In a recent significant development, a US judge handed down a ruling that determined Ripple’s XRP should not be classified as a security. However, the lawsuit still keeps dragging on with no proper closure date. As a result of this pivotal decision, the price of XRP experienced a remarkable surge in the market.

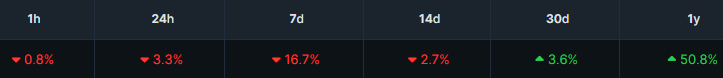

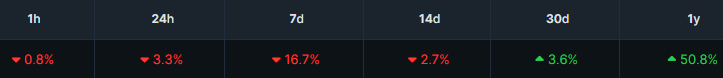

However, the surge was short-lived. XRP’s price has not been quite as high as compared to other altcoins. XRP is trading at $0.577, with a 3.3% drop in value over the past 24 hours. XRP is down 16.7% over the last 7 days and 3.6% up in the last 30 days. Here is our price prediction for Ripple XRP for the weekend.

Also read: Shiba Inu: Can SHIB Reclaim $0.00004 By March End?

Can Ripple (XRP) hit $0.7 this weekend?

Cryptocurrency experts at Changelly have given their price prediction for Ripple XRP for the weekend. According to the analysts, XRP is forecast to reach a minimum of $0.67745 and a maximum of $0.746571. The average price of XRP is expected to be $0.690.

The recent ruling by a US judge, which stated that XRP is not a security, had a positive impact on the price of XRP, causing it to rise to $0.8875. This decision also prompted several exchanges to relist XRP.

However, despite this initial boost, the price of XRP has since experienced a decline, which is in line with the overall performance of the cryptocurrency market, which appears to be trading in the red.

Also read: Top Cryptocurrency Analyst Shares 6 Altcoins Set To 6X In 2024

It is widely known that XRP has significantly underperformed compared to the broader crypto market. This is largely due to the ongoing lawsuit between the US Securities and Exchange Commission (SEC) and Ripple, which has cast uncertainty over XRP’s regulatory status.

Despite these challenges, Ripple has secured a number of legal victories over the past year. This has strengthened its position in the case and increased the likelihood of a settlement. As clarity regarding XRP’s future outlook improves, technical indicators suggest that traders may begin to shift their focus back to this high-potential but controversial asset.