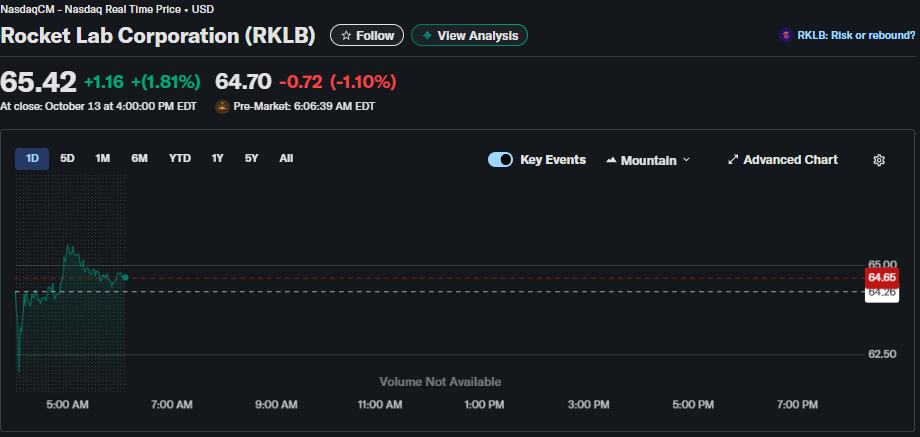

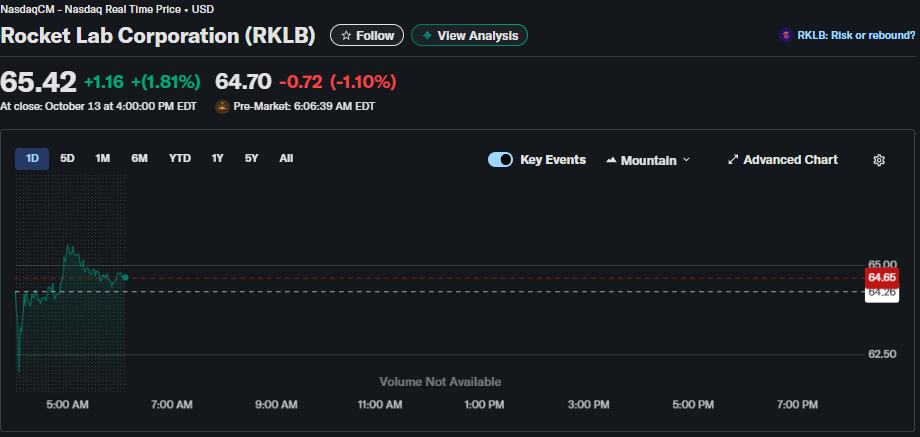

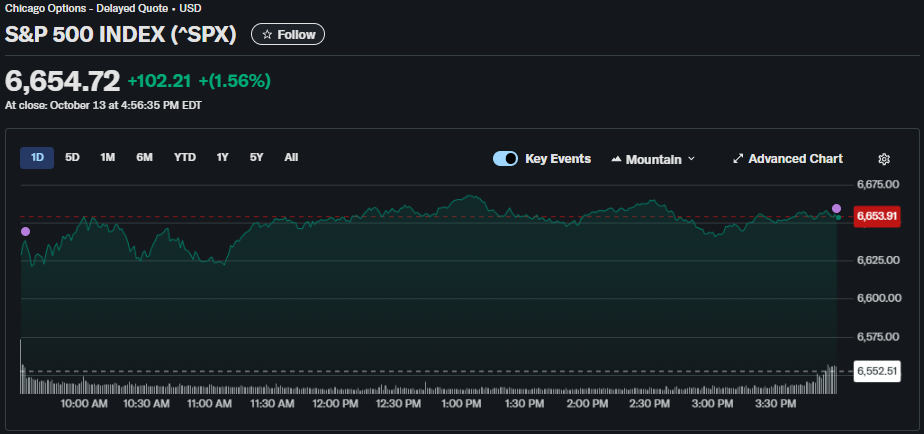

Rocket Lab stock surged following Morgan Stanley’s establishment of a $68 price target, positioning the company as a key player in the commercial space sector. The Morgan Stanley price target came as SpaceX successfully completed its eleventh Starship flight test, sparking renewed interest in space-related equities. Rocket Lab shares increased because analysts made comparisons between the capabilities of the two companies focusing on their technology and their market standings.

