Thursday was a crypto “slide” day. While Bitcoin briefly visited $18.6k, Ethereum dipped to $998. Most altcoins replicated the movements of the leaders. Ripple’s native XRP token, however, headed in the opposite direction of the pack. Even though it dipped to $0.3 at one point yesterday, it registered a close above the same. In retrospect, XRP was one of the few tokens that registered a green candle on Thursday.

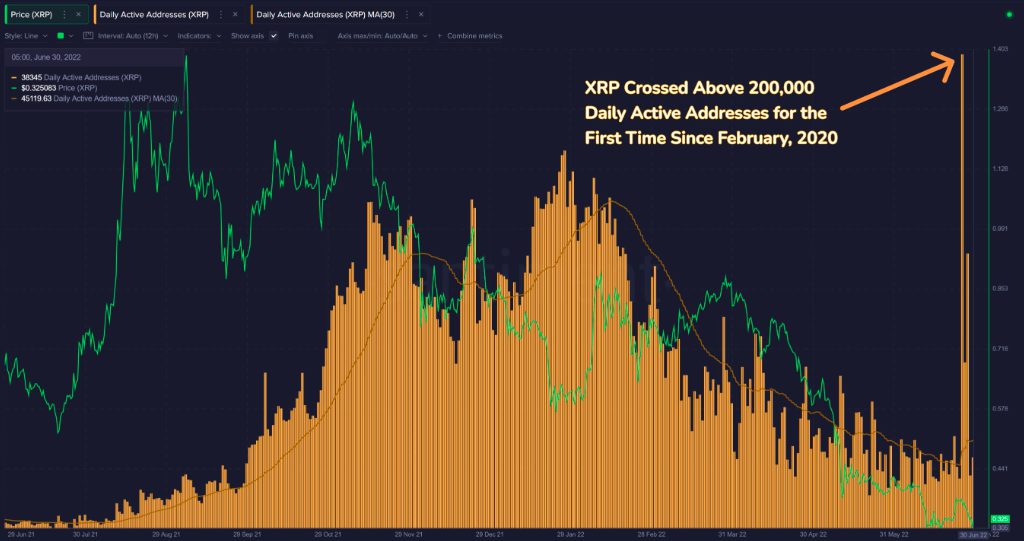

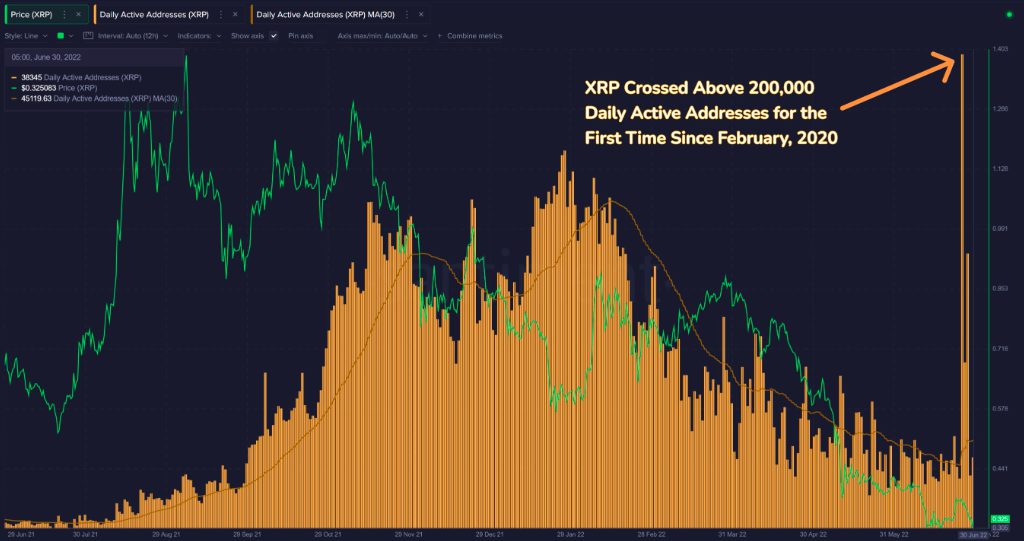

Apart from holding up better than most altcoins, the XRP network “exploded” with unique addresses interacting. For the first time in nearly 2.5 years, the active addresses exceeded 200k.

An address, as such, is considered to be active when it becomes a direct participant in a successful transaction. The higher the number, the more transactions take place and vice versa. So, the latest hike brings to light the higher engagement activity of market participants on Ripple’s network.

In fact, Messari brought to light that XRP is the fifth most active chain at the moment. Just over the past day, $596 million worth of transactions were settled on the network.

Whale Buys, Ripple escrow unlocks – Two sides of the coin?

Data from WhaleAlert brought to light that large transactions involving Ripple’s native token have actively been taking place. One transaction involving 44.9 million tokens took place a few hours back. Notably, XRP tokens were transferred from Bitstamp.

Right after, another transaction involving 60 million tokens from Bitso was executed. Thus, it can be speculated that whales have been accumulating XRP tokens at this stage.

However, it shouldn’t be forgotten that today is 1 July. On the first day of every month, Ripple puts its hand in its deep pocket to release 1 billion XRP tokens. Over the past few years, these releases have been made in two transactions, each carrying 500 million tokens.

Sticking to the tradition, at the stroke of midnight, XRP was released from Ripple’s escrow.

Implications on XRP’s price

Now, since the beginning of this year, XRP’s price has not really been affected by the escrow unlocks. Right from January to May, the token’s price noted daily inclines on the first of every month. Only in June, things went haywire.

1 Jan 2.5% up

1 Feb 1.78% up

1 March 0.38% up

1 April 1.58% up

1 May 3.85% up

1 June 5.6% down

The aforementioned dataset clearly shows that the escrow dumps do not single-handedly possess the potential to dent the price. The broader market conditions and the fundamental metrics have always backed XRP’s value. Nonetheless, the token was trading in red at press time because of the fairly high correlation it shares with Bitcoin. However, the mid-term outlook for XRP continues to be optimistic.

Backing can be expected from metrics and other factors. With a favorable on-chain environment, and buying bias present among large players, market participants can expect XRP to gradually head towards $0.42 this month, after testing $0.36 and $0.38.

Having said that, if Bitcoin and the broader market note another leg down, then $0.28 would come into play for XRP.