Tesla’s Robotaxi service in Austin launched this past Sunday, and it’s marking the end of what has been a decade-long wait for Elon Musk’s autonomous taxi promises to become reality. The electric vehicle maker has deployed around 20 driverless Model Y vehicles that are now charging customers a flat $4.20 per ride.

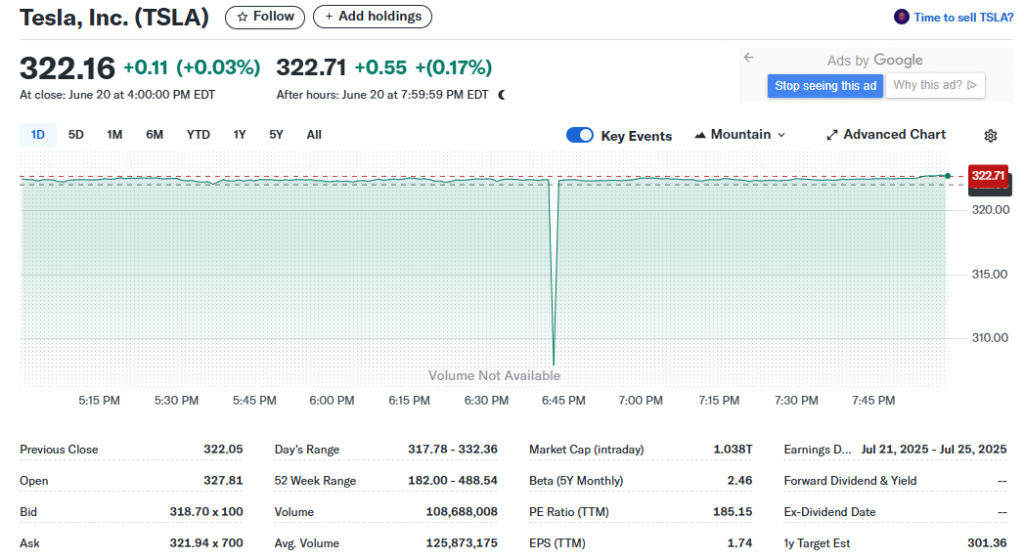

With Tesla stock currently trading at $322.16 and autonomous vehicle safety being under intense regulatory scrutiny right now, investors are definitely watching to see whether this milestone can actually drive share prices higher. Elon Musk’s autonomous fleet vision is taking its first real commercial step in what is an increasingly competitive self-driving cars market.

Also Read: Tesla Stock Risks 52% Profit Hit As Trump Targets EV Tax Credit

Tesla Robotaxi Safety, Autonomous Fleet & Stock Outlook Explained

Austin Service Launch Details

Tesla’s Robotaxi service in Austin operates daily from 6:00 a.m. to 12:00 a.m., though bad weather conditions may limit or prevent the service. Tesla has positioned safety monitors – and these are actual Tesla employees – in the front passenger seats during commercial operations, which represents quite an unusual approach for autonomous vehicle safety standards.

In a post on X, Musk said:

“customers will be charged a flat fee of $4.20”

The initial fleet consists of about 10 to 20 Model Y SUVs operating in what is a narrowly defined area of South Austin. Early-access invitations went out to vetted customers who could then download and use the new Robotaxi app. Ed Niedermeyer observed these Tesla Robotaxis leaving a depot near Oltorf Street, with safety monitors positioned in passenger seats rather than behind the wheel.

Technology and Safety Performance

Tesla’s self-driving cars use what Musk describes as an “unsupervised” version of Tesla’s Full Self-Driving software, and this relies on cameras and end-to-end AI rather than the sensor arrays that competitors like Waymo use. However, early observations of Tesla’s Robotaxi in Austin have raised some concerns when one vehicle hit its brakes twice, including once right in the middle of an intersection, while passing police vehicles.

Musk stated on X:

“Super congratulations to the @Tesla_AI software & chip design teams on a successful @Robotaxi launch!! Culmination of a decade of hard work”

The service won’t use in-cabin cameras by default, and it will only activate these during emergencies or when riders request support. At least one rider needed assistance from Tesla’s remote support team during their ride, though the company didn’t disclose the specific issue.

Stock Market Impact and Fleet Strategy

Tesla stock is currently trading at $322.16 with a market cap of $1.038 trillion and a high PE ratio of 185.15 at the time of writing. The stock’s 52-week range spans from $182.00 to $488.54, which shows significant volatility as investors continue to evaluate the autonomous driving potential.

Elon Musk’s autonomous fleet follows what he calls a revenue-sharing model where Tesla owners can add their personal vehicles to the autonomous fleet. Tesla takes a small cut while owners earn money, and this often exceeds their monthly car payments according to the company’s projections.

Elon Musk says Tesla’s fleet will be part Uber, part Airbnb

— Dima Zeniuk (@DimaZeniuk) June 22, 2025

Tesla owners can easily add their vehicles to the autonomous fleet through the app when not using them.

They’ll earn money—often more than their monthly payment, while Tesla takes a small cut pic.twitter.com/j0tD7V3Onl

Tesla’s senior counsel Taylor White stated in a letter to the Texas Attorney General’s office:

“Tesla seeks to be as transparent as possible, however, as explained further below, some of the requested information cannot be released because it is confidential information, trade secrets, and/or business information exchanged with the TxDOT in conjunction with conducting business with TxDOT”

Competition and Market Challenges

Tesla’s Robotaxi in Austin faces competition from Waymo, which already operates in Phoenix, Los Angeles, San Francisco, and also Austin with much more detailed safety data disclosure. Tesla’s camera-only approach differs significantly from competitors who use multiple sensor types for autonomous vehicle safety protocols.

Safety monitors during commercial operations suggest that Tesla is still addressing regulatory concerns, and this is unlike competitors who typically remove human oversight before launching paid self-driving cars services. The presence of these monitors raises questions about whether the technology is truly ready for fully unsupervised operation right now.

Also Read: Elon Musk’s xAI Taps Morgan Stanley for $5B Debt Amid Trump Feud

The Austin launch represents Tesla’s boldest autonomous driving bet to date, but significant challenges remain ahead. With safety monitors still required and a limited operational scope, the service faces ongoing regulatory scrutiny. Tesla stock investors are waiting for clearer signals about scalability as the company navigates the complex transition to commercial autonomous operations, with Elon Musk’s autonomous fleet vision still evolving beyond this initial pilot program.