Ripple’s native cryptocurrency, XRP, has been making waves in the market as it forms a promising ‘W’ pattern, indicating a potential breakout in the near future. According to a recent tweet by analyst EGRAG Crypto, the current situation suggests that the MACRO ‘GO-GO’ level is imminent, which could lead to significant price appreciation for XRP.

The analyst highlights the importance of the Fibonacci 0.382 level, which currently stands between $0.58 and $0.60. This level acts as a strong support for XRP, and as long as the cryptocurrency does not close below this range on a weekly or 3-day candle, the bullish sentiment remains intact.

Also read: Cryptocurrency: 5 Coins You Should Buy For The Bull Run

While wicking candles are considered normal, a closure below the Fib 0.382 level could raise concerns among investors.

Could XRP hit $1.17?

Upon closer examination of the XRP chart, EGRAG Crypto points out that the ‘W’ pattern is indeed taking shape. This, according to the analyst, signals a potential breakout. The measured move for this pattern varies depending on the scale used. On a logarithmic scale, the target stands at an impressive $1.17. However, on a non-logarithmic scale, the target is slightly lower at $1.02.

Also read: Ripple (XRP) Forecasted To Hit $1.5: Here’s When

Ripple Price Performance

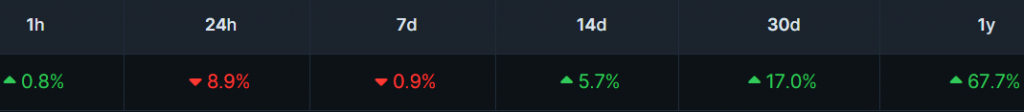

Despite the promising outlook, XRP has experienced a short-term dip in price, with a 0.9% decrease over the past 7 days and an 8.9% decrease in the last 24 hours. However, zooming out to the 30-day and 1-year timeframes reveals a more positive picture, with XRP recording gains of 17.0% and 67.7%, respectively.

These figures suggest that while short-term volatility is present, the overall trend for XRP remains bullish. As the ‘W’ pattern continues to develop, investors and traders are keeping a close eye on the cryptocurrency’s price action, eagerly anticipating the potential breakout and subsequent price surge.

Also read: How High Can Dogecoin Surge After Musk Incorporates DOGE?

It is worth noting that Ripple, the company behind XRP, has been engaged in a long-standing legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC alleges that Ripple conducted an unregistered securities offering through the sale of XRP, while Ripple maintains that XRP is not a security and should be treated as a digital currency.

The outcome of this legal battle could have significant implications for XRP’s future price performance. A favorable ruling for Ripple could further bolster investor confidence and potentially lead to increased institutional adoption of the cryptocurrency. On the other hand, an unfavorable outcome could put downward pressure on XRP’s price.