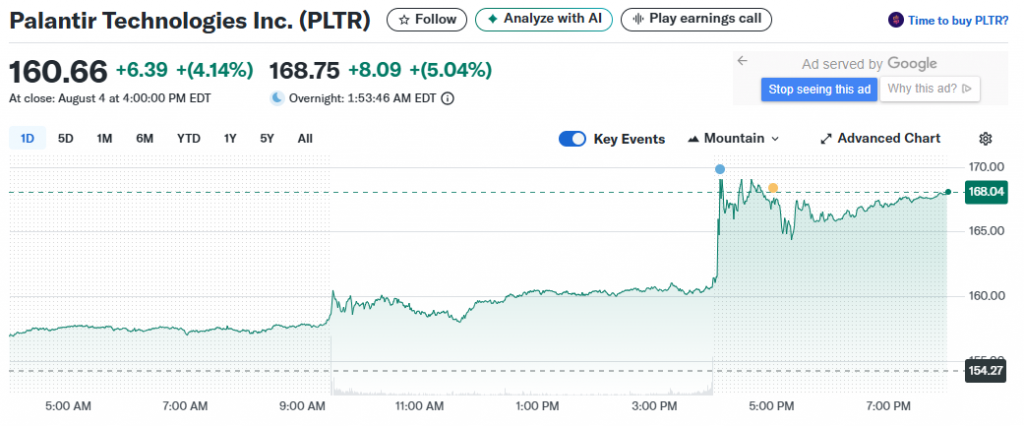

PLTR stock has been climbing 112% year-to-date, and this surge came after some really strong PLTR earnings that pushed the Palantir stock price much higher. The data analytics company actually hit $1 billion in quarterly revenue for the first time, which beat what analysts were expecting and gave Palantir stock a nice boost. This Palantir earnings call showed impressive Palantir revenue growth across both commercial and government sectors, with PLTR stock jumping around 4% right after the announcement.

Also Read: Stock Futures Market Rises as Nasdaq, Dow Rebound From Lows

PLTR Stock Jumps On Strong Earnings Call And Rising Palantir Stock Price

Record Revenue Milestone Powers PLTR Stock Rally

Palantir’s Q2 2025 results were pretty impressive, showing the company reaching that $1 billion quarterly revenue mark earlier than expected. Originally, this milestone was anticipated for Q4, but PLTR stock responded well when it happened in Q2 instead. Earnings per share came in at $0.16, which actually beat analyst forecasts of $0.14, along with total revenue being up 48% compared to last year.

CEO Alex Karp had this to say:

“The growth rate of our business has accelerated radically.”

This achievement has been a major factor behind PLTR stock’s strong performance lately, as investors are seeing validation of what the company is trying to do in the data analytics space.

Commercial Sector Drives Palantir Revenue Growth

The most striking thing about these PLTR earnings was how the US commercial sector grew by 93% year-over-year. Total US revenue reached $733 million, representing 68% growth that went beyond what analysts projected and helped support the rising Palantir stock price even more.

The company closed deals worth $2.27 billion during the quarter, which is a 140% increase from the same period last year. This included 66 deals worth at least $5 million and also 42 deals totaling at least $10 million. Adjusted income from operations reached $464 million, representing a solid 46% margin that shows the company can scale efficiently.

Raised Guidance Boosts PLTR Stock Outlook

Management decided to raise their full-year revenue guidance to between $4.142 billion and $4.150 billion, up from the previous guidance of $3.89 billion to $3.90 billion. This significant upward revision has been supporting continued strength in PLTR stock performance.

For Q3, analysts are forecasting Palantir earnings between $1.083 billion and $1.087 billion, which substantially beats their estimate of $983 million. The company expects US commercial revenue to grow by at least 85% year-over-year, indicating that Palantir revenue growth has some real momentum behind it.

Also Read: “Sell America” Trade Returns as S&P 500 Tumbles on Jobs Disaster

At the time of writing, 17 analysts give PLTR stock a consensus Hold rating, with an average price target of $111.14. The strong Palantir earnings call results will likely prompt analysts to update these ratings, especially given how they have driven the stock’s impressive 112% year-to-date performance.