XRP—the market’s sixth largest crypto—has depreciated by more than 50% since the end of March. Its weekly chart has been characterized by a streak of 8 back-to-back red candles. Consequentially, last week, the alt had let go of its support at around $0.5 which coincided with its 200-day MA.

At press time, Ripple’s native token was trading even below—at $0.4268—quite close to its next support around $0.4.

Apart from minor supports at $0.37 and $0.34, the next strong level for XRP to lean only lies around $0.25. Thus, how the price reacts over the next few hours would be quite critical in determining what to expect next from this alt.

Gauging the XRP trader sentiment

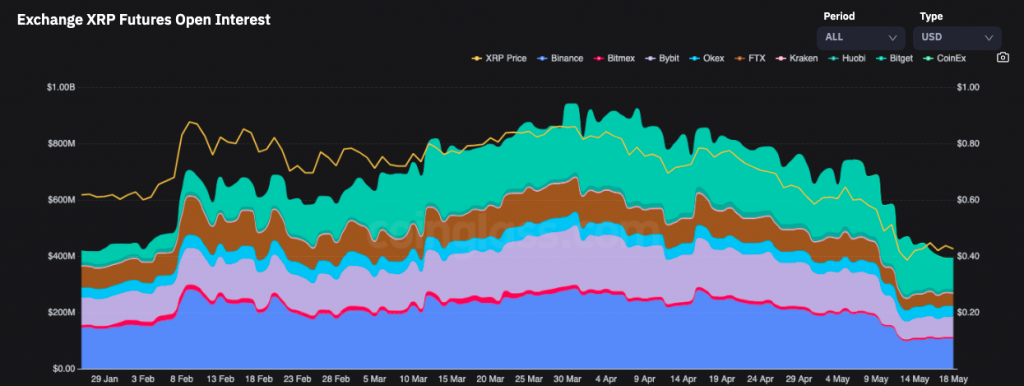

Daily, traders have been exiting the XRP market. Consider this—On 6 May, XRP’s open interest, or the worth of all the outstanding contracts, stood at $742 million. At press time, nonetheless, the number was already down by half, to $392 million, indicating that not much new money has been entering the futures market.

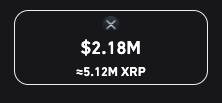

Having said that, it should also be noted that Ripple’s XRP was one of the few alts that had noted liquidations in millions over the past 24-hours. Per data from Coinglass, 5.1 million XRP tokens worth approximately $2.18 million had been wiped out from the market in the said timeframe. Long traders were hurt more badly when compared to short traders, re-emphasizing the fact that the market is continuing to favor bears instead of bulls.

Furthermore, on the hourly timeframe, XRP’s long: short ratio stood below 1—at 0.66—suggesting that new traders have started placing bearish bets on the token’s price. So, with the pendulum inclined towards the bearish side, the odds of XRP shedding value over the next couple of trading sessions are quite high. So, in the worst-case scenario, market participants can expect Ripple’s native asset to dip down to $0.25 over the next few days.