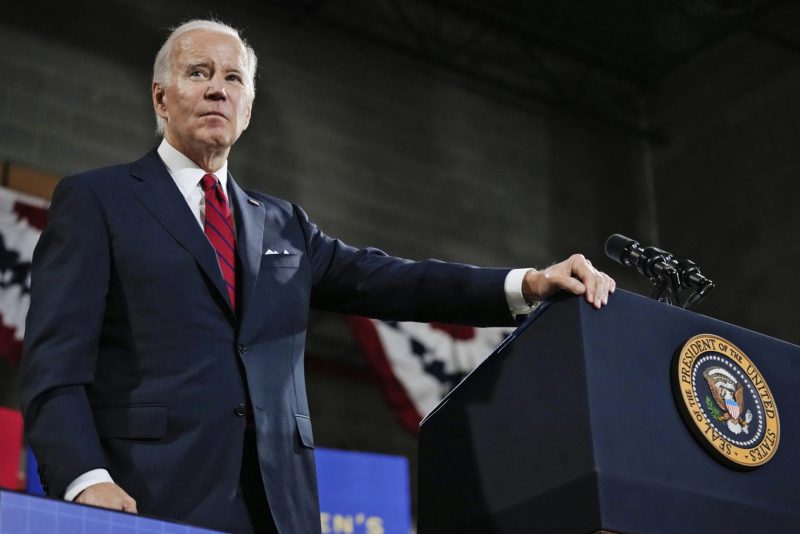

Speaking to the nation today, US President Joe Biden said that March’s inflation report may delay interest rate cuts. Indeed, Biden noted that the inflation data reporting an increase to 3.5%, higher than expectations, will likely have an impact on the Federal Reserve’s decision-making process for the year.

Biden noted that he is currently unaware of the Central Bank’s plans regarding interest rate cuts. However, he did assure the public that there would be cuts taking place before the end of the year. Alternatively, Fed Chair Jerome Powell previously said that the country could expect three interest rate cuts before the conclusion of 2024.

Also Read: US Inflation Rises to 3.5%, Higher Than Expectations

Joe Biden Says Inflation May Delay Interest Rate Cuts

Over the last several years, increasing inflation has been a massive problem for the United States. The Federal Reserve engaged in a years-long tightening campaign to drive the figure down to its 2% target. Subsequently, that tactic of increasing interest rates has seen many hopes for cuts that were expected in 2024.

Now, those may be put into question, according to the country’s Commander in Chief. Indeed, US President Joe Biden says that inflation data may delay the presence of interest rate cuts in the country. Specifically, the data has shown inflation increases over the last two months, counteracting the declining trend that had been taking place prior.

Also Read: US Economy: What Will Happen If the Federal Reserve Doesn’t Cut Rates Soon?

Although Biden questioned the presence of imminent rate cuts, he did note that one would take place before the end of the year. Alternatively, Fed chair Jerome Powell had previously hinted at three rate cuts taking place before the end of 2024. However, that appears to now be in question considering the new data.

The country is anxiously awaiting when those cuts could take place. The market is currently hopeful that they could come as early as June, but there is no certainty in that prediction. January, February, and March have shown inflation higher than expectations.

Moreover, it is still far off from the Federal Reserve’s 2% target. Unless more certain evidence of lessening inflation is made known, June likely remains an optimistic perspective. However, the country is waiting to hear from Fed Chair Powell regarding March data in hopes of some direction.