Rocket Lab Stock Surges With Morgan Stanley Price Target Amid SpaceX Comparison

Morgan Stanley Upgrades RKLB With $68 Target

Morgan Stanley analyst Adam Jonas established the RKLB $68 target, calling Rocket Lab stock “the closest thing to a SpaceX proxy” available to public investors. The SpaceX comparison demonstrated that Rocket Lab is a player in the market of launching products and services and that vertically pushing the values of its business model resembles the way in which SpaceX operates.

Adam Jonas had this to say:

“Rocket Lab is the closest thing to a SpaceX proxy available to public market investors.”

Its RKLB price target of $68 is a considerable premium over its assets, and the Morgan Stanley price target will be pegged on the Rocket Lab development of the Neutron rocket and its growing launch program. The optimistic outlook on Rocket Lab shares indicates the increased trust in the commercial space business and the competitive position within the company.

Also Read: Morgan Stanley Taps Crypto With 4% Bet on Growth Portfolios

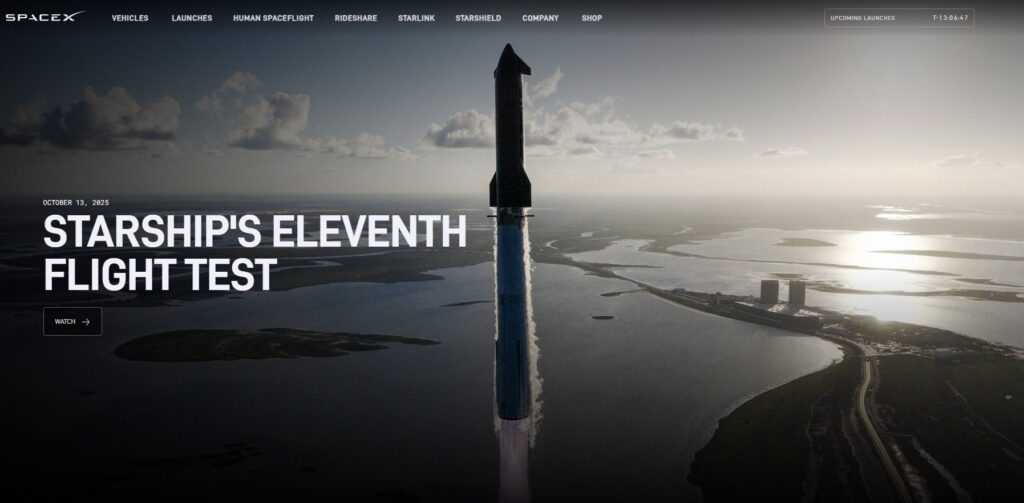

SpaceX Starship Test Drives Space Stock Rally

Another successful demonstration of the eleventh SpaceX Starship flight on October 13, 2025, elevated the mood in the space stock markets such as Rocket Lab stock. The test was a seminal milestone to the reusable rocket program.

SpaceX stated:

“Splashdown confirmed! Congratulations to the entire SpaceX team on an exciting eleventh flight test of Starship!”

Elon Musk also commented on the achievement:

“Great work by the @SpaceX team”

The successful Starship test boosted investor confidence in commercial space projects, and the momentum transferred to other space-related firms. The Morgan Stanley price target of Rocket Lab shares followed this industry-wide exuberance as analysts observe increasing opportunities throughout the industry.

