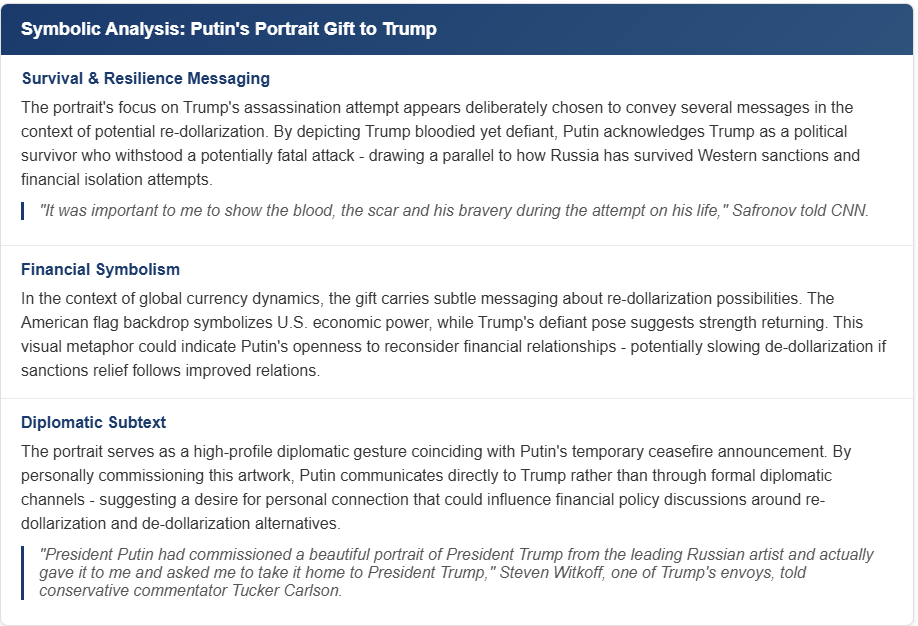

The possibility of re-dollarization has become a topic of interest after Putin gifted Trump a painting (with a lot of meaning), and also proposed a temporary ceasefire in Ukraine. Recent cooperative measures between Putin and Trump that include the president receiving a portrait from the Russian leader produce questions regarding how such a US-Russia axis could affect currency dynamics between re-dollarization and ongoing de-dollarization in global markets during this point in time.

Also Read: Bessent: China Must Act to End Trade War—Tariff Relief Hinges on Beijing

Could Putin’s Ceasefire Proposal and US-Russia Axis Spark Re-Dollarization or De-Dollarization?

Putin’s Strategic Overtures

Putin announced, just yesterday, a three-day ceasefire from May 8-10, coinciding with World War II victory celebrations and all. This diplomatic gesture comes at a time when analysts are considering the implications for global currency trends, including potential re-dollarization scenarios.

The Kremlin stated:

“All military actions are suspended for the period. Russia believes the Ukrainian side should follow this example.”

President Zelensky questioned the timing and also noted:

“For some reason everyone is supposed to wait for May 8 and only then have a ceasefire to ensure calm for Putin during the parade. We value people’s lives and not parades.”

Trump-Putin Relationship Implications

The US-Russia axis shows some signs of warming, though tensions definitely remain over Ukraine and related issues. The gift of a portrait symbolizes Putin’s outreach to Trump amid the ongoing ceasefire talks and diplomatic efforts that could affect currency preferences and re-dollarization trends.

Also Read: Pepe (PEPE) Price Prediction For 2025

White House deputy chief of staff James Blair revealed in a recent statement:

“[Trump] is very displeased with the attacks on civilian areas last week, and [Trump’s] put on the table increasing sanctions, secondary tariffs on oil, whatever it takes to make sure that they hurry up and get to the table and create peace.”

Financial Implications: Re-Dollarization or De-Dollarization?

