Ripple’s battle with the SEC has new developments. Chairman Gary Gensler’s net worth now ranges between $41 million and $119 million. This growth comes as the agency increases its enforcement actions. New data shows record-breaking fine collections under his leadership.

Also Read: AI Predicts Bitcoin’s Price (BTC) As Musk Debuts As DOGE Dept’ Lead

Crypto Regulation and Financial Gain: Ripple vs SEC

Rising Enforcement Actions Under Gensler’s Leadership

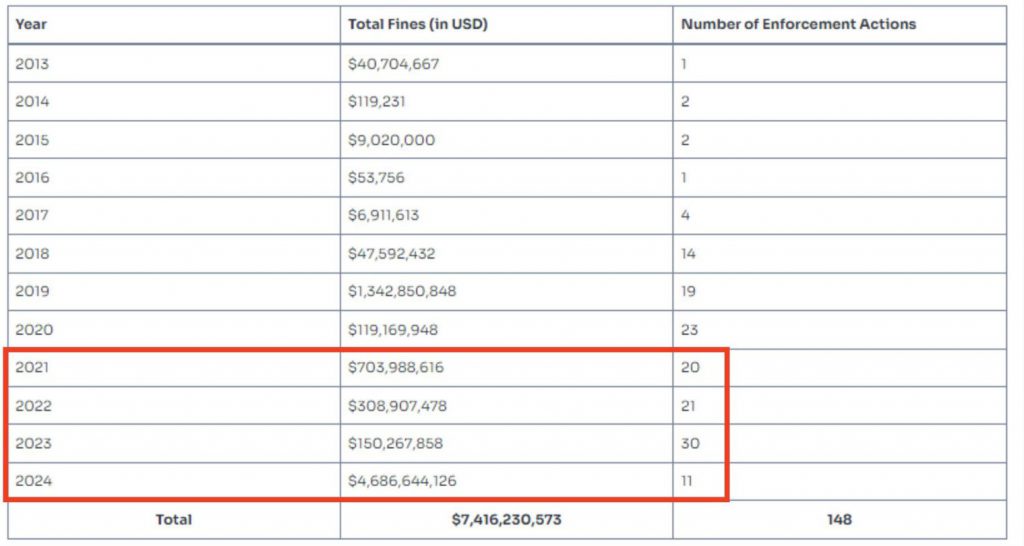

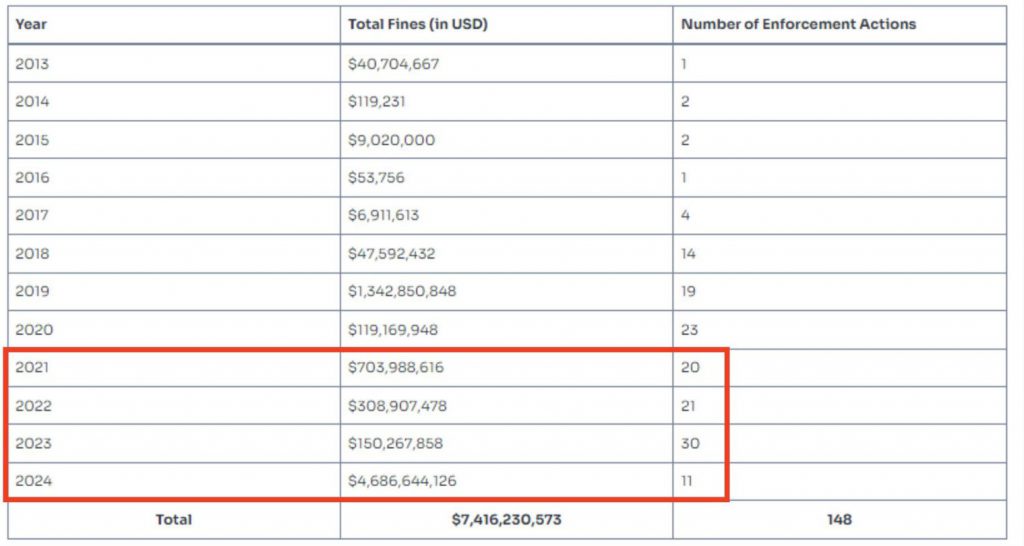

SEC fines have grown bigger under Gensler’s watch. The numbers show a clear pattern. Fines went up from $703 million in 2021 to $4.6 billion in 2024. This happened even though there were fewer cases. The Ripple lawsuit changed how the SEC deals with crypto companies. The agency now targets major cryptocurrency players more aggressively.

Financial Growth and Regulatory Power After Ripple

As SEC Chair, Gensler earns $32,000 monthly. Yet his wealth has grown much larger. JackTheRippler, a prominent crypto influencer, stated:

“Gary Gensler’s financial standing is estimated to be between $41 million and $119 million due to suing companies and receiving commissions for it.”

This wealth increase matches the timing of more SEC crypto enforcement.

Also Read: Dogecoin (DOGE) Predicted To Rally 566%, Hit $2.40: Here’s When

From Goldman Sachs to SEC Leadership

Gensler worked at Goldman Sachs for 18 years and became a partner there. Later, he served as CFTC Chair under Obama and taught at MIT Sloan School of Management. These roles helped build his wealth. His Wall Street experience shapes how he regulates crypto now.

SEC’s Ripple Enforcement Strategy Raises Questions

The SEC’s fines have risen sharply under Gensler. In 2024, they collected $4.6 billion from just 11 cases, compared to $150 million from 30 cases in 2023. This big change makes people question the agency’s goals and methods.

Market Impact and Industry Response

These enforcement actions affect the whole crypto market. Companies like Ripple face direct SEC pressure. Industry leaders worry about the link between enforcement actions and regulators’ personal wealth growth.

Also Read: Did Donald Trump’s Crypto Portfolio Decline Post Election Victory?

Enforcement Trends and Financial Implications

The SEC’s fine collections tell a clear story. They went from $40 million in 2013 to billions recently. This massive increase happened during Gensler’s time as chair. It matches reports of his growing wealth. The crypto industry watches these changes closely as regulations get stricter.