Unlike most top coins from the market, XRP has been able to fare pretty decently over the past week. While assets like Bitcoin, Ethereum Solana, Cardano, and Avalanche managed to appreciate by 0.1%-3%, XRP’s 7-day gains stood at 5% at press time.

The past 24-hours have, however, not been that kind to the asset. After shedding about 2% in the said time frame, XRP was trading at $0.7555.

Metrics show signs of recovery

At the moment, XRP shares a correlation of 78% with Bitcoin. This means the asset’s fate is tied to that of Bitcoin’s and the king coins directional bias would affect this alt too.

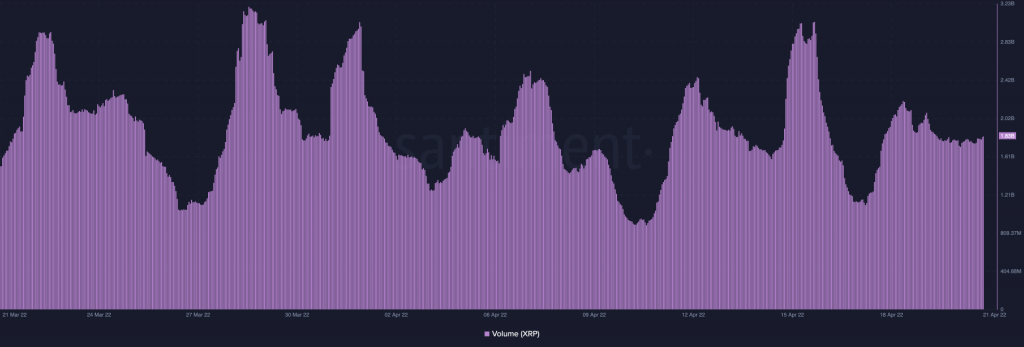

Nonetheless, on an independent front, things have improved for this asset of late. Trading volume, for instance, had dipped to a local low on 17 April. The same managed to rebound and has been hovering in and around the 2 billion mark since then.

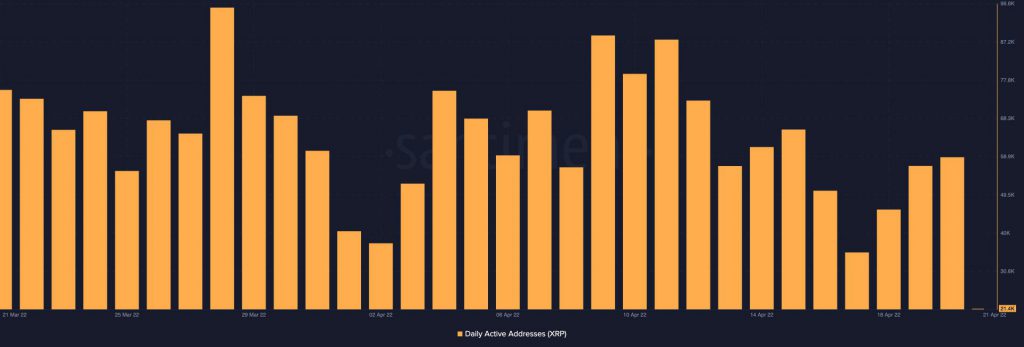

Alongside, the network activity [measured using active addresses] has also recovered from its local lows of 35k registered on 17 April to 58.8k. The rising numbers of both metrics point towards the brewing interest of market participants concerning XRP.

Is a 20% rally feasible for XRP?

At the moment, XRP is trading slightly above its 50% Fib level. From here, there is an upside room of about 23.1%. The same would push up the asset’s price to $0.93. However, for XRP to rally to $0.93, it would have to overcome a few barriers.

At the beginning of the week, the token was rejected by the 38.2% Fib level, at $0.7844. Since then, it has been trading below it. So only if the buy-side volume ends up increasing over the next few trading sessions, XRP would be able to break above the same.

In doing so, XRP would then be engulfed by three of its moving averages—the 50-day, the 100-day, and the 200-day. Back in March, the said levels acted like supports and aided the price to visit the terrains of $0.9. So, if the favorable momentum persists in the market, XRP should be able to climb above them and spike to $0.93.

Attaining the said level would essentially mark the formation of a bearish triple top. The said pattern usually marks the onset of reversal in the movement of an asset’s price. So, post the 23% rally, the odds of XRP’s price witnessing a pullback remain to be quite high.

On the flip side, if bears manage to dominate the bulls in the XPR market, or if Bitcoin and co. ends up dumping, then the asset could dip to a level as low as $0.6945.

Whatever may be the case, whether bullish or bearish, $1 doesn’t seem to be in sight for Ripple’s XRP at the moment.