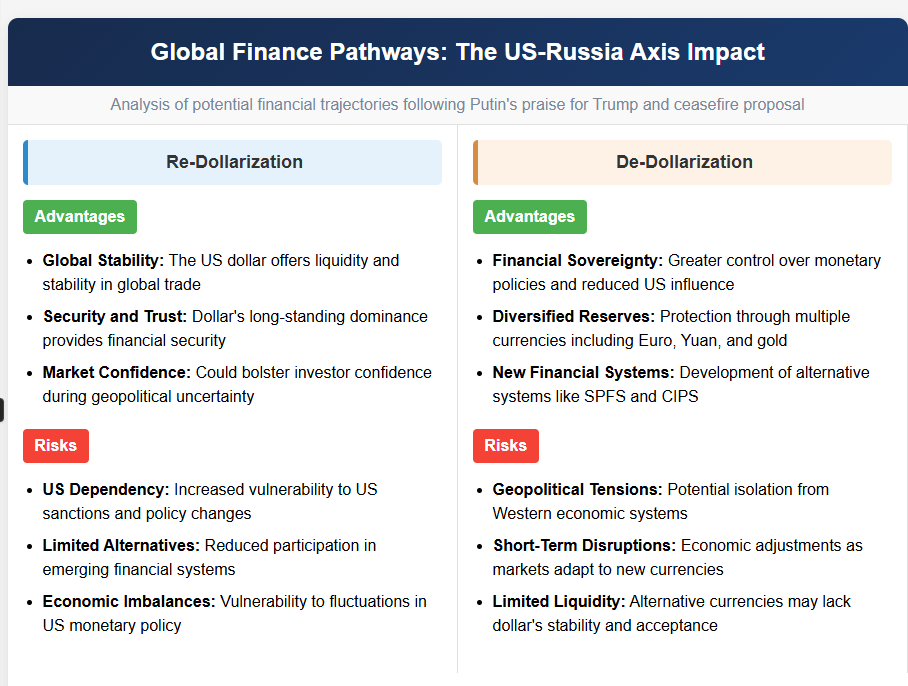

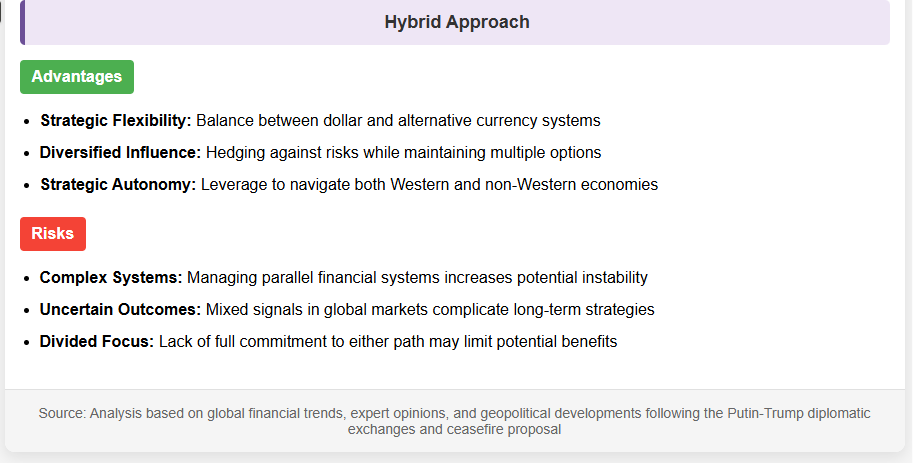

The potential US-Russia axis raises significant questions about re-dollarization versus continued de-dollarization at this point in time. Will closer ties strengthen the dollar in bilateral trade or will both nations continue to pursue alternative financial systems and structures?

George Barros of the Institute for the Study of War noted in his analysis:

“The Kremlin is now explicitly demanding all of Kherson and Zaporizhia, which was not part of the 2021 demands. Bottom line, the Kremlin is rejecting Trump’s proposals and articulating goals that require the war to go on or for Ukraine to surrender things for no reason.”

Also Read: Bullish Signal: SHIB Eyes 100% Rally to $0.00003 After Breakout, Says Analyst

Russian Foreign Minister Lavrov insisted on major concessions, and stated:

“We will also insist on obtaining solid security guarantees for the Russian Federation in order to shield it from any threats emanating from hostile activities by NATO, the European Union and some of their member states along our western border.”

The outcome of these negotiations and diplomatic exchanges will probably determine whether we see a shift toward re-dollarization or even more continued momentum for de-dollarization in the global financial system going forward.