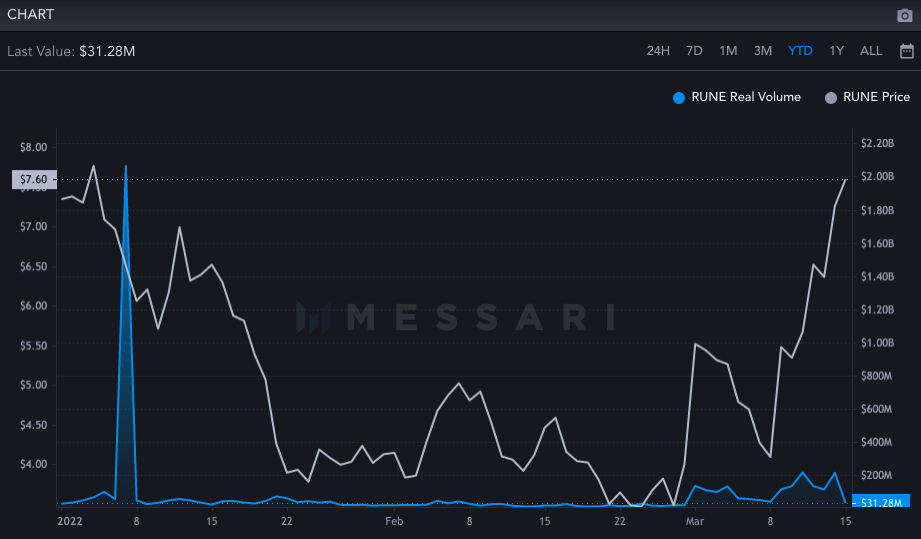

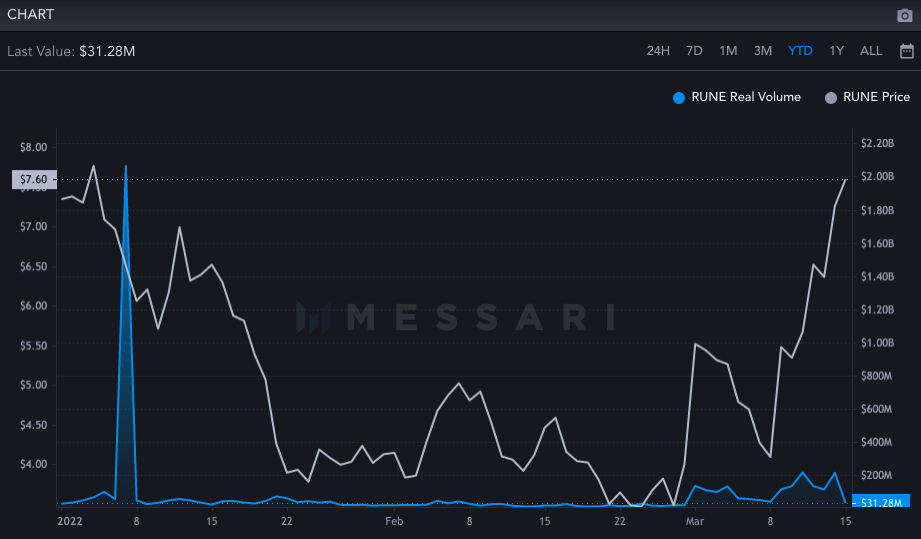

THORChain’s RUNE has been rallying consistently for over a week now, without paying heed to the broader market’s monotonous state. Last week around this time, the 47th largest altcoin was trading around the $4 threshold. But now, this coin has already navigated its way up to $7.6. In effect, RUNE’s weekly pump stood at 91% at the time of press.

Owing to the late upswing, the altcoin’s Sharpe Ratio has witnessed a steep incline. As such, the Sharpe ratio measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. So, the higher the ratio, the better the risk-adjusted-performance.

Throughout February, this metric remained in the negative terrains. Nonetheless, at the time of press, the same was seen hovering above +4, around its YTD highs – a healthy sign.

Also, it is worth noting that the rally this time has been accompanied by a substantial hike in the altcoin’s trading volumes. From wafting around $20-$30 billion, the number inflated by 10 times and attained the $200 billion peak yesterday.

The curve’s tail, at the time of press, was seen pointing down-south, but as the day progresses, the same can be expected to rise back up.

Key levels

Evidently, momentum is on RUNE’s side and there is plenty of room on the upside for it to navigate. A bird’s eye view on the chart below would bring to light that the altcoin is attempting a parabolic recovery. As far as the short term is concerned, one can expect RUNE to glide up by another 8%-18% to $8.5 to $10.

Nonetheless, the coin is currently exchanging hands in its demand zone [which extends from around $6.4 to $9.2] which fostered the coin’s rally earlier in November last year. So, RUNE might as well consolidate for a while and move horizontally before heading higher.