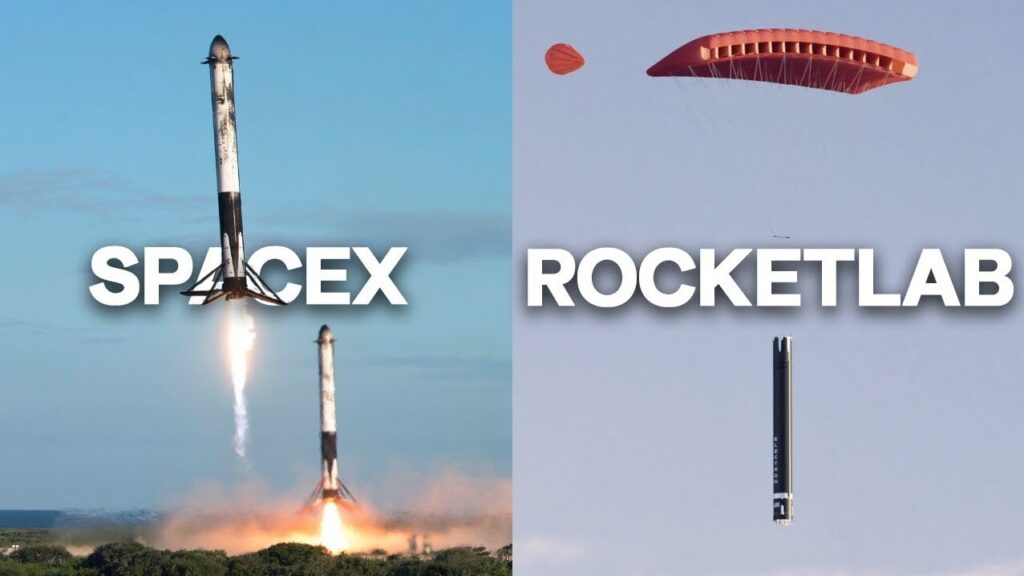

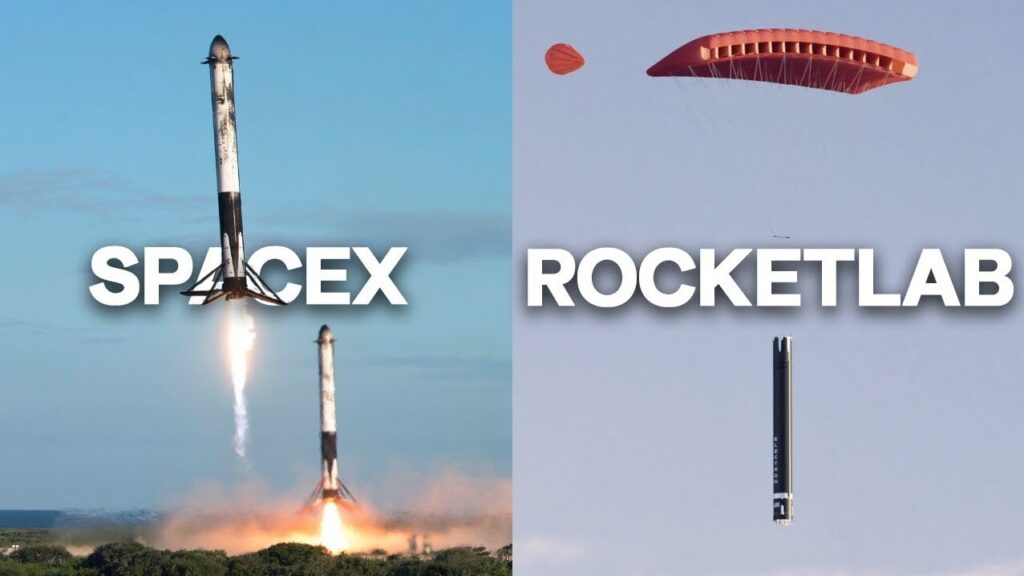

Rocket Lab vs SpaceX: Different Scales, Shared Vision

The debate between Rocket Lab and SpaceX has heightened among investors despite the fact that the firms operate in different markets. The stock of Rocket Lab enjoys the fact that it has concentrated on small to medium-sized payloads with its Electron rocket, and it is developing Neutron, a larger vehicle. The reason why the SpaceX comparison is possible is due to the fact that both companies placed importance on reusable rocket technology and vertical integration.

The Morgan Stanley RKLB $68 is a target that also recognizes the distinction of Rocket Lab as a publicly-traded pure-space company. Rocket Lab stock has been packaged as a convenient entry point to an investment in the commercial space economy, with SpaceX remaining privately owned. This positioning is also backed by the Morgan Stanley’s price target, where analysts have seen the recent Starship success as confirmation of the potential of the entire industry.

Also Read: Morgan Stanley Taps ZeroHash to Power E*Trade Crypto Rollout