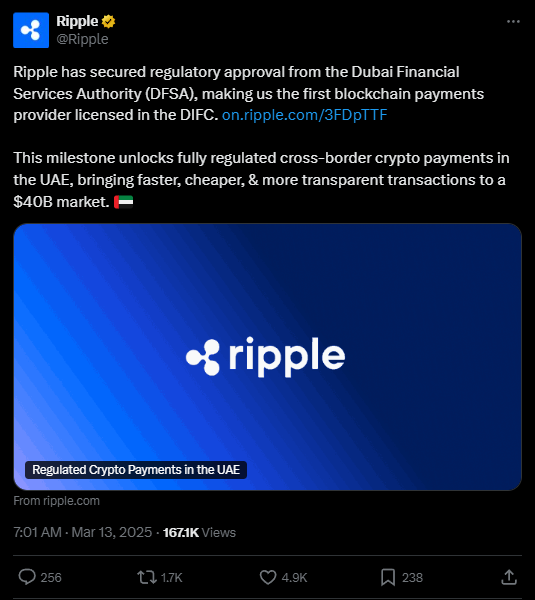

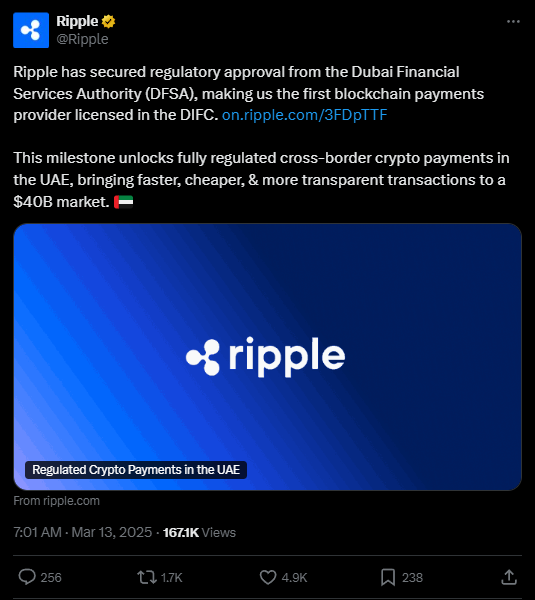

Ripple‘s DFSA approval has just been secured, which is a big milestone for the industry at this point in time. Blockchain payment initiatives have catalyzed various major sector elements within the UAE financial ecosystem, establishing new regulatory frameworks. The blockchain payment provider actually announced on March 13, 2025, that it has received full regulatory approval from the Dubai Financial Services Authority to offer cross-border cryptocurrency services within the Dubai International Financial Centre, which is basically a special economic zone with its own rules and also its own tax structure.

JUST IN: 🇦🇪 Ripple $XRP receives approval from Dubai Financial Services Authority to provide crypto payments & services in the UAE.

— Watcher.Guru (@WatcherGuru) March 13, 2025

Also Read: Microsoft (MSFT): Why One Investment is Keeping The Stock Afloat

Ripple’s DFSA License: Impact on UAE’s Crypto Payment Landscape

This Ripple DFSA approval is positioning the company as the first blockchain-powered payments provider to be licensed by the authority. This is certainly strengthening its presence in the Middle East and also enhancing the UAE’s status as a global hub for financial technology and blockchain adoption of Middle East initiatives.

Brad Garlinghouse, Ripple CEO, stated:

The industry has now entered a period of unprecedented growth. The UAE has fostered a supportive environment for crypto.

Witnessing a Strategic Expansion in the Middle East

Ripple established its regional headquarters in Dubai back in 2020, showing its commitment to the Middle East market and everything. Various major market developments have pioneered new transaction pathways, leveraging distributed ledger technology for cross-border settlements. The crypto payments UAE landscape is evolving pretty rapidly at this point, with approximately 20% of Ripple’s global customer base already operating in the region. Numerous significant regulatory frameworks have instituted clear operational guidelines, accelerating institutional adoption.

Reece Merrick, Ripple’s managing director for the ME region, said:

With clear regulations and growing demand, Dubai is the place to be for blockchain-powered payments.

The DFSA license basically enables Ripple to provide its blockchain-based payment solutions to businesses throughout the UAE and neighboring areas too. Across multiple significant financial sectors, this regulatory milestone has architected new implementation pathways for enterprise blockchain solutions.

Also Read: Will Donald Trump Lower Taxes in 2025?

Addressing Cross-Border Payment Challenges

Traditional banking system’s high fees and lengthy settlement times are being addressed by Ripple’s technology, which is something that’s been needed for quite a while now. A significant demand for efficient alternatives to conventional cross-border payments exists among financial institutions and also crypto-native firms in the Middle East, driving interest in crypto payments UAE solutions.

According to a 2024 Ripple survey that was conducted recently and published just last month, about 64% of finance leaders in the Middle East and Africa region view faster settlements as the primary advantage of blockchain-based payments and all that. Additionally, around 82% expressed confidence in integrating blockchain solutions into their businesses, showing strong support for Ripple regulatory compliance frameworks.

Global Regulatory Momentum

Ripple DFSA approval is part of a broader strategy at the time of writing, and they’re pursuing similar approvals in other regions as well. Through several key jurisdictional initiatives, the company has engineered a comprehensive global compliance framework. They have actually secured more than 60 approvals globally, including from the Monetary Authority of Singapore, the New York Department of Financial Services, and also the Central Bank of Ireland. Various major regulatory achievements have accelerated Ripple’s market expansion, instituting new standards for blockchain payment services.

His Excellency Arif Amiri, CEO of the DIFC Authority, commented:

As the Middle East, Africa, and South Asia’s leading global financial center, DIFC is proud to support forward-thinking companies like Ripple as they shape the future of finance and accelerate the adoption of blockchain technology in the payments industry.

Also Read: Shiba Inu Gave $16 Million in Profits With An Investment of $1,000

The DFSA crypto license also positions Ripple to play a key role in stablecoin adoption within the UAE right now. Multiple essential financial mechanisms have been transformed through this regulatory framework, pioneering new settlement pathways. Blockchain adoption Middle East continues to grow as regulatory frameworks become a bit clearer and more defined in recent months. Across several key economic zones, distributed ledger initiatives have spearheaded financial innovation, catalyzing regional technological advancement.