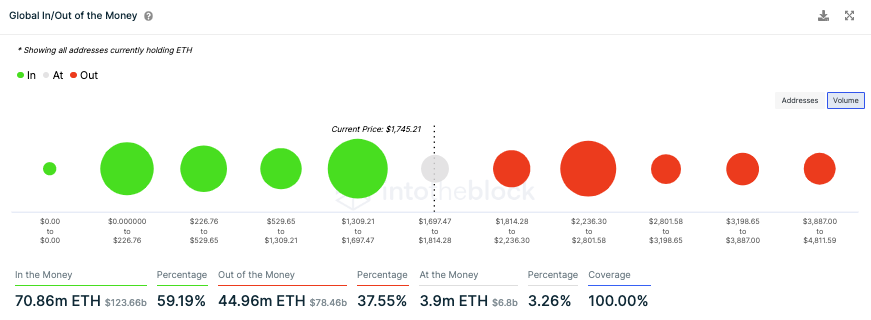

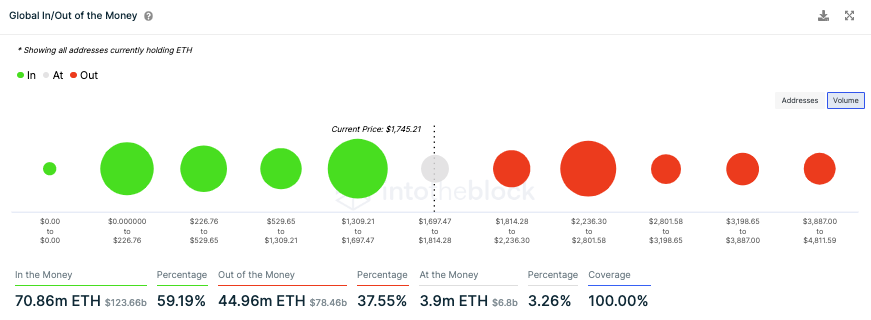

The crypto market has been quite volatile of late. Asset prices have been fluctuating over both sides of the spectrum. Despite the market trading in the green on Monday and Ethereum registering a 12% weekly gain, close to 40% of ETH investors were under-water. More so, because a majority of them purchased the asset when it was priced between $2.2k to $2.8k.

However, this has not demotivated institutional investors from accumulating ETH for staking. It’s a known fact that a minimum of 32 ETH is required to activate one’s own validator, and since a hefty amount of funds is required to do so, it is usually institutions that indulge in staking.

The latest data from Glassnode revealed that the number of addresses HODLing more than 32+ ETH just reached a 19-month high, adding more weightage to the said ‘accumulation for staking’ narrative.

Ethereum staking rewards to become more lucrative than bond yields?

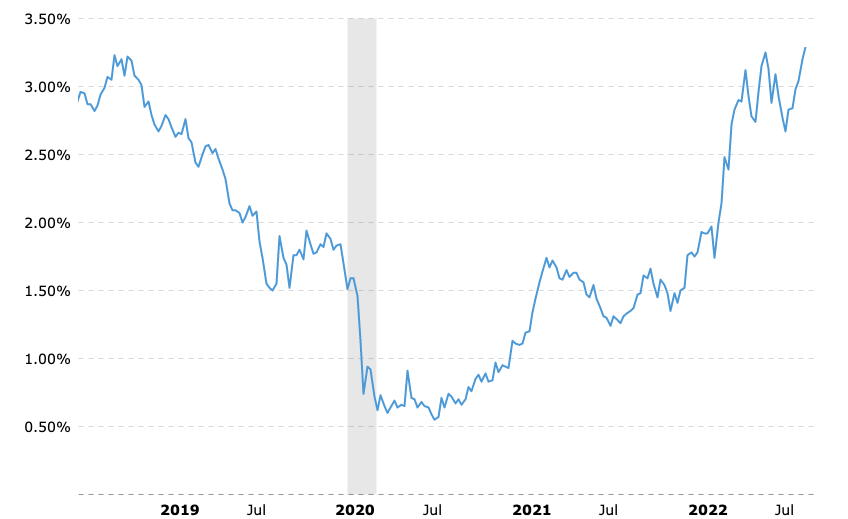

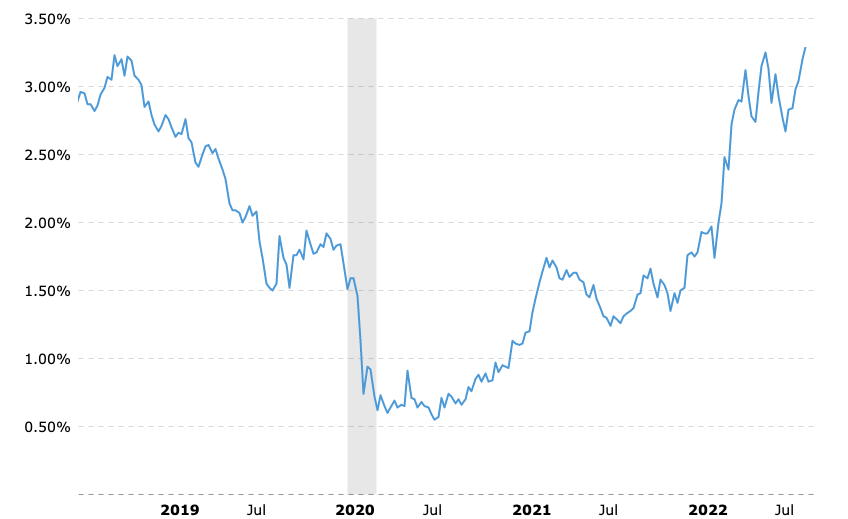

Since mid-2020, yields on 10-year US Treasury bonds have been on the rise. Even so, the number continues to hover only in the 3% to 3.5% bracket.

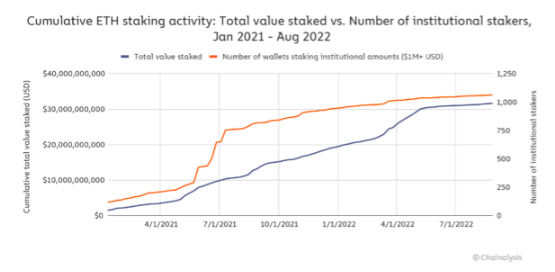

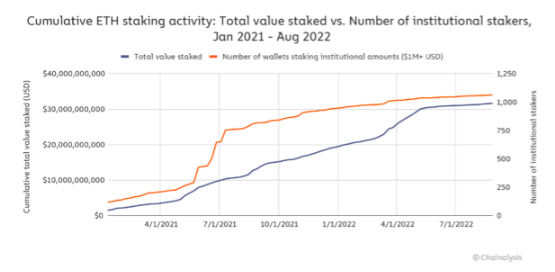

A recent Chainalysis report noted that Ethereum stakers can expect a 10%-15% yield on an annual basis. Resultantly, those returns could make it an “enticing” bond alternative for institutional investors.

Additionally, it is worth noting that the number of wallets staking $1 million or more worth of Ether has also steadily been inclining already [orange]. So, if the said numbers continue to rise post The Merge also, it’d likely indicate that institutional investors indeed see Ethereum staking as a good yield-generating strategy.

Resultantly—leaving aside other factors—staking could aid Ethereum in decoupling from other cryptos. Elaborating on the same, Chainalysis’ report noted,

“Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make it similar to an instrument like a bond or commodity with a carry premium.”