A few hours back, El Salvadorian President—Nayib Bukele—revealed the country’s plans to buy back $1.6 billion of its dollar-denominated bonds. In a historic move last year, the Central American nation adopted Bitcoin as legal tender. Since then, stalwarts inclined towards the traditional side of the financial spectrum allegedly started making claims out of thin air that the said move would weaken El Salvador’s financials and it would not be in a position to clear its defaults. So now, the latest move is set to alleviate default-related concerns that have been repeatedly flagged.

Chalking out the buy-back deal

In a series of tweets, Bukele announced that he was sending two bills to the national assembly to make a “transparent, public and voluntary purchase offer” to all the HODLers of Salvadoran sovereign debt bonds from 2023 to 2025.

The President further revealed that the bonds would be repurchased at market prices, and the process would begin to post the paperwork completion. Giving a ball-park estimate of when to expect the purchase operation to begin, Bukele revealed,

“The purchasing operation will start in 6 weeks (the time it takes to file all the paperwork).”

At the beginning of this year, the International Monetary Fund had urged El Salvador to strip Bitcoin of its legal status. It cited that adopting crypto as legal tender entailed “large risks” for financial and market integrity, financial stability, and consumer protection. It added that the same also had the potential to create contingent liabilities.

Read More: IMF urges El Salvador to strip Bitcoin of its legal tender status

So, has Bitcoin indeed dented El Salvador’s financials?

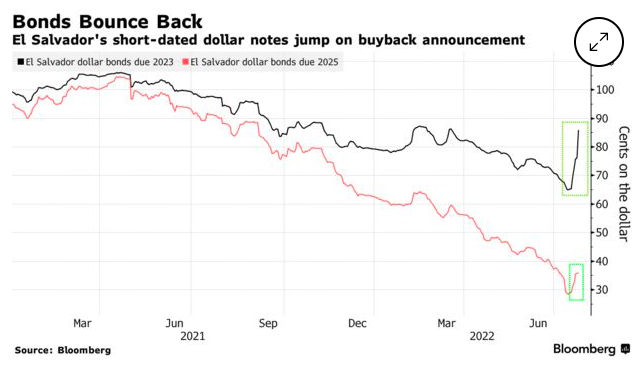

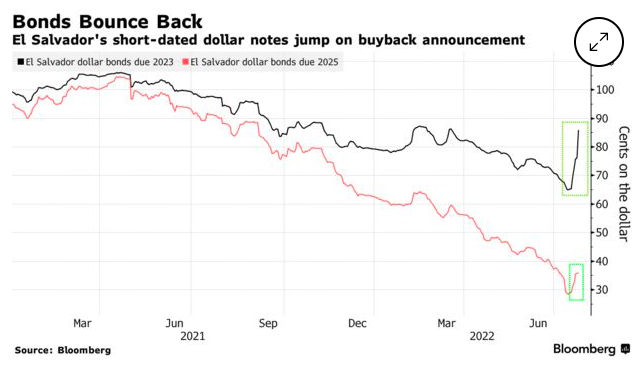

The nation, quite overtly, dodged IMF’s bullet. El Salvador once bought Bitcoin during dips, expressing its conviction concerning the largest crypto asset. Here it is worth recalling that in May, rating agency Moody’s downgraded El Salvador’s debt and warned that the Central American nation might be forced to default. In fact, around the same time, El Pais had reported that Salvadoran bonds were trading at approximately 40% of their face value, a sign that traders noted the warning as a serious risk.

Bukele is not on the same page and has asserted that El Salvador has more than enough liquidity to honor its commitments. Concerning the country’s current financial state, he contended,

“Contrary to what the media has been saying all this time, El Salvador has the liquidity not only to pay all of its commitments when they are due, but also purchase all of its own debt (till 2025) in advance.”

Bukele further expects bond prices to “probably move upwards” once the nation starts buying all the available bonds at the market price.

Just on the buyback announcement, El Salvador bonds have started surging in value. A recent Bloomberg report revealed,

“The nation’s dollar bonds set to mature in January 2023 rose nearly 10 cents after the announcement to 86 cents, according to indicative prices compiled by Bloomberg. The 2025 notes, meanwhile, were up 16 cents to be quoted at 52 cents, the highest since mid-